🔵$PYPL (+0.59%) ANALYSIS - PART 1

1) COMPANY OVERVIEW

PayPal $PYPL (+0.59%) is a globally recognized financial technology company that revolutionized online payments, enabling secure and convenient transactions between individuals and businesses. Serving as a digital alternative to traditional methods, PayPal facilitates online money transfers, eliminating the hassle of checks and money orders. With over 400 million active accounts worldwide, PayPal has become an integral part of the digital commerce ecosystem.

2) SERVICES

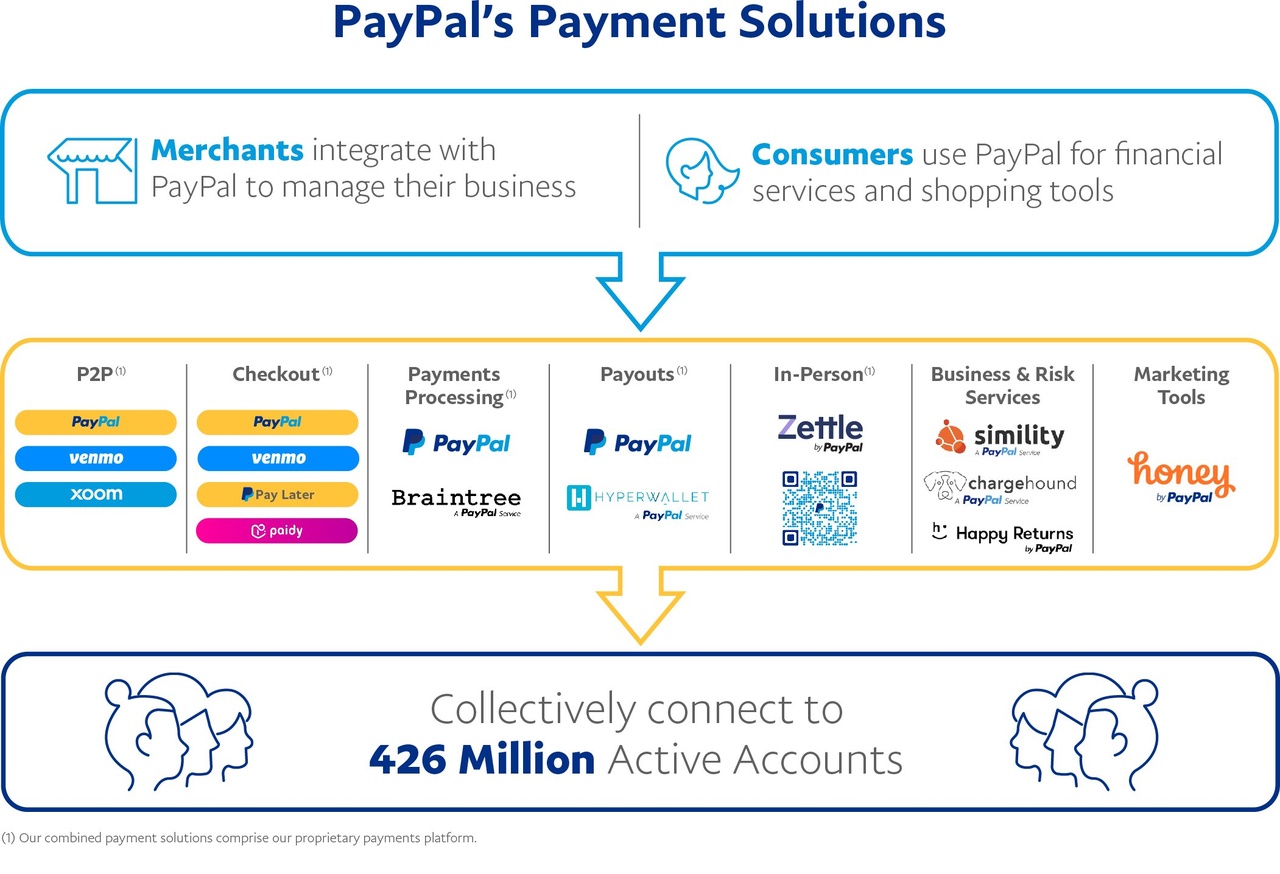

PayPal's Payment Solutions include P2P (Included PayPal App and Venmo), Branded and Unbranded Checkout (Braintree) and other small business divisions (figure 1).

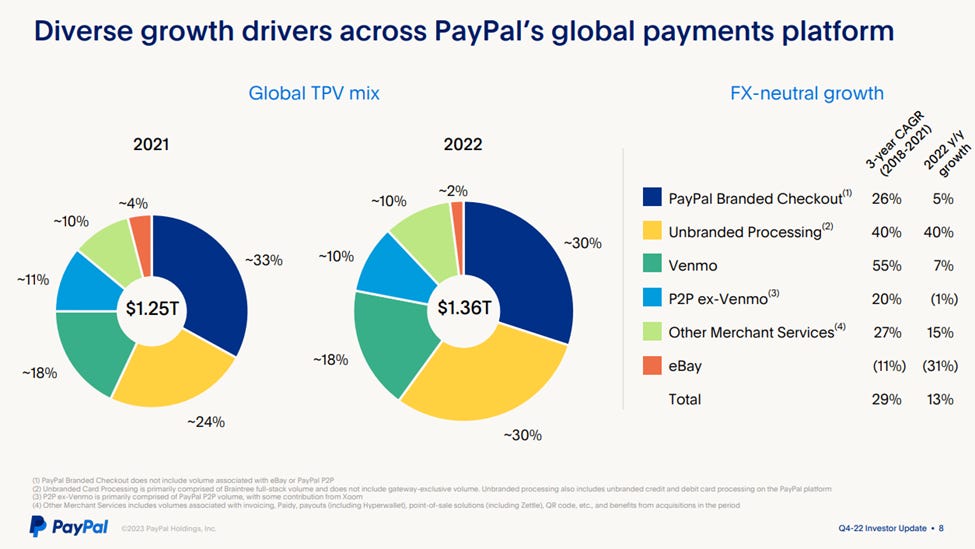

Figure 2 represents revenue segments for $PYPL (+0.59%) in 2021 and 2022, in particular Branded Checkout is becoming less important while Unbranded checkout is growing strong and double digit.

3) MARKET ANALYSIS

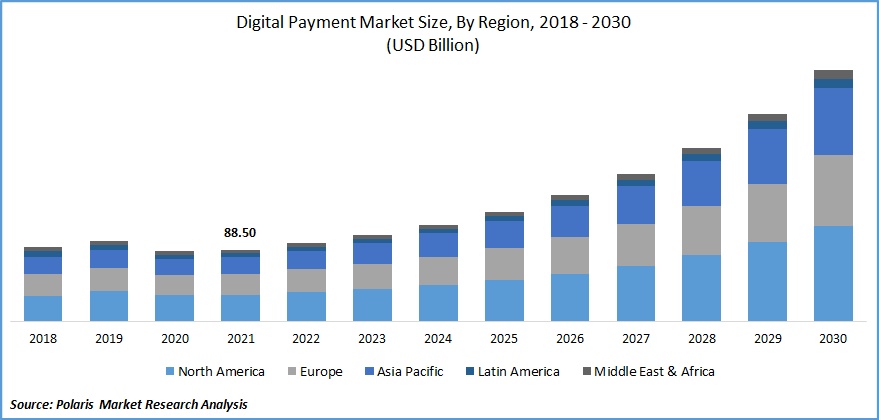

- Digital Payments: based on a Polaris Market Research "The global digital payment market" was valued at USD 88.50 billion in 2021 and is expected to grow at a CAGR of 15.7% during the 2021-2030 period (Figure 3).

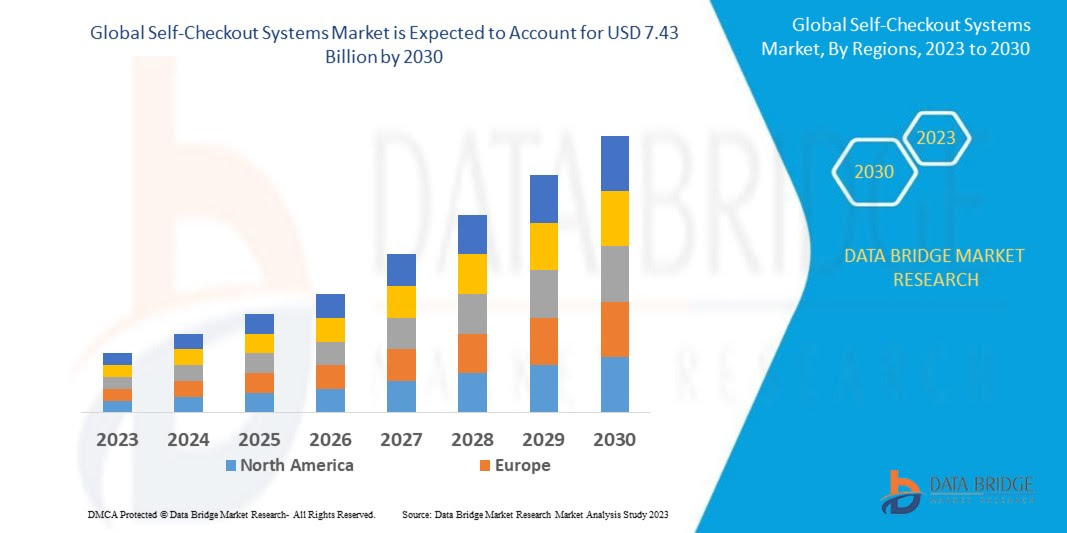

- Unbranded Checkout: data of Bridge Market Research analysis show that the self-checkout systems market, valued at USD 3.91 billion in 2022, will reach USD 7.43 billion by 2030, growing at a CAGR of 8.37% during the forecast period of 2023 to 2030 (Figure 4).

4) COMPETITORS

- Stripe: a popular payment processing platform, it is a good choice for businesses of all sizes.

- Adyen: $ADYEN (+2.74%) operates the most used unbranded checkout (direct competitors of Braintree)

- Square: $SQ (+0.95%) is another popular payment processing platform that is particularly well-suited for small businesses. Square offers a variety of point-of-sale (POS) systems.

- Google Pay $GOOG (+0.59%) and Apple pay $AAPL: (+0.73%) mobile payment platforms that can be used to make in-store and online purchases.

5) RISKS

-Cybersecurity risk: Paypal stores sensibile data for more than 400 million users.

-Competitors risk: as I said before PayPal has lot of competitors and if they are not able to upgrade the technology of payments while maintain high quality services they'll surely lose market shares.

Company like Adyen are currently growing faster than PayPal and that's a big threat for the future.

6) OPPORTUNITIES

- New CEO: Alex Chriss @acce became the new CEO in September 2023 after leaving his important position in Intuit $INTU (+3.07%).

- Expanding in new markets can be a potential growth opportunity for capturing new users and increase revenue.

- Focus on the quality of their products and increase the revenue per users.

- Selling to business other secondary services as the new CEO said during Q3