Hello Quins,

I finally dare to ask for feedback on my portfolio.

I am a 28 yr old (still) computer science student who went all in in bitcoin/etherum in 2016/2017. I luckily took profits in early 2022 and have been diversifying into dividend ETFs ever since, with the goal of eventually being able to live off the income alone.

The goal is to be on 90% ETFs 10% BTC/ETH sometime in 2025/2026.

Keep the tips coming!

#portfoliofeedback

#eth

#btc

#dividend

#etfs

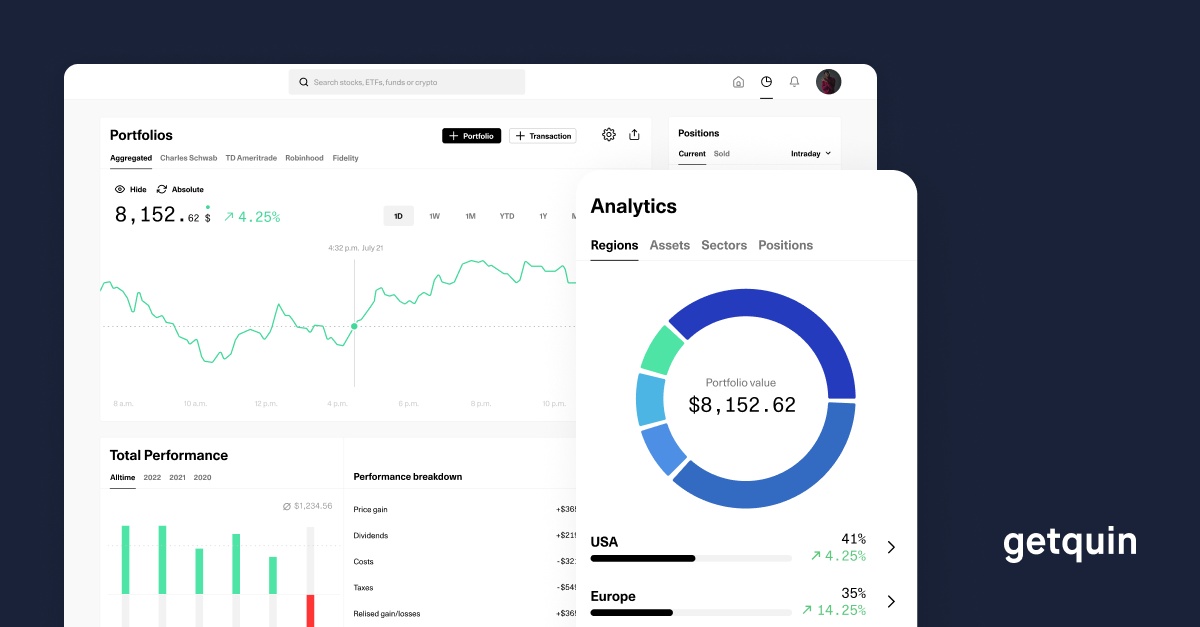

Here is my portfolio: