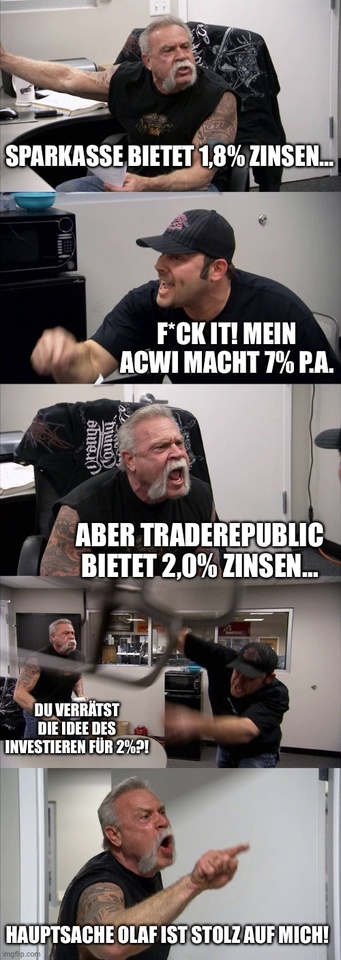

+++ Olaf is proud of you +++

Currently, all of Finfluencer Germany and getquin is going crazy... Wow! How great... where otherwise Sparbüchler and Sparbüchlerinnen are laughed at are suddenly all quite hyped the interest because of... "Great cinema". 🍿