The French stock market offers a large number of interesting stocks that are also very popular with investors.

Popular?

Well, yes,

Who wouldn't like LVMH, Sanofi, Air Liquid, Airbus, Safran, L'Oreal,

Essilor-Luxottica, Hermes, Danone, Pernod-Ricard and perhaps even more in your portfolio.

in the portfolio.

However, there are some hurdles and risks here.

On the one hand, we have to deal with the selection of stocks and the valuation and try to buy the stocks that we believe will rise in value at a favorable time.

Secondly, buying French shares is subject to French financial transaction tax (FTT) and 30% withholding tax on dividend distributions.

My optimization suggestion:

Instead of dealing with a large number of French shares and ending up doing everything wrong, I choose an ETF.

This has the following advantages, among others:

1 The individual share risk is spread.

2 Tax advantage for withholding tax, thanks to the double taxation agreement (see below)

3 Automatic rebalancing - the worst stocks are removed at regular intervals and new promising stocks are added to the ETF.

4 Low trading fees

Biggest disadvantage:

1 Most likely you will only achieve the average market return.

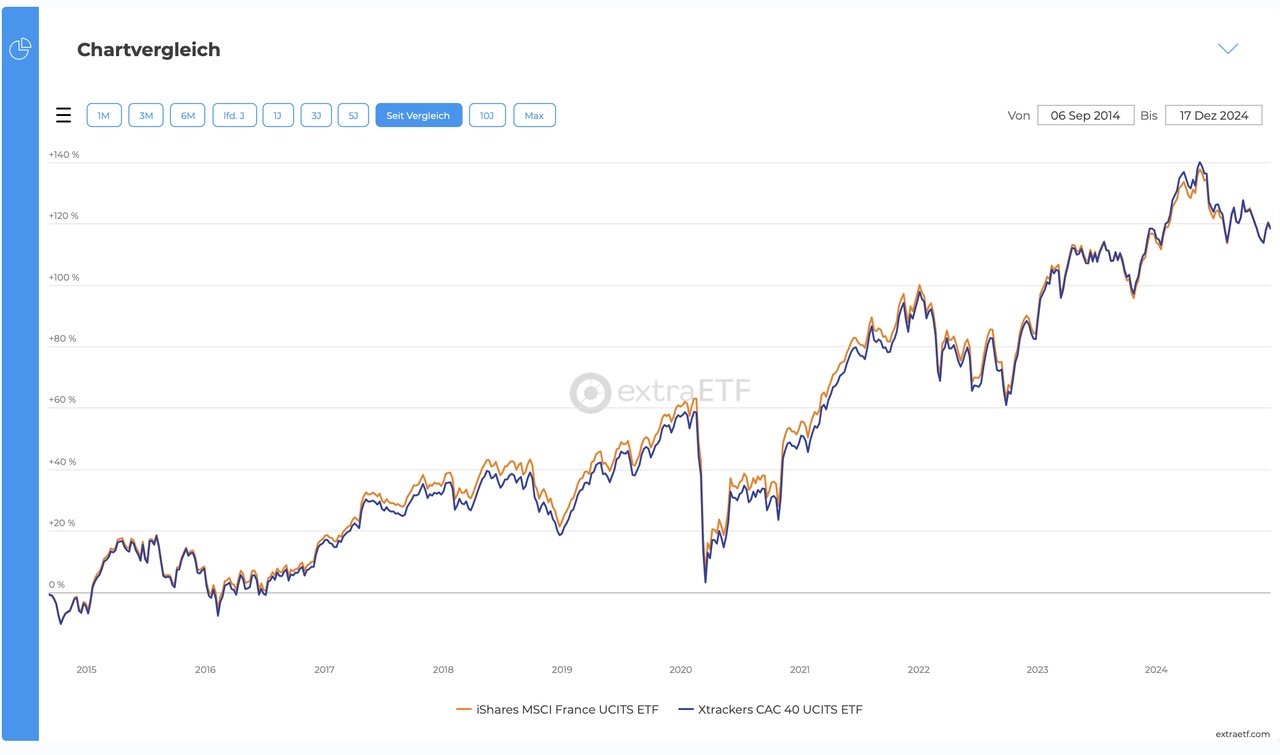

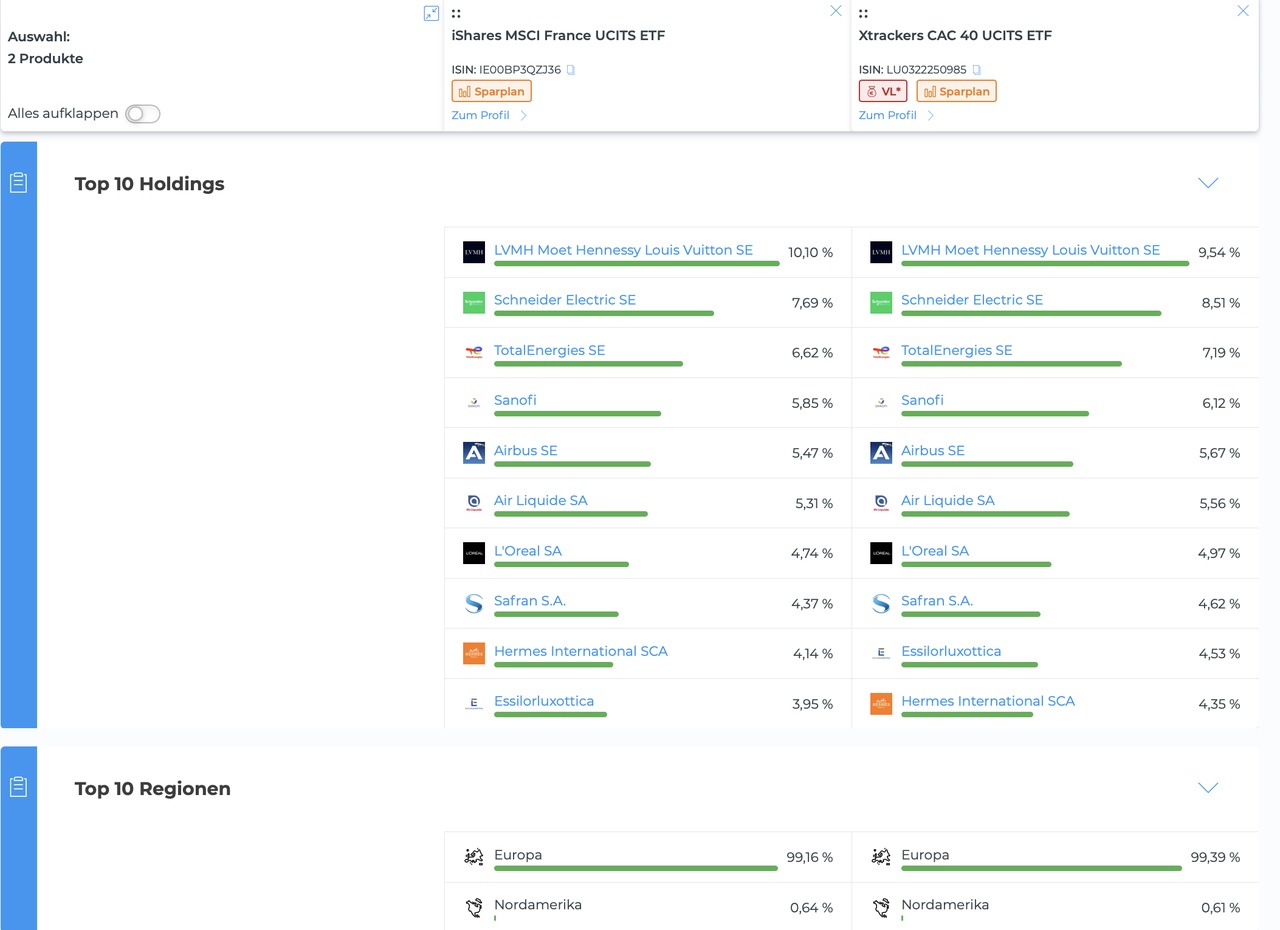

I have therefore opted for the Xtrackers CAC 40 LU0322250985 and will no longer buy French equities. Alternatively, the accumulating iShares MSCI France IE00BP3QZJ36 would also have been a good choice in my opinion.

Both ETFs offer a tax advantage, although you cannot avoid FTT. However, both Luxembourg and Ireland have a double taxation agreement with France. This means that the withholding tax on French dividends is reduced to 15%. Of course, this tax advantage applies not only to distributing ETFs, but also to accumulating ETFs.

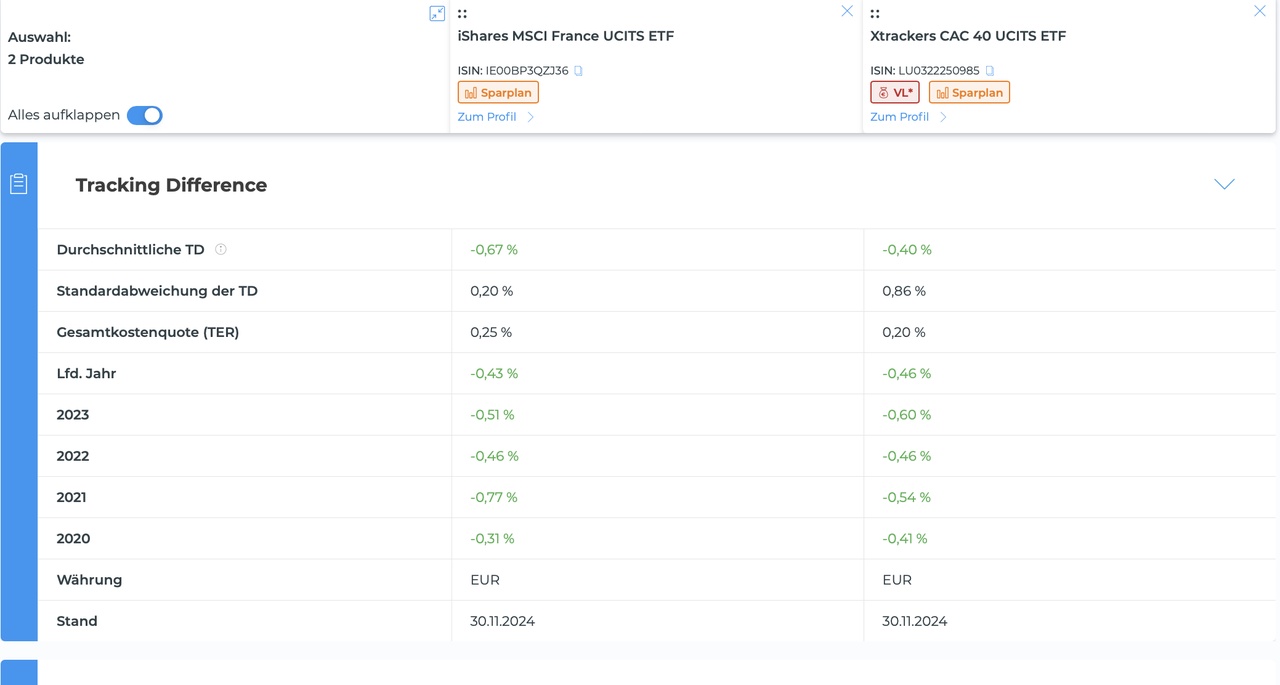

I consider the already low TER of 0.2x% to be completely negligible, as both ETFs have had a positive TD for years.

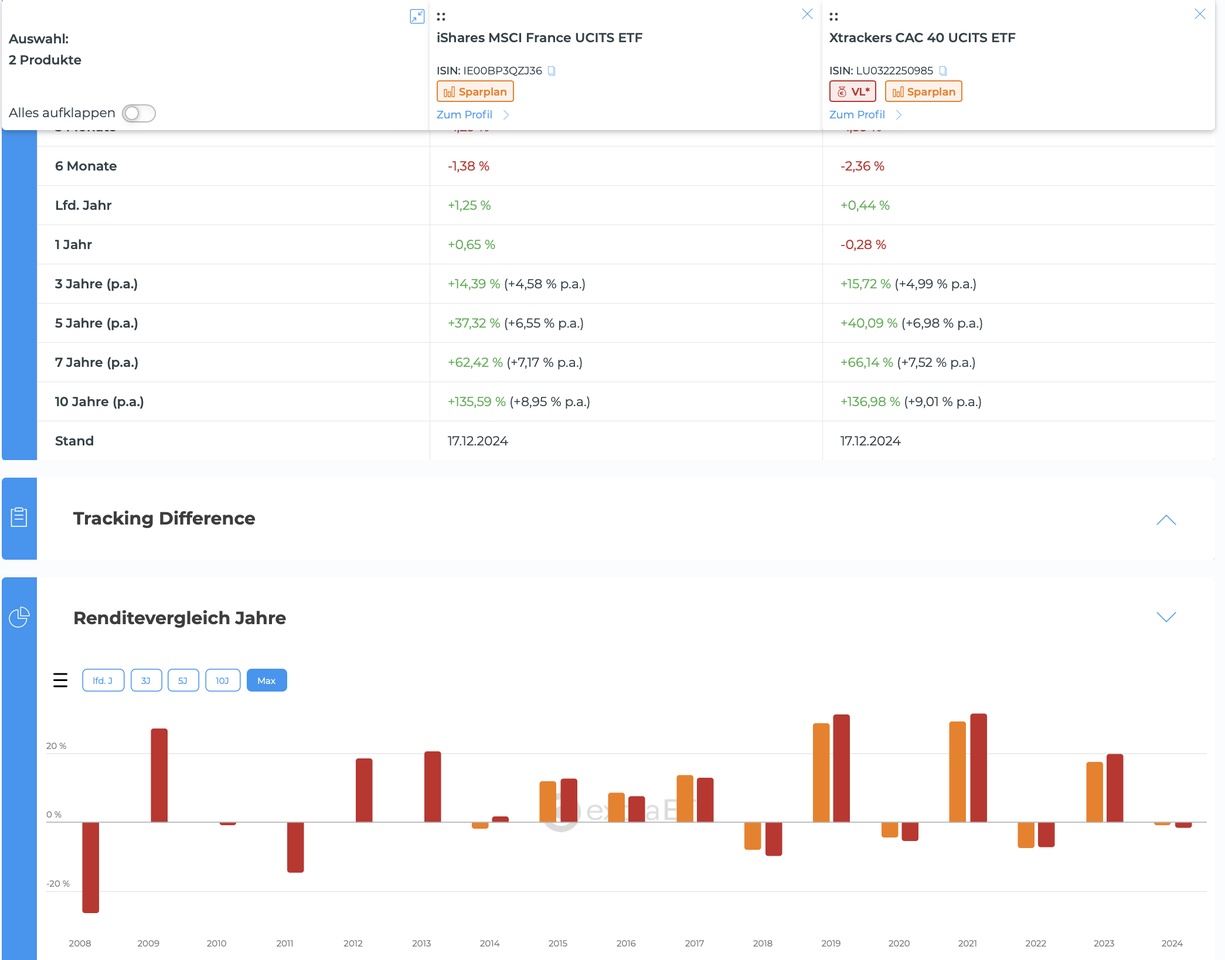

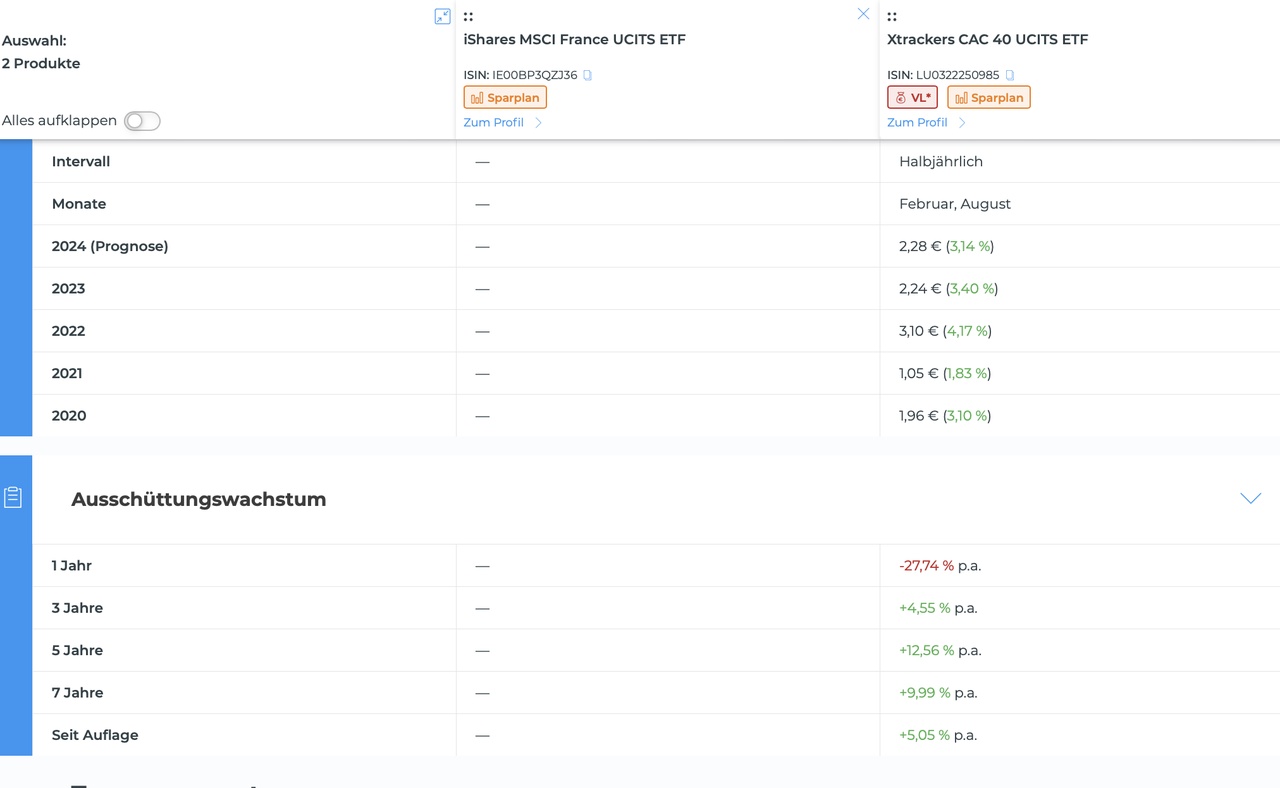

In view of the weak performance of the current year, we could now be in a phase in which it could pay off to collect shares "cheaply" in order to benefit later from a higher personal dividend yield.

Conclusion:

I am selling LVMH and betting on the Xtrackers CAC 40 ETF to cover my entire exposure to France.

-----------------------------------------------------------------------------------------------------------

$MC (-0.25%)

$AIR (-0.84%)

$AI (-0.22%)

$OR (-0.71%)

$RMS (+0.75%)

$EL (-0.22%)

$RI (-0.91%)

$DX2G (-0.23%)

$IS3U (-0.19%)