Analysis to $VOE (+1.03%) a wish from @TomTurboInvest

https://www.tradingview.com/x/ty4TL3Ma/

Foreword

Hello everyone :)

Today we are looking at Voestalpine together. I was a little surprised at first because the ticker on Tradingview differs from the one here in Getquin. I have now taken the XETRA chart.

I will try in the future to create my analysis always in the same scheme.

Analysis:

Note:

Very important for every TA is that you analyze from HTF > to LTF. For daytrades the timeframes 1h - 15min - 5min are very interesting. For swing trades 1D - 4h - 1h. And for longer position trades I basically look at the monthly, weekly and daily chart.

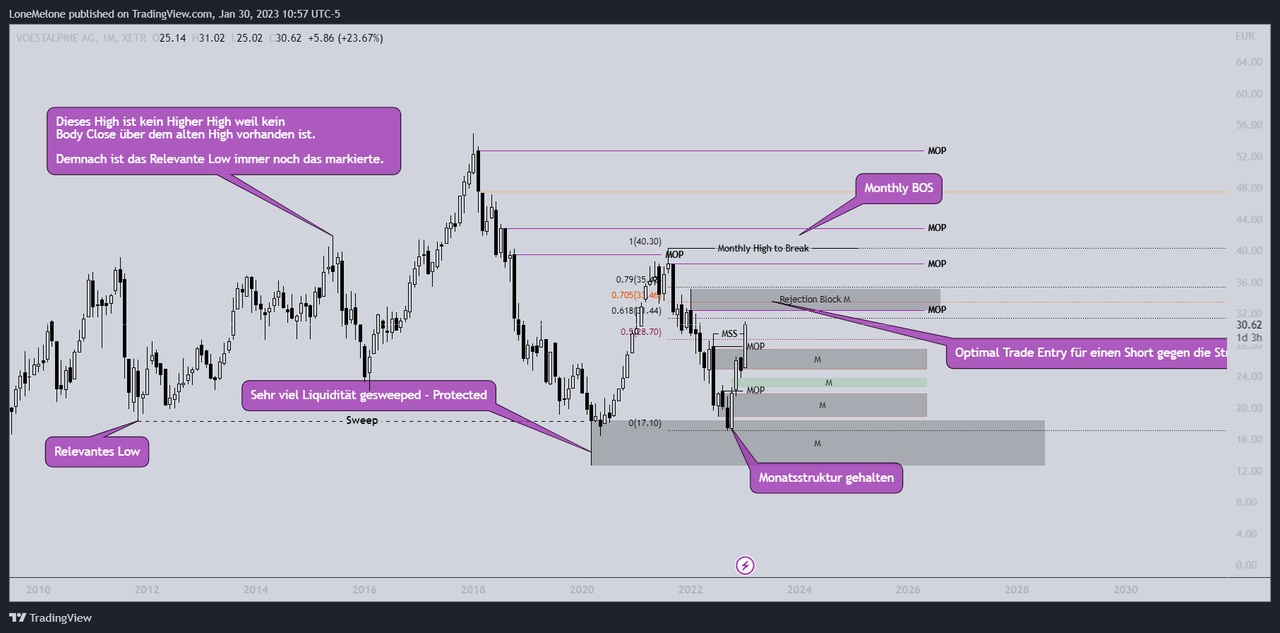

Monthly chart:

Structure:

The structure on the monthly chart is Bullish.

The Corona low took out pretty much all the liquidity possible on the buyside (below) at that time. Accordingly, this structure is Low Protected. This means the market/price has very little incentive to go below it again.

This is exactly what happened. As you can see we bounced off our Corona low order block in August/September with a very strong impulse.

(By the way, my next info post will be about order blocks - I tell you order blocks on individual stocks is a gamechanger.)

We have 2 enormously strong monthly candles - a small retrace and then directly our current very strong candle. That's what I call a rebound - by the way known as V-Shape Recovery - Optimally we would have here no retrace but that is often a very bullish signal.

Accordingly, status quo:

As explained on the chart, our relevant structural low was never broken. Accordingly, we have never been bearish monthly. The optimal entry for a short contrary to our structure is at around 33.5€. However, I would never recommend this to beginners in particular, because further and more advanced confirmation methods are necessary.

Accordingly, I expect a "relatively" strong reaction in the marked order block around the 33.5€. So that we can completely confirm our bullish momentum again and go to ATH course, we must break 40.3€ on the monthly chart (Important: Body Close).

Also at the marked points with MOP we can either expect a Bearishe reaction or evaluate as a Bullishes signal if they are broken with a Body Close.

A final TP could be either at the volume imbalance at 47.4€ or if you really want to hold long term also just above the ATH.

Liquidity:

I don't have to say much about liquidity here. The main liquidity here is above the Monthly High to Break, the ATH and the current low in the order block at €17.

I currently consider the liquidity at 40.46€ and below the low to be the most attractive. So those are both potential reversal options. So if we go below our current low but don't close the month with a body that would be potentially bullish. If we break 40.46€ but don't close above it with a body, that would be potentially bearish.

Weekly chart:

There is not much to say about the weekly chart and also the relevant levels are rather on the monthly chart. Therefore, pay particular attention to the levels of the monthly chart.

But the structure is aufjedenfall Bullish.

Conclusion:

So we expect a potential correction at our order block between 35 and 32€. Also at the levels 32, 38 and 43€. It is important that we close the "Monthly High to Break" with a body. If this is not the case, a potential reversal scenario comes into effect where the target would be the liquidity below the current lows at 16.8 and 16.3€. The marked order blocks (in gray) below our current price are potential support levels at which we expect an upward reaction. We would like to see the green box at 23.8-22.6 filled. But it is also a support level.

So for you to finish, here are my take profits if I were in the trade.

SL already long ago on Breakeven or in profit

I would probably have taken some profit now and rather left my SL at breakeven instead of in profit.

Definitely 1st take profit should take place in the area of 32.44 to 35.16€. I would simply wait for a stronger reaction on the daily chart or take a part out directly at 32.44€.

Take profit would be at the level 38.36€ or if you are a little more motivated 40.3€. Then I would wait to see if the high on the monthly chart is broken impulsively.

If yes - continue to hold the rest until 48€

If no - SL tighten more definitely in profit.

If you still have a residual position after 48€, you can hold it until the ATH.

If you are of course very motivated and want to swing-trade the whole thing, you can always add something to your position in any serious correction.

So last but not least a little disclaimer as always:

This is not investment advice! I only provide my opinion here. I also have trades that do not run according to plan. Anyone who tells you he has a 99% on 50-100 trades is lying.

If you would like to have your stock analyzed like this or you have suggestions for improving the structure of the analysis, please let me know. I am also happy to answer any questions.

Otherwise until next time. :) Have a good start into the week.