First analyst house starts coverage of the stock with price target $25 which is over 700% gain! 😱

One of my favorite stocks anyway but this steps it up a notch and the rationale is solid.

Win the following:

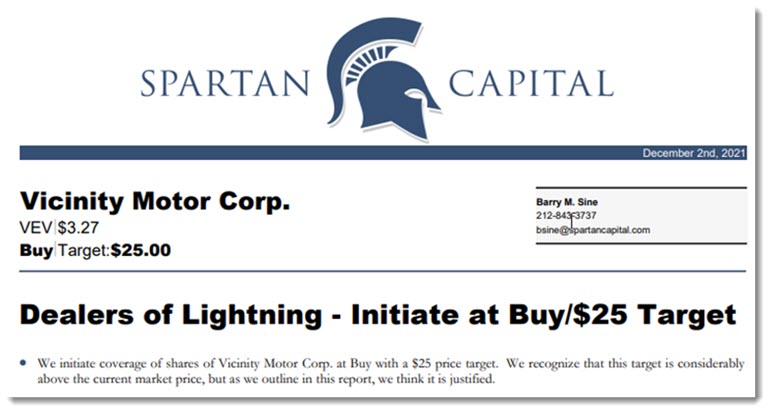

We begin coverage of Vicinity Motors with a Buy rating and a $25 price target. Vicinity is a British Columbia, Canada-based manufacturer of mid-size electric buses for transit agencies, Class 3 commercial vehicles and, through a partnership with Optimal Electric Vehicles, electric shuttle buses.

We rate Vicinity stock as a manufacturer of electric vehicles with a correspondingly high valuation multiple. Competitors trade at 6 times estimated 2023 sales. This is also the multiple we use to value Vicinity stock. We believe Vicinity has two key advantages over its competitors:

Vicinity is currently producing and delivering vehicles. To date, it has delivered approximately 800 units, and its classic transit buses have passed the Federal Transit Administration's (FTA) "bus breaker" test in Altoona, Pennsylvania. Competitors such as Arcimoto, Lordstown, AYRO, WorkHorse, Nikola and ElectraMeccanica have not yet been able to deliver vehicles in large quantities.

The transit division and some commercial customers receive significant funding from state and federal programs, led by the recently passed $1.2 trillion infrastructure bill. Lucid, Rivian, Arcimoto and even industry leader Tesla must rely on consumer buying power. Vicinity customers, for the most part, MUST buy electric vehicles and have access to significant funding sources to pay for them.

I'm sticking with this. Long term a must have in the portfolio for speculative investors who believe in electrification of transportation 🤔