I am looking more into dividends for the first time. Can someone please help me understand the following?

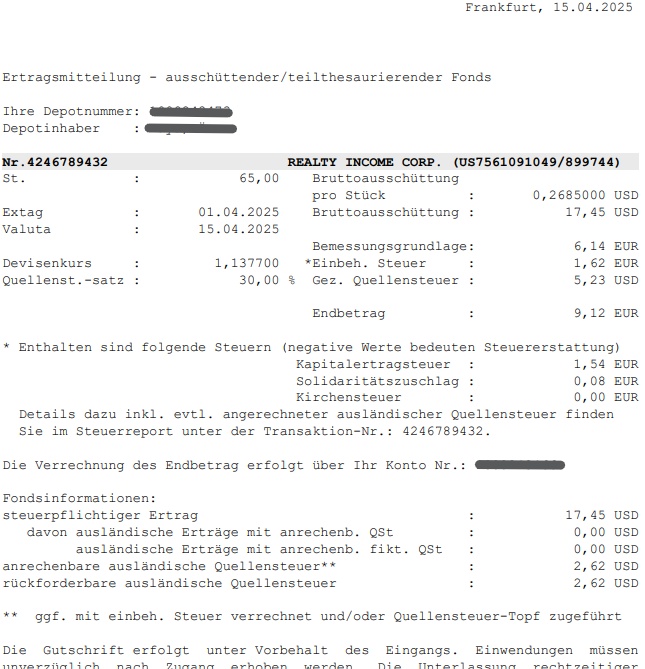

17.45 USD today is ~15.40 €. Final amount (what is paid out) is 9.12 €. That's a sick ~40% tax?!

I understand

- the tax withheld 1,62 €

- the statutory (German) withholding tax 5.23 USD (25%)

what I do not understand is the assessment base of € 6.14

Is that the same for you private individuals $O (+1.99%) the same?