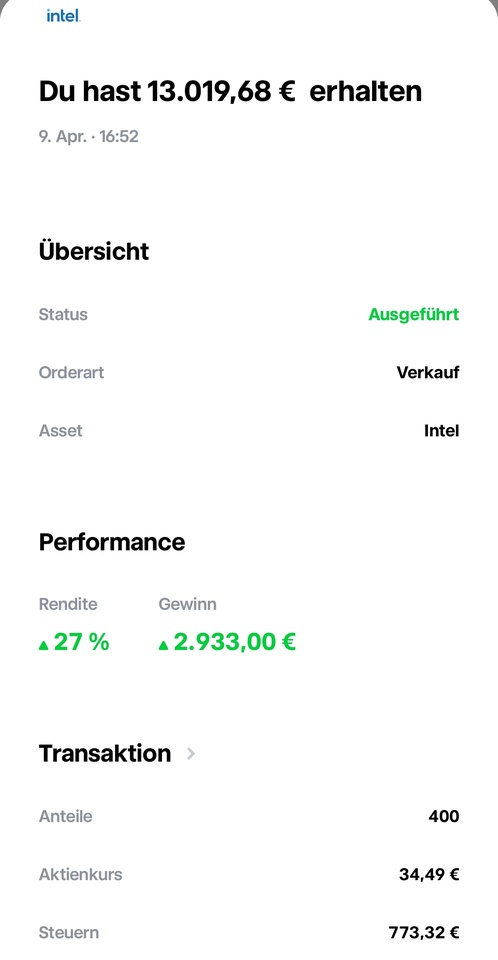

Sale Intel with +27% / +€2,933 after 14 months holding period

Intel recently explained the plans for its foundry strategy and stated that it will probably not make money with it for another six years, i.e. 2030. The market sold off the share, causing it to fall 12% last week.

It was actually no surprise, as it is known that Intel is building or expanding many sites in the USA, Ireland, France, Italy, Poland, Israel and here in Magdeburg. New chip factories are expensive and take a long time to build. In Magdeburg there is only the field so far. Everything is actually known, but the market was disappointed and still doesn't trust Intel.

I have always said that Intel is only a turnaround story for very patient investors. I am still quite confident, but in the short term, various crypto stocks in the crypto bull market are more attractive. And as derivatives such as warrants, they naturally perform much better. Hence the shift to a faster horse. You can find out all the details about the new purchases as a patron in the Telegram group (advertising):

https://www.patreon.com/Techaktien

You could certainly hold Intel, but I'm taking a risk. I could well imagine buying Intel back next year, as I did in February 2023. With 1,000 AMD shares, I am still well invested in the semiconductor market. I currently only own four real stocks: AMD, Alphabet, Palantir and Take Two Interactive.

What do you think of Intel shares?

#intc

#intel

#amd

#palantir

#taketwo

#pltr

#aktien