$VOE (+1.03%) In terms of share price, we have once again reached the bottom🥶

It's been a while since you could read anything about the Austrian steel producer here. You only find these lows for VOEST every few years. See also the following daily and weekly charts.

Yesterday there were the 1st half-year figures 2024/2025.

- Focus on high-tech products and broad positioning by sector and region supports Group result

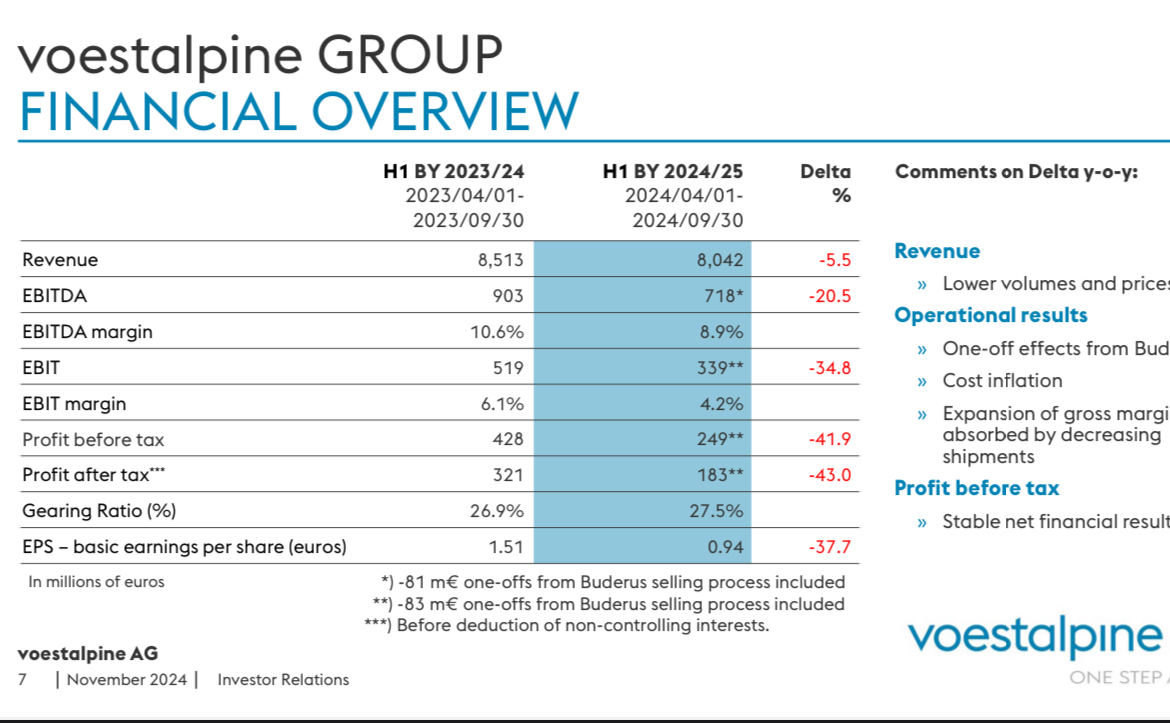

- Sales of EUR 8 billion slightly down on the previous year (EUR 8.5 billion)

- EBITDA of EUR 718 million influenced by negative one-off effects (previous year: EUR 903 million)

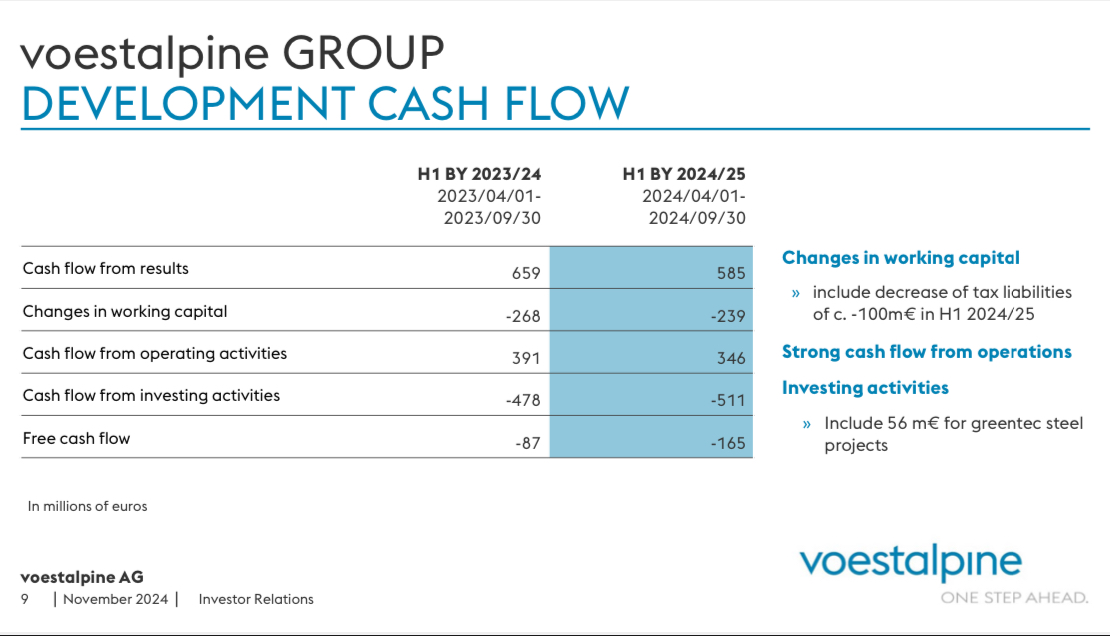

- Equity of EUR 7.4 billion stable compared to the balance sheet date (March 31, 2024) Leverage ratio at 27.5 % (March 31, 2024: 22.0%) at a solid level

- Numerous international growth growth projects being implemented

- Successful placement of a green bond - the first European steel company to do so

- Number of employees (FTE) increased by 1% year-on-year to 51,700

- EBITDA outlook at around EUR 1.4 billion

Not available for TL:TR -- the whole thing in more detail📃

The voestalpine Group was confronted with low economic momentum in the current reporting period. This weakened the revenue fell by 5.5% in the first half of 2024/25, from EUR 8,512.8 million in the previous year to EUR 8,042.3 million. The year-on-year decline in sales, which affected all four divisions equally, is the result of lower sales volumes and a drop in prices against the backdrop of falling raw material costs.

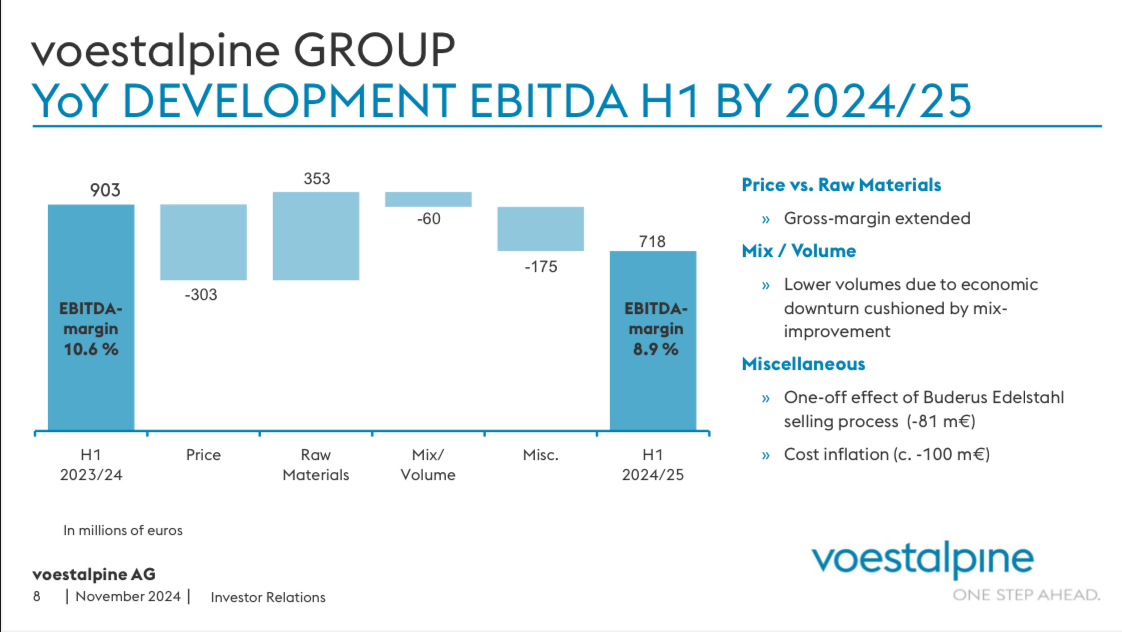

The operating result (EBITDA) of the voestalpine Group vdecreased by 20.5% year-on-year in the first half of 2024/25, from EUR 903.4 million (margin of 10.6%) to EUR 718.1 million (margin of 8.9%). The operating result (EBIT) of the voestalpine Group fell by around a third year-on-year, from EUR 519.3 million (margin 6.1%) in the first half of 2023/24 to EUR 338.5 million (margin 4.2%) in the first half of 2024/25.

Outlook.

Outlook:

At the start of the 2024/25 financial year, the weak performance of the construction, mechanical engineering and consumer goods industries was offset by very good demand from the railroad infrastructure, aviation, warehouse technology and conventional energy sectors. The automotive industry also performed largely stable at a solid level.

The conventional energy sector weakened noticeably over the course of the first quarter and the automotive industry also lost considerable momentum at the end of the second quarter following a series of profit warnings from well-known European OEMs. The economic mood in Europe changed over the course of the first half of 2024/25 after large corporations announced extensive plans to reduce their workforce.

On the basis of the result for the 1st half of 2024/25, the significantly gloomier market developments in Europe and the non-recurring burdens on earnings totaling more than EUR 100 million from the sale of Buderus Edelstahl and the reorganization of the reorganization of the Automotive Components business in Germany the Management Board of voestalpine AG expects for the business year 2024/25 from today's perspective an EBITDA in a range of around EUR 1.4 billion.

This earnings outlook is based on the on the expectation of continued good global development in the railroad infrastructure, aviation and warehouse technology business areas. The assessment of the performance of the voestalpine sites outside Europe in the other business segments also remains positive for the second half of 2024/25.

The challenges in Europe, and especially in Germany the Management Board of voestalpine AG is meeting the challenges in Europe, and especially in Germany, with active management and, where not otherwise possible, by reducing the Group's presence in this region.

My conclusion: I will continue to hold my position for the time being, but will not expand any further. Depending on the economic environment, Trump's influence, etc., a sale may also be an option

Who else has VOEST in their portfolio? What's your view? Hold, increase or sell?

Source of the data: voestalpine Investor Relations & Geschäftsbericht - voestalpine