$VWCE (+0.24%)

is a scam...

At what point is a US overweight harmful?

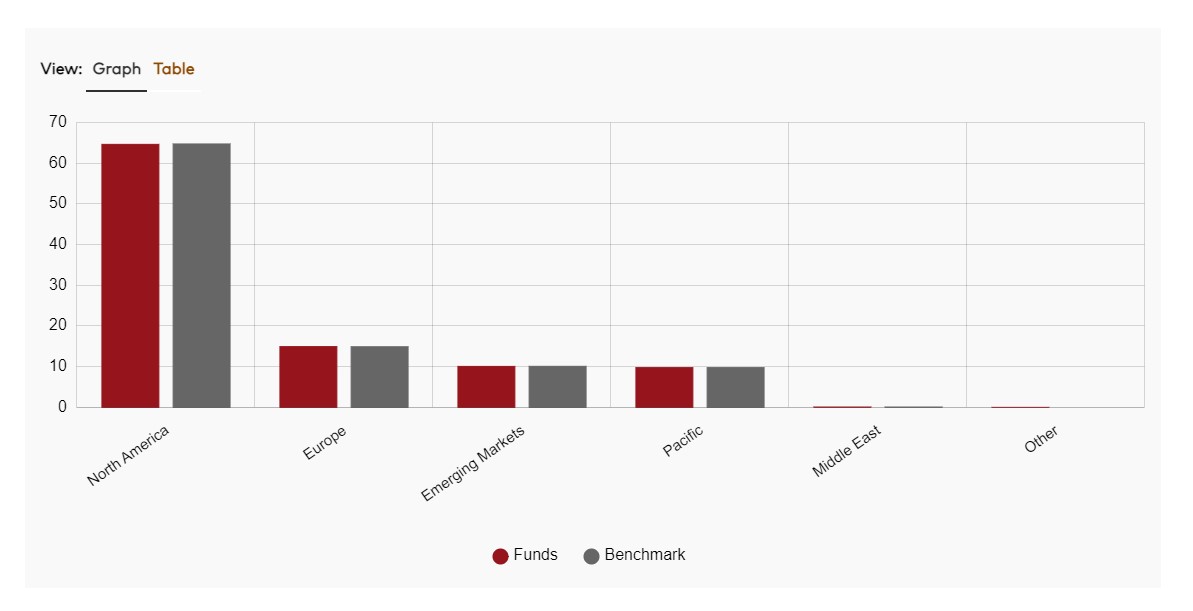

The US weighting in the $VWCE is still blatant.

And yes, of course, it doesn't bother anyone, because that's exactly what has outperformed in recent years and is now alone at the top of the global economy

But isn't investing in an AllWorld about risk diversification? Diversified investment in large parts of the global economy in order to cushion any bubbles in individual sectors as much as possible?

That is not at all the case with US tech.

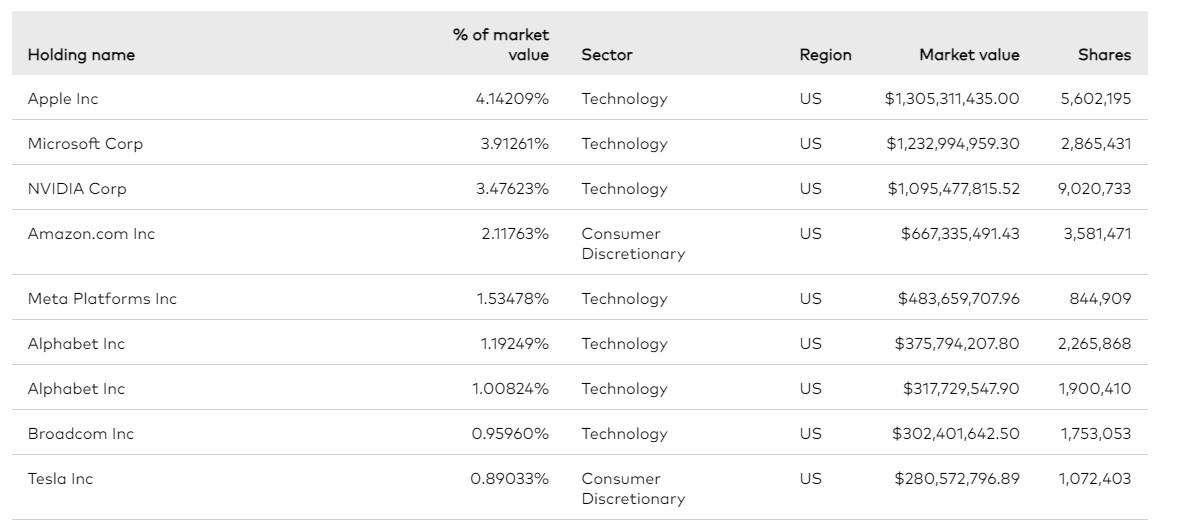

The biggest 10 make up 20%. That doesn't have much to do with risk-free diversification, maybe it's yield-oriented overweighting, but is that the purpose of an All World ETF?

Not in my eyes, so what should be changed?

The All World ETFs have 2 defined focuses: The companies covered are large and just over 60% American.

So to at least balance out the diversification I would need an ETF without US participation, as well as an All World Small/ Mid Cap

Before I start my search, do you see it the same way or have I overlooked something?