📈 REIT Depot Update January '23 📈

Hello everyone 🙋♂️. With this post I want to give you a little update on my REITs.

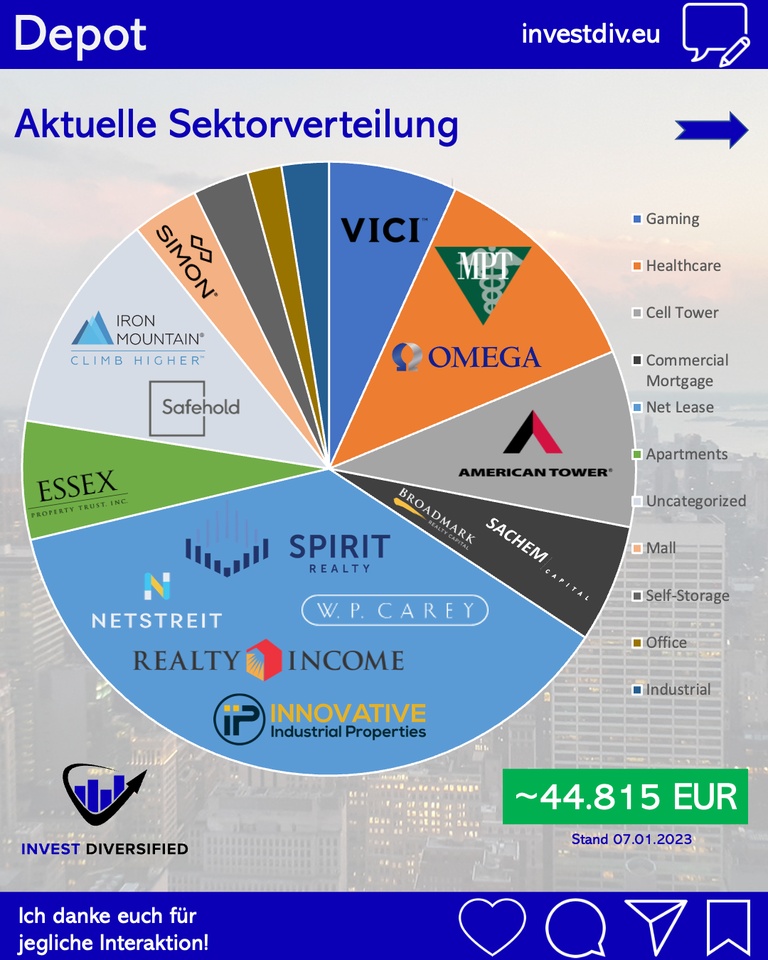

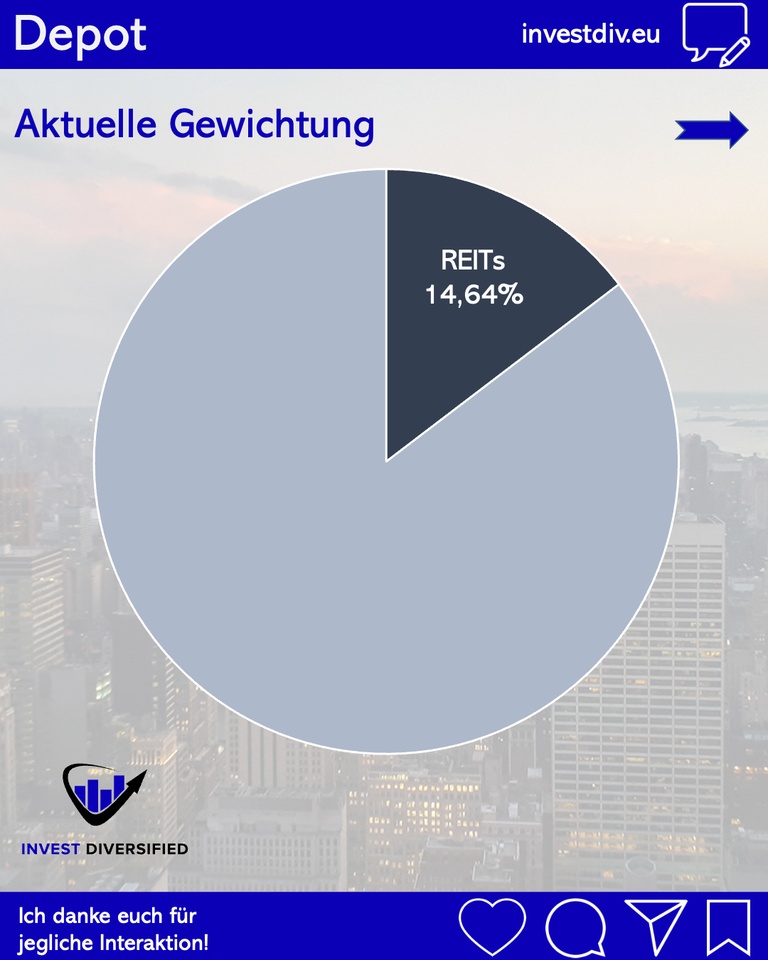

➡️ In total, the REITs in my portfolio have a market value of ~44,815 EUR (as of 07.01.23) and therefore a weighting of 14.64% in the total portfolio 👍.

➡️ Largest value is still $O (+1.22%)

with ~8,239 EUR, smallest the $ONL (+1.65%) with approx. 806 EUR.

➡️ In the last few months I have with from $SKT (-0.63%) separated and took positions with $SRC, $UMH (+2.52%) as well as $STAG (+1.53%) opened.

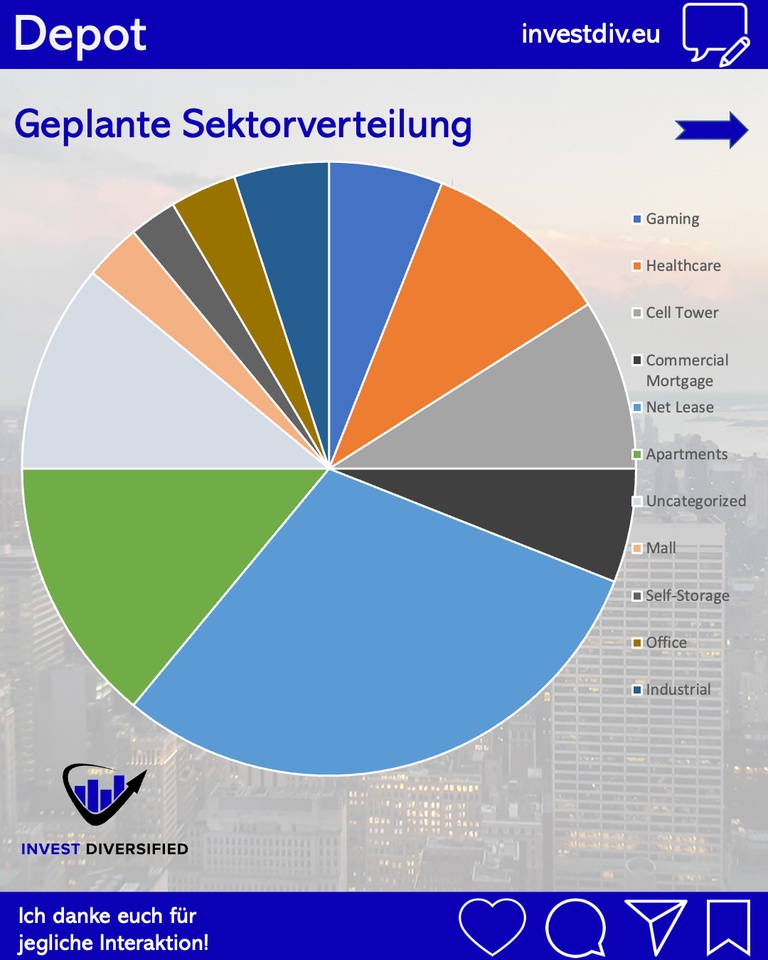

➡️ On the following pages you will find a (sub)sector overview, the future planned weighting and some notes.

➡️ With -19%, my REITs have performed worse in 2022 than, for example, the S&P 500. Of course, the interest rate increases have had a negative impact on prices, since, among other things, it is automatically assumed that refinancing costs will rise. That may also be the case for one or the other REIT. But in general, REITs with solid financing that have taken advantage of the low-interest-rate phase to obtain long-term financing have the best prospects. And it is precisely such REITs that are very attractive in terms of valuation.

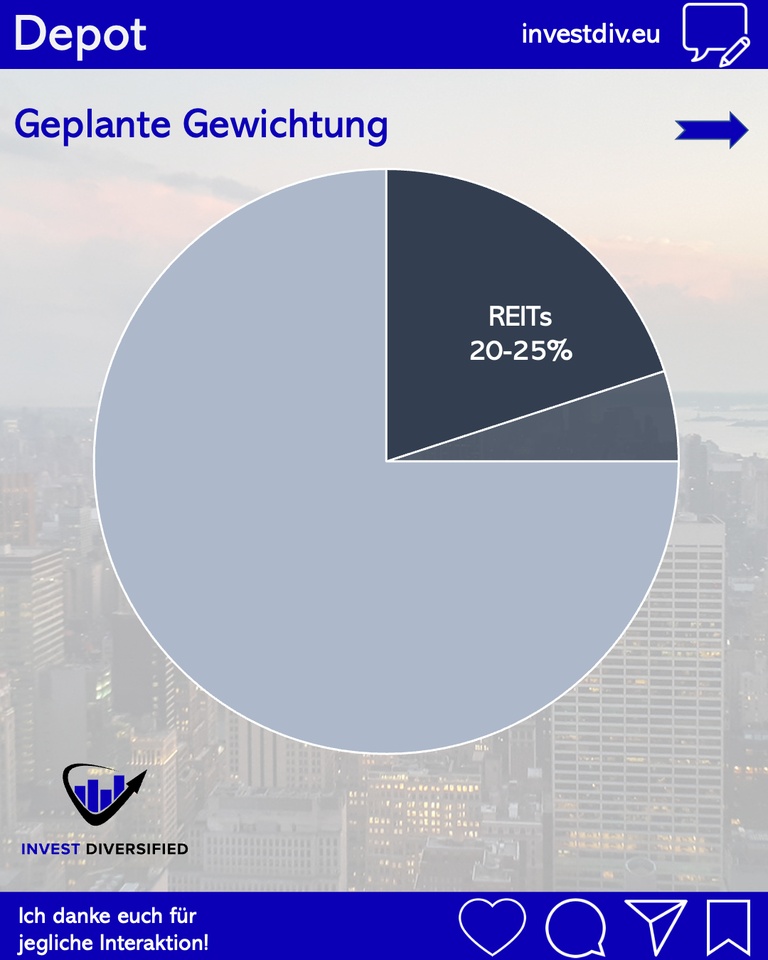

➡️ Therefore, I intend to increase my REIT share to up to 25% in 2023 and focus primarily on apartment REITS, but also on those from the office and industrial sectors. The first candidates are already on the list.

#reit

#immobilien

#dividende

#depot