Just in time for closing time, I'd like to show you one of my favorite stocks in the midcap segment: Sprouts Farmers Market!

Sprouts is a US organic supermarket chain. The sustainable idea hits the spot. They are the third largest organic supermarket chain in the world.

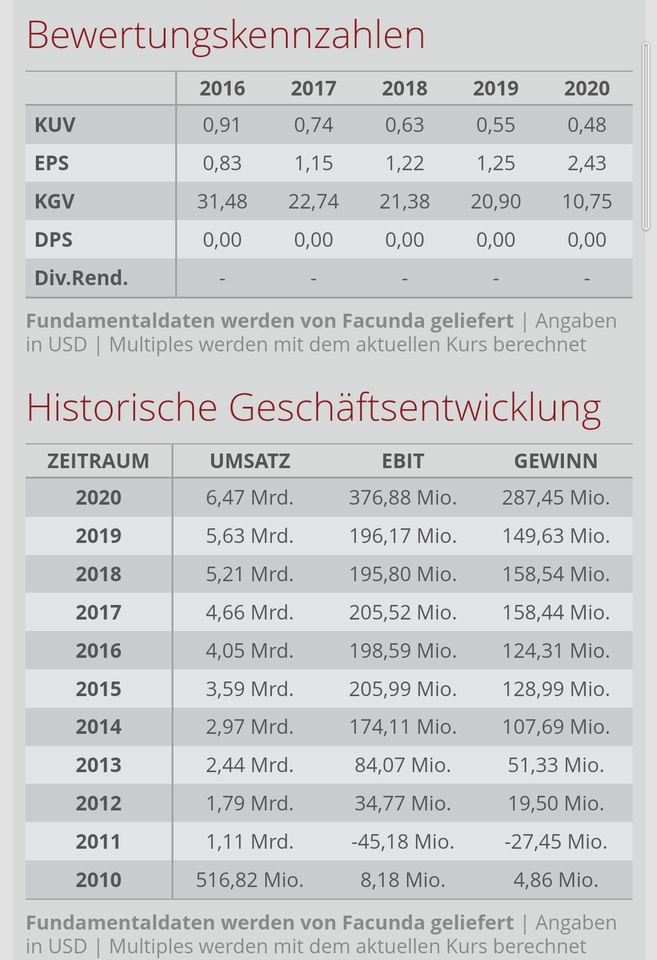

Key figures overview:

P/E 20: 10.75

P/E ratio 21e: 12.6

Gross margin: 36.78

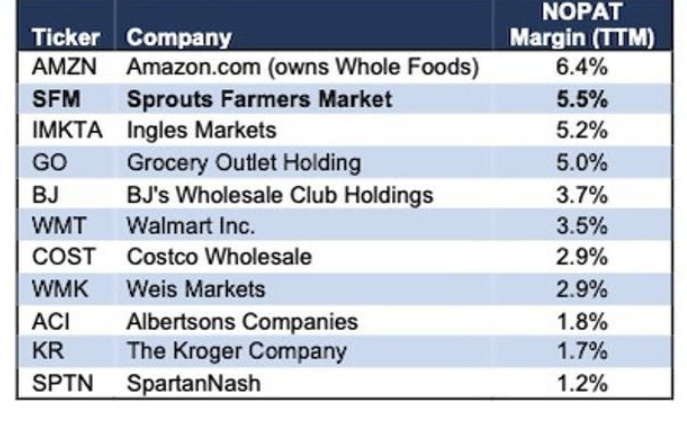

Net operating margin (NOPAT): 5.5% and thus second-best margin of all main competitors (see NOPAT overview)

ROCE: 24

Leverage ratio < 4 x EBIT (3.3)

Why Sprouts? Firstly, the very favorable valuation, and secondly, the good market position compared to the competition. Sprouts is in a growing market and meets the ravages of time.

Why also interesting in the short term? Consumer goods stocks with some pricing power can take advantage of slightly higher inflation to push through higher prices to sustainably increase their margins.

What do you think? Who has been shopping in a Sprouts Market? I would be very interested in the experience 😊

Disclaimer: I am invested myself.