Enphase Energy before earnings. $ENPH (+6.64%)

Hello my dears,

Next week there will be figures for Enphase, perhaps an opportunity to start the 🚀 from the bottom upwards.

After a not so good year, I have picked out the estimates for you.

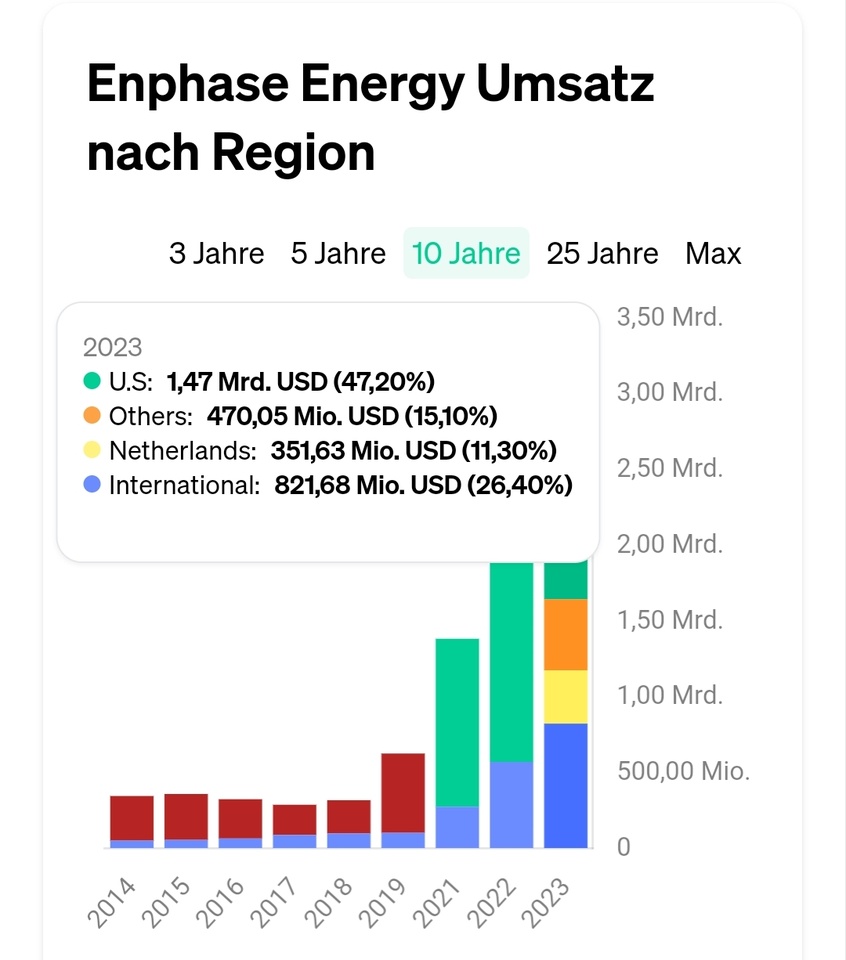

Since the beginning of the year, Vistra $VST (+1.56%) has become one of the top performers thanks to AI and data centers.

Do you see similar potential for Enphase?

According to estimates, it almost looks like it.

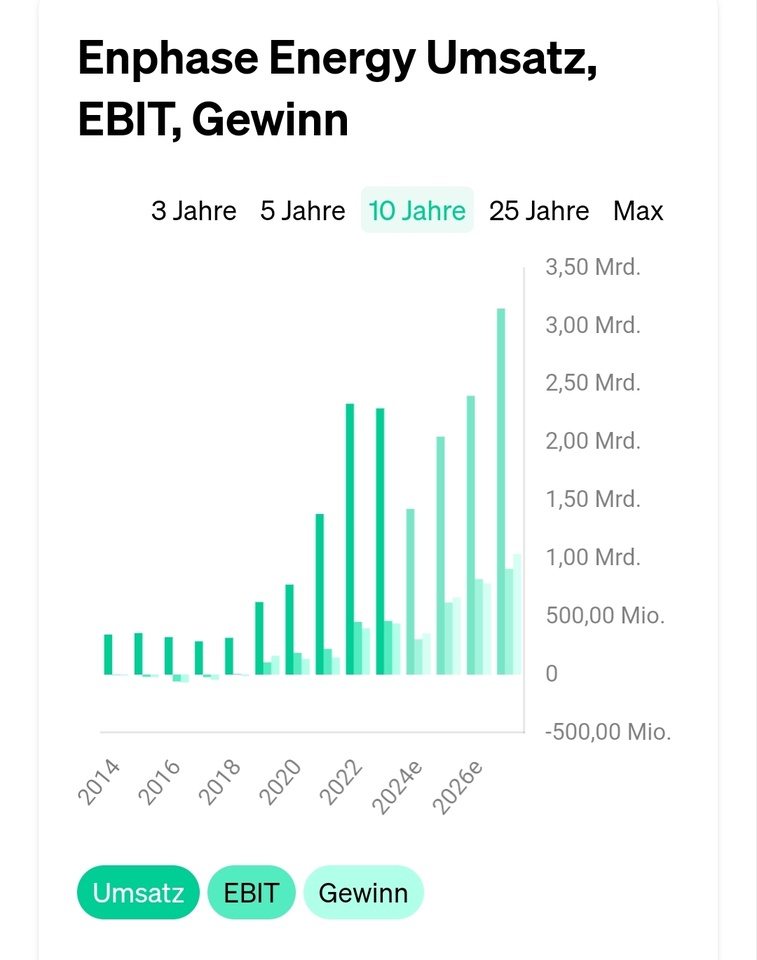

Earnings growth until 2026 amounts to 30%, which will reduce the P/E ratio to 19.93 next year

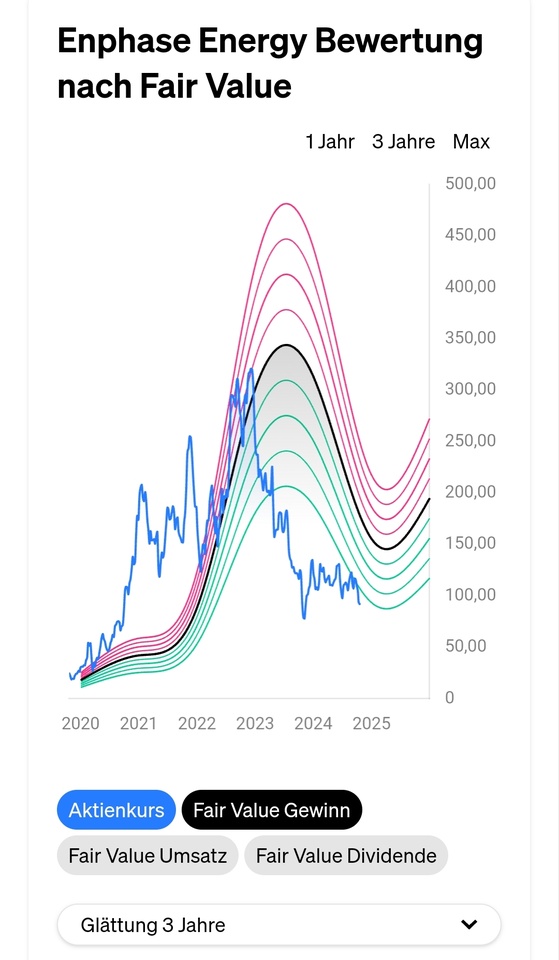

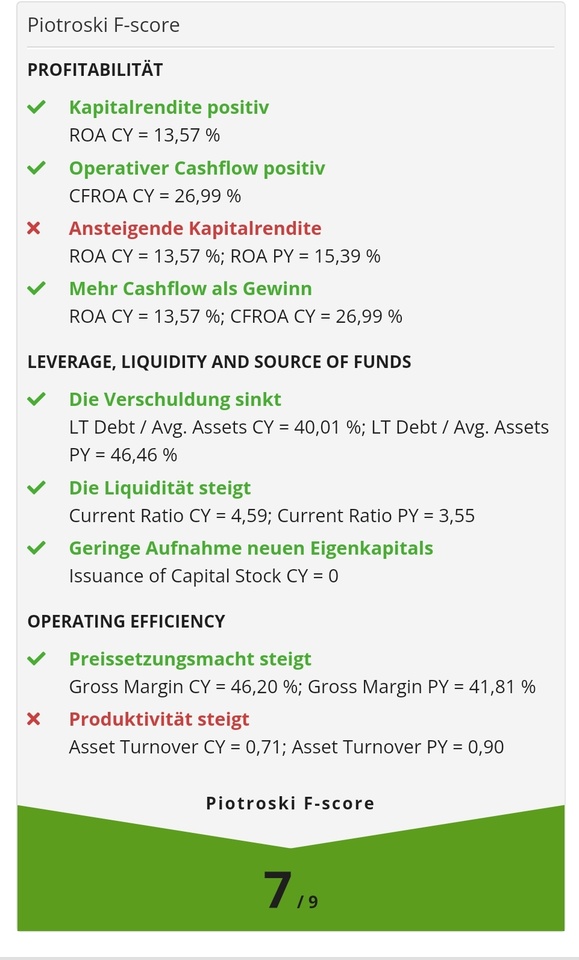

According to the share finder, Enphase is undervalued

EbiT margin: 2024: 21.30%

2025: 30,24%

2026: 34,25%

EbiT: 2024: 303.69 million

2025: 619.40 million

2026: 821.70 million

Turnover: 2024: 1.43 billion

2025: 2.05 billion

2026: 2.40 billion

Earnings per share: 2024: 2.51

2025: 4,60

2026: 5,51

Free cash flow: 2024: 383.76 million

2025: 549.15 million

2026: 679.85 million

Book value per share: 2024: 7.68

2025: 11,09

2026: 16,92

Market capitalization 11.42 billion