Hello everyone and a happy new year!

I'm currently thinking about how I can optimize my trading strategy or how I can start by creating a proper strategy.

My previous investments in my conservative retirement provision portfolio were traditionally based on ETFs (e.g. MSCI World) and in my "play money portfolio" I am currently more "spontaneously" driven. I want to change that now.

My specific question to you:

There is a stock market rule: "Back and forth empties your pockets".

I can of course follow this in my head and it sounds logical at first.

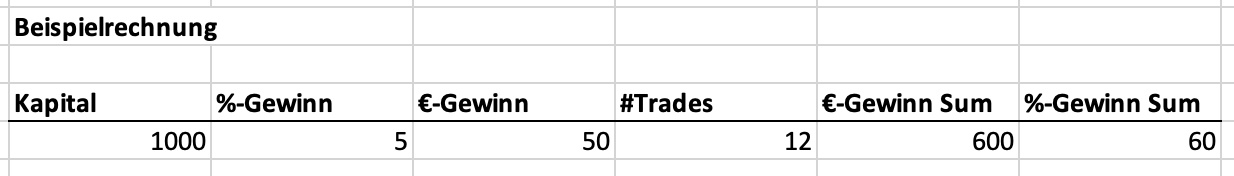

On the other hand, if I make 12 trades in a year, in which I sell directly after a 5% increase in the respective value, I would have an annual return of 60% (minus fees, etc.).

Of course, selecting the stocks for the 12 trades involves a certain amount of risk. The target profit of 5% is only an example calculation, but even at 4% you would still have an annual return of 48%. I think the chance of achieving such a return with a single stock that you hold for the whole year is rather less likely.

What do you think of the two investment approaches?

I look forward to a constructive discussion!

Best regards,

Alex