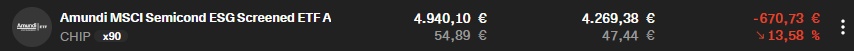

From the $CHIP (+0.77%) to the $IE00BMC38736 (+0.79%) shift?

Entered on 10.07., which was probably a very unfavorable time (from a current perspective). The share of over 30% $NVDA (+2.01%) is $CHIP (+0.77%) already very strong. Which makes it heavily dependent on NVIDIA, which in retrospect bothers me a little. What do you think? Is it worth reallocating?