When you throw your money out the window right after receiving your salary - But in a getquin way 😂 Additionally: Novo Nordisk and the impact on the food industry

Perhaps one of the best and easiest savings tips. Directly after salary receipt invest the money, then you do not get used to your entire salary at all and get along extremely well with less.

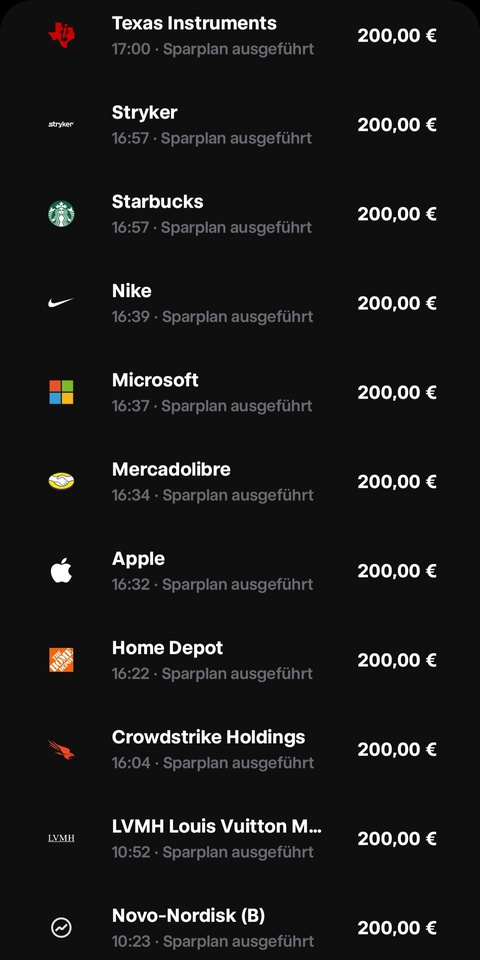

I currently have a total of 33 stock savings plans running, these are executed quarterly, so every month 11 of them.

This month it was Novo Nordisk's turn again. $NOVO B (+0.72%) again. And also with Starbucks $SBUX (+0.05%) a stock that is supposedly not going to be around much longer, if you follow some opinions that claim we will soon all inject ourselves with Wegovy and then never touch sugar, fast food and the like again.

"Allegedly because of the boom in appetite suppressants, the share prices of PepsiCo or McDonald's had recently also come under pressure. An expert from the financial firm Mizuho told the business channel CNBC that the business of the U.S. restaurant industry could also shrink by $25 billion by 2025. Bank of America analysts also see providers of low-calorie frozen foods as another potential loser from the trend. They could be made obsolete by the new drugs."

https://www.spiegel.de/wirtschaft/unternehmen/ozempic-und-wegovy-walmart-meldet-sinkende-nachfrage-wegen-neuer-abnehmspritzen-a-e3505d1d-34c2-4b36-b917-9d128e762721

In my eyes, 3 reasons argue against this:

- People smoke and drink even though they know it is not healthy. It will be the same with eating. If I have less appetite, I can still go to McDonalds and save one of the other two meals. Instead of skipping the bag of chips, I can just skip the serving of vegetables. It's not the appetite for unhealthy foods that is inhibited, but for all of them.

- If the big companies really notice that they are losing a massive amount of sales, they will react to this and develop healthier products or otherwise try to increase margins in order to counteract the decline (see the current reaction of companies to sales declines due to inflation - price increases compensate for this disproportionately).

- The drug is extremely expensive and continues to be that: a drug with potential side effects. I cannot imagine that this drug will be widely consumed as a lifestyle product - I am aware that there can and will be abuse as with e.g. painkillers, but not on a society-changing scale.

How do you guys feel about these thoughts? Can you imagine this really impacting these stocks in the long run?

#aktien

#stocks

#invest

#growth

#savingstips

#news

#personalstrategy