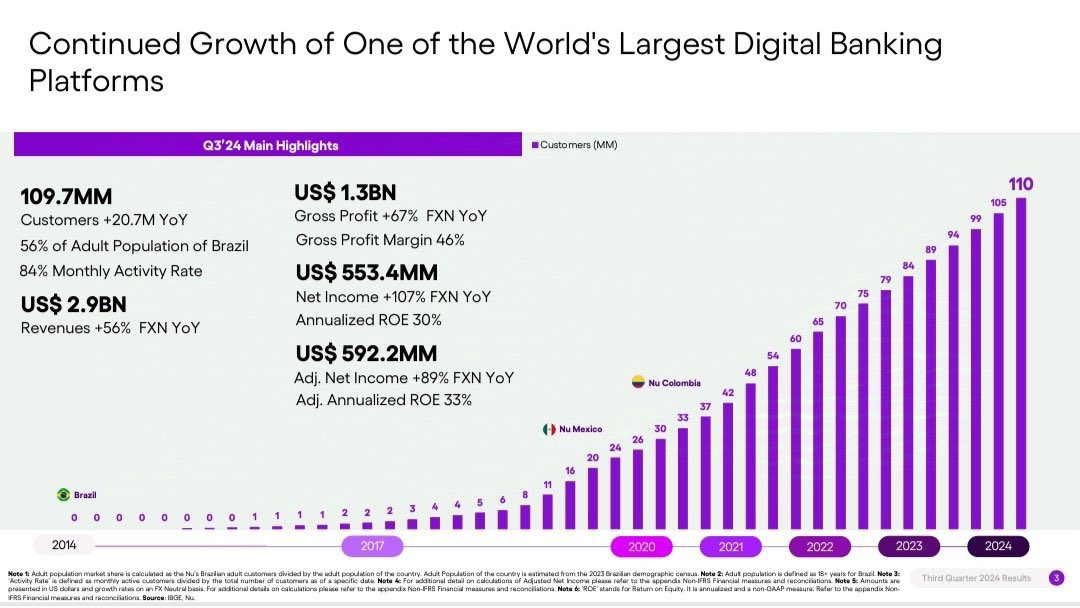

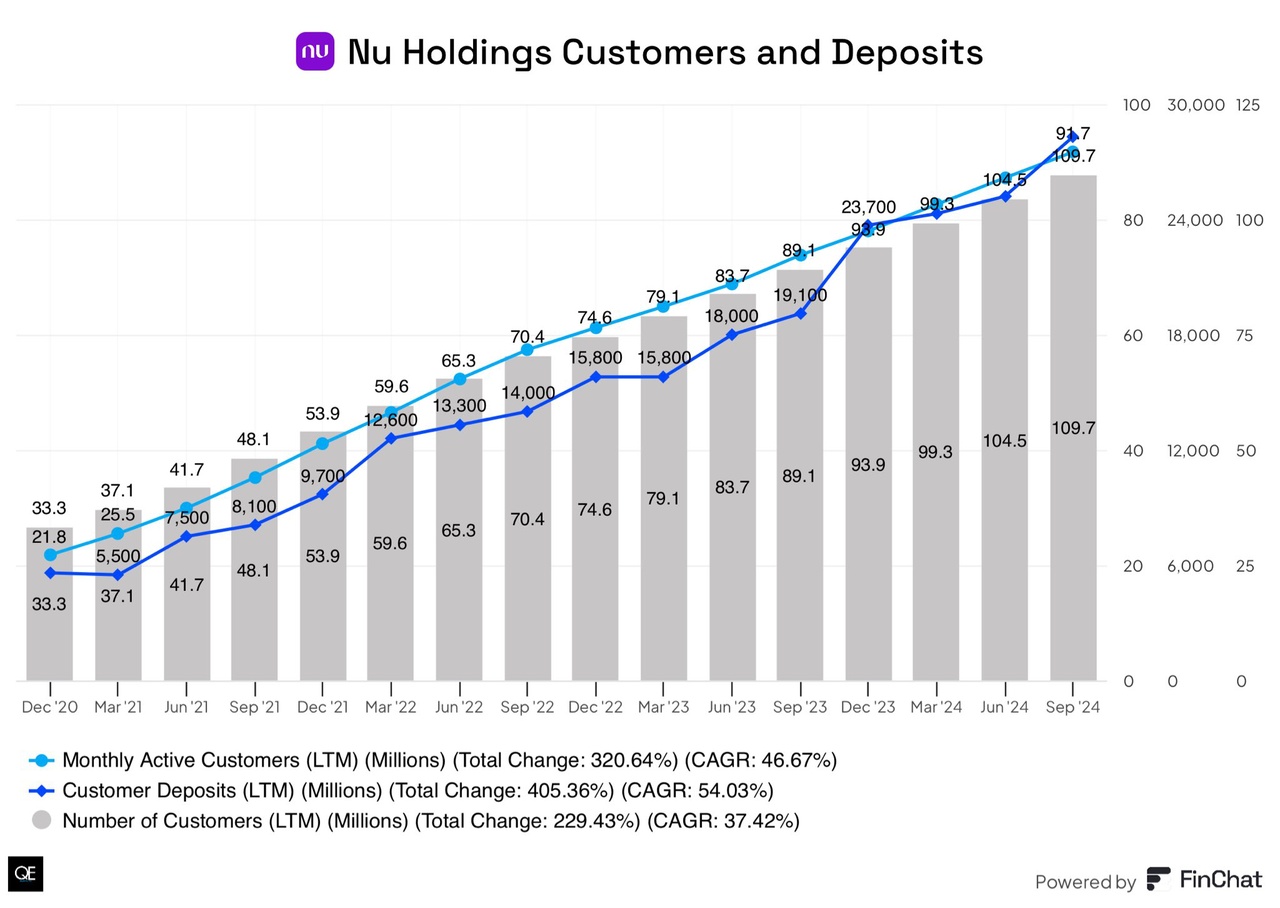

- The rapid user growth will continue in my opinion, as the expansion into Mexico and Colombia has only just begun and other countries could follow

- Revenue per user has great growth potential as it is currently around a quarter of the revenue of traditional banks

- Service costs continue to fall despite record lows

- The ratio of non-performing loans is approximately at the level of US competitors

- Business customer business is still a largely undeveloped area and has great potential for expansion

It is trading at a ridiculous FWD-PEG ratio of 0.5, which in my opinion is currently one of the best opportunities in the market

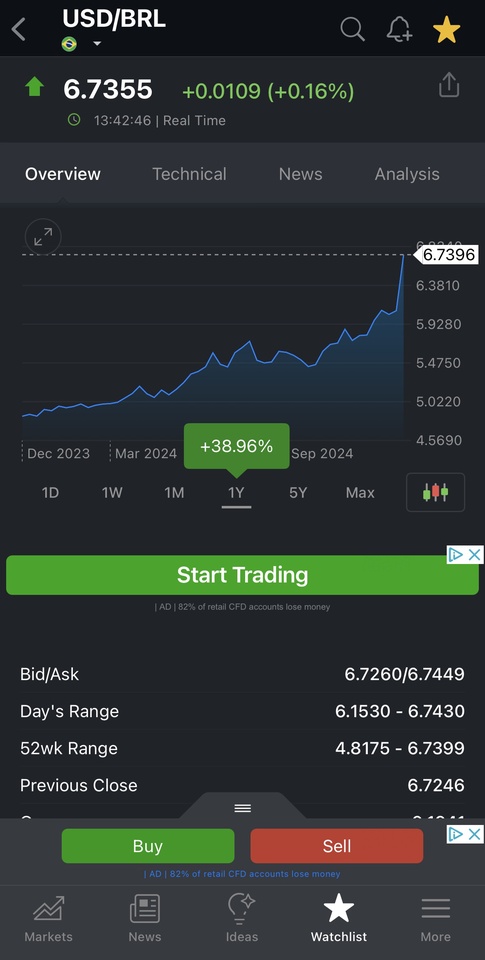

USD/BRL - here lies the problem of current weakness, dollar strength against the Brazilian real, but this has been the case for the last 5 years.

Nevertheless $NU (+0.26%) still perform magnificently ✌️