Scalable Robo Advisor

I'm testing Scalable Wealth since August (so far only with 50 Euro per month)

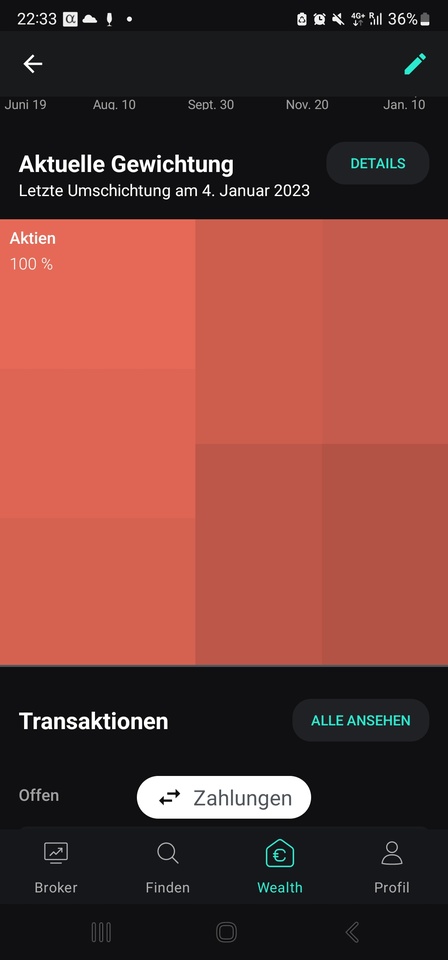

Right now I find it interesting that on Jan 4th 100% Invested,

in December the ratio before the Fed meeting was 75% stocks and 25% overnight money.

Let's see if the algo is right.

My chosen product is the Megatrend Portfolio.

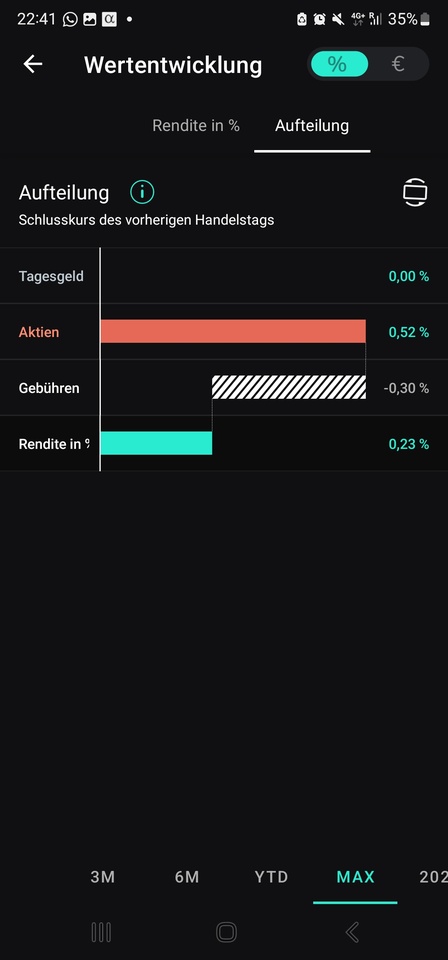

Return after costs so far at +0.23%.

My first conclusion after 4 months:

Is not as bad as I thought, am positively surprised that the return is still above the costs. +0.23% return is of course not mega but satisfactory for a Robo Advisor in the market environment.

I must also say that it is actually intended for a one-time investment, but I invest per savings plan.

In August, I will then decide whether I invest a larger amount or let it continue to run per savings plan.