Depot review December 2023 - On the home stretch, 2023 was still able to make up for all the losses from 2022 and break the €250,000 mark 🚀

In keeping with the new year, there is also a new profile picture for the first time - an AI-generated elf who specializes in lembas and mithril trading.

But now to the portfolio update:

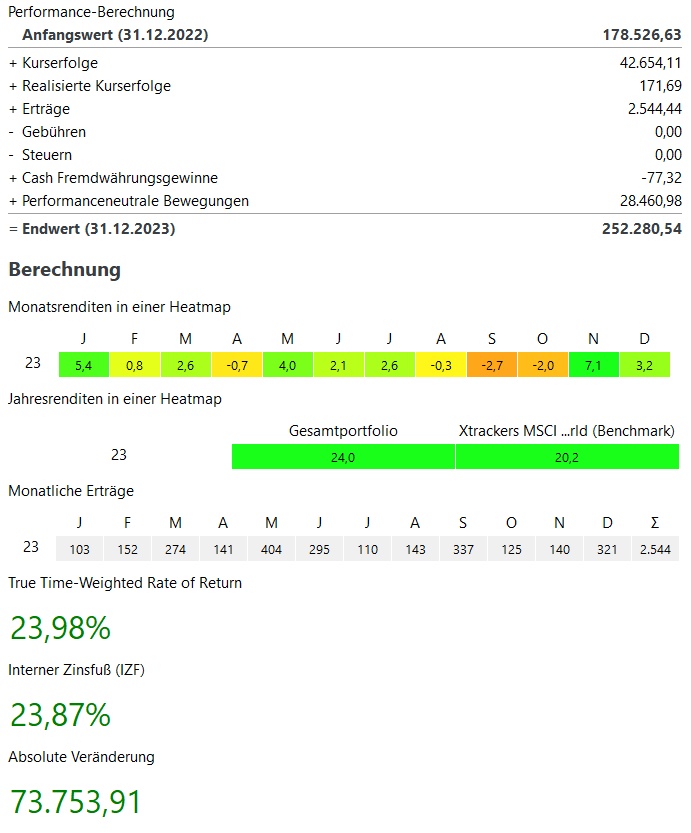

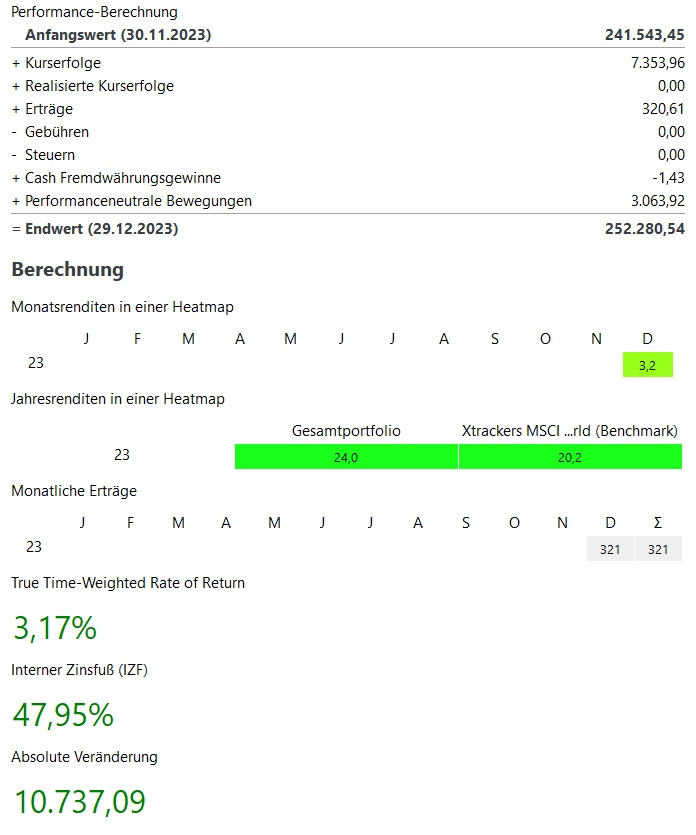

After November was already the second-best November of my investment career, December has now also gone into the books as the second-best. In total, a return of +3,2% for December.

This brings my performance for the year to +24,0% and was thus able to beat my benchmark, the MSCI World (+20.2%).

Tech stocks were the main winners in 2023. With almost +8.000€ is hardly surprising NVIDIA

$NVDA (+2.01%) at the top. With +5,000€ and +4,000€ respectively then follow Palo Alto Networks $PANW (-2.12%) and Meta

$META (-2.23%)

Also Alphabet

$GOOG (+1.03%) and Microsoft

$MSFT (-1.05%) with each +3.000€ very strong this year

The main losers this year were healthcare, utilities, consumer staples and China. The biggest losers this year were:

- Pfizer $PFE (+1.49%) -1.100€

- China ETF $MCHS (-0.07%) -900€

- Nextera $NEE (+1.64%) -900€

- Johnson & Johnson $JNJ (+0.03%) -800€

- Procter & Gable $PG (-1.24%) -500€

In total I bought again in December for ~2.500€ in December.

In total, my portfolio now stands at ~252.000€. This corresponds to an absolute increase of ~€74,000 in the current year 2023. ~43.000€ of this comes from price gains, ~2.500€ from dividends / interest and ~28.000€ from additional investments.

Thanks to the strong November and December, all price losses from 2022 have been made up.

Nevertheless, it has to be said that the last two years were not profitable overall. The portfolio has actually only grown through additional investments.

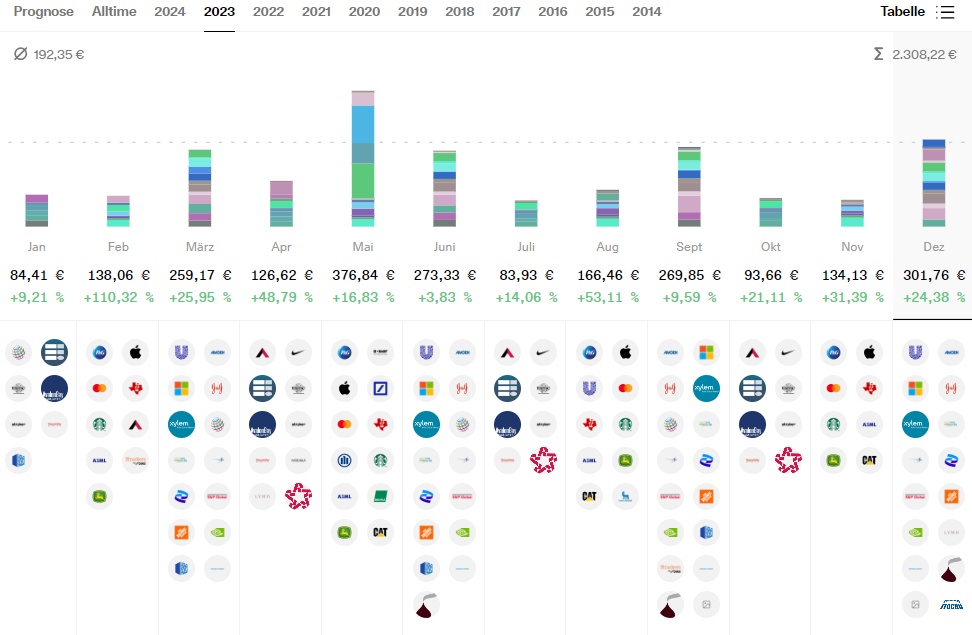

Dividend:

- Dividends in December were +23% above the previous year at ~€300

- For the year as a whole, dividends were +24% above the previous year at ~2.300€. In addition there was ~200€ in interest

- The following companies paid the highest dividends this year, all of which distributed more than €100: Amgen $AMGN (+0.51%)

Procter & Gamble

$PG (-1.24%)

Unilever

$ULVR (-1.44%)

Johnson & Johnson

$JNJ (+0.03%) and Starbucks

$SBUX (-1.55%) - The highest dividend yields are achieved by Allianz

$ALV (-0.66%) with 9,5% on. In 2024 and a further dividend increase, I see a 10% yield here

Buys & sells:

- I bought again in December for approx. 2,500€

- As always, my savings plans were executed:

- Blue chipsItochu $8001 (-0.17%) ASML $ASML (-1.59%) Deere $DE (+0.19%) Lockheed Martin $LMT (+0.94%) MasterCard $MA (-0.34%) Northrop Grumman $NOC (-0.09%) NVIDIA $NVDA (+2.01%) Republic Services $RSG (-1.09%) Thermo Fisher $TMO (+0.81%)

- GrowthSartorius $SRT (+2.08%) Synopsys $SNPS (-1.06%)

- ETFsMSCI World $XDWD Nikkei 225 $XDJP Invesco MSCI China All-Shares $MCHS and the WisdomTree Global Quality Dividend Growth $GGRP

- CryptoBitcoin $BTC and Ethereum $ETH

- Sales there were none in December

With another extremely strong performance in December, my portfolio broke through the €250,000 barrier. This really exceeds my wildest expectations that I had a year ago or even in October.

At the beginning of the year, my year-end target was €220,000 and my best-case scenario was €240,000.

What investments did you make outside of the stock market?

In 2022 I bought a balcony power plant installed. This has given me around 600kwh this year, saving me electricity costs of ~€200. In relation to the purchase price, this corresponds to a return of almost 30%.

In 2024, the topic of renting is also on the agenda, so far only investments have been made here, but from 2024 rental income should also start to flow.

Outlook for 2024:

I am now assuming an above-average stock market year in 2024. If we really do see a soft landing and some additional interest rate cuts from both the Fed and the ECB, this should give the markets a further tailwind. Of course, you have to bear in mind that November and December have already priced in a lot, 10% should be possible in any case.

I therefore see my assets at ~€300,000 at the end of 2024. This is mainly due to the lower investments I plan to make in 2024.

Overall, my savings rate will probably fall from €2,500-3,000 per month to "only" ~€2,000. This is mainly due to some private expenses that will be incurred in 2024.

What are your plans & expectations for 2024?

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy