Heute eine neue Analyse zum Thema KI.

Diesmal ein eher wenig bekannter Titel. Vorgestern kamen Quartalszahlen, die überzeugt haben, die Aktie sprang um 15 % an und durchbrach damit einen 3-jährigen Abwärtstrend.

Die Web-Version des Beitrags: https://investorsapiens.de/splunk-aktie-prognose-ki-kaufen/

SPLUNK: Ein KI Infrastrukturunternehmen

Vorwort

Heute schauen wir uns eine Aktie an, die KI-Infrastruktur bereitstellt. Es ist die SPLUNK Aktie, die ich im Artikel Megatrend KI-Aktien als einen Profiteur des Megatrends KI vorgestellt habe. Gestern veröffentlichte SPLUNK seine Quartalszahlen und übertraf die Erwartungen deutlich.

SPLUNK Das Unternehmen

Die Geschichte von SPLUNK beginnt im Jahr 2003, als die visionären Gründer, Erik Swan, Rob Das und Michael Baum, die enorme Lücke in der Art und Weise erkannten, wie Unternehmen Daten nutzen und verstehen. Sie sahen, dass herkömmliche Ansätze zur Datenanalyse den wachsenden Datenmengen nicht gewachsen waren und es an effizienten Möglichkeiten mangelte, wertvolle Erkenntnisse aus diesen Daten zu gewinnen. Mit dieser Erkenntnis legten sie den Grundstein für Splunk und schufen eine Plattform, die es Unternehmen ermöglicht, große und komplexe Datensätze und Big Data effizient zu durchsuchen, zu analysieren und daraus wichtige Erkenntnisse zu gewinnen.

Bis 2007 hatte SPLUNK 40 Millionen US-Dollar von Risikokapitalfirmen wie August Capital, Sevin Rosen, Ignition Partners und JK&B Capital aufgebracht. Im Jahr 2009 wurde das Unternehmen profitabel. 14 Jahre später liefert SPLUNK überragende Quartalszahlen, die deutlich über den Erwartungen liegen und beendet den Tag mit 15 % im Plus, während andere Unternehmen deutlich im Minus schließen.

Der Hauptsitz von Splunk befindet sich in San Francisco, Kalifornien, USA. Von dort aus lenkt das Unternehmen seine globalen Aktivitäten und Innovationen. Mit Niederlassungen und Büros in verschiedenen Ländern rund um den Globus hat Splunk eine internationale Präsenz aufgebaut, die es ihm ermöglicht, mit Kunden weltweit in Kontakt zu treten. Die Mitarbeiteranzahl von SPLUNK beläuft sich derzeit auf mehrere tausend hochqualifizierte Fachkräfte, die sich leidenschaftlich für Datenanalyse, KI und Innovationen einsetzen.

SPLUNK hat sich auf die Entwicklung von Softwarelösungen spezialisiert, die Unternehmen bei der effizienten Verarbeitung, Analyse und Interpretation von Daten unterstützen. Die Plattform von SPLUNK ermöglicht es Unternehmen, maschinelles Lernen und KI-Algorithmen auf Daten anzuwenden, um Muster, Zusammenhänge und Erkenntnisse zu entdecken, die zuvor möglicherweise verborgen waren. Dabei deckt SPLUNK eine breite Palette von Anwendungsfeldern ab, von IT-Sicherheit über Geschäftsanalysen bis hin zur Überwachung von Infrastrukturen. Besonders bemerkenswert ist der Fokus von Splunk auf künstlicher Intelligenz, der es Unternehmen ermöglicht, fortschrittliche Analysen und Vorhersagen zu treffen, um wettbewerbsfähig zu bleiben und fundierte Entscheidungen zu treffen.

SPLUNK zählt mehr als 15.000 Kunden in über 110 Ländern, darunter auch bekannte Namen wie Adobe, Bosch, Coca-Cola oder die Deutsche Bahn.

Zahlen, Daten und Fakten

SPLUNK KI Profiteur

Im Artikel Megatrend KI Aktien habe ich die 3 wesentlichsten Bausteine und Komponenten einer KI genannt, die eine KI im Wesentlichen bilden. Das sind Daten, die eine KI füttern und mit den die KI trainiert wird. Das sind Algorithmen und Methoden, das maschinelle Lernen (ML) und die Infrastrukturkomponenten, die eine KI betreiben. Rechenleistung, Chips, GPUs, Could-Computing-Platformen und so weiter.

Splunk bietet eine Cloud-Plattform für maschinelles Lernen und Analysen von Big Data an.

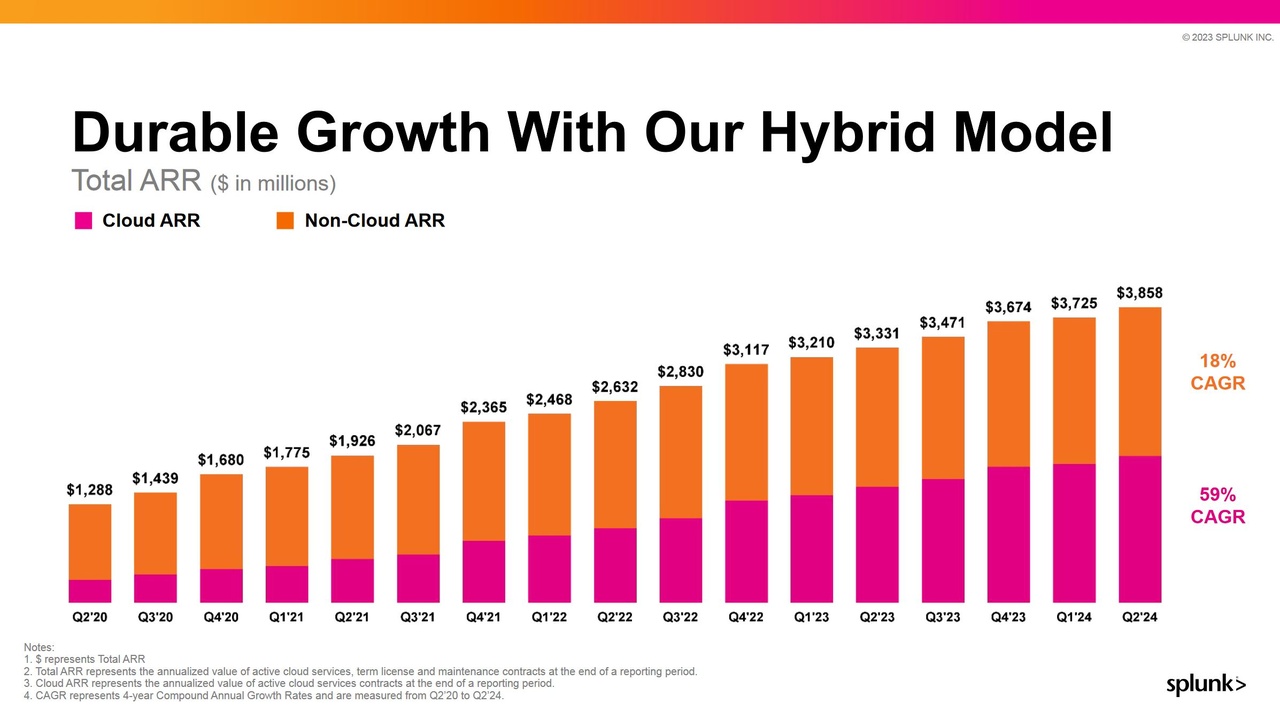

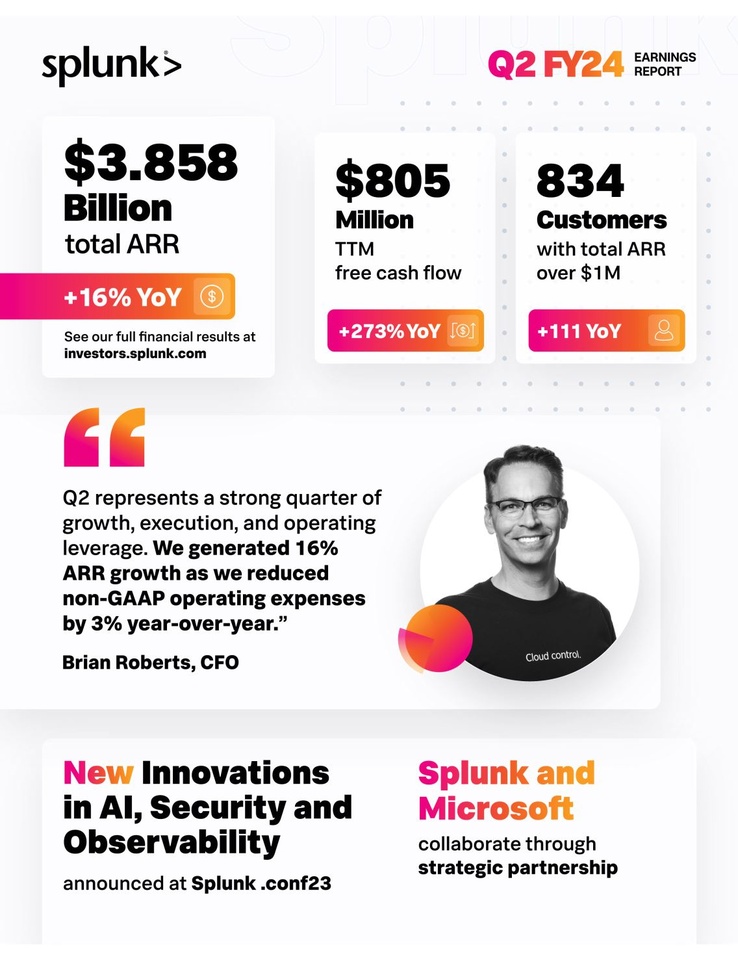

Quartalszahlen Q2FY24

Splunk präsentiert hervorragende Quartalszahlen und katapultiert sich an die Spitze der Cloud-Anbieter. Nach US-Börsenschluss meldete das Unternehmen einen bereinigten Gewinn pro Aktie von 71 Cent. Damit übertraf die Splunk Aktie die Erwartungen von 46 Cent pro Aktie um über 50 Prozent. Weiterhin wurde die Prognose für das Gesamtjahr deutlich angehoben. Die erwartete Gewinnmarge steigt von 18 bis 18,5 % auf 21 bis 21,5 %. Das ist ein Plus von über 16 %.

Mit den starken Zahlen sowie der angehobenen Prognose steigt die Aktie und wird zum Top Pick der KI Cloud Aktien. Während andere KI Aktien heute deutlich korrigieren (NVIDIA -8 %, C3.Ai -13 %) ist Splunk mit +15 % klar an der Spitze.

Übernahmeziel

Im Februar 2022 gab es diverse Berichte darüber, dass Cisco Insiderinformationen zufolge über 20 Milliarden Dollar für die Übernahme von Splunk angeboten hat. Damals war das Angebot ein deutlicher Aufschlag von ca. 50 % auf den Unternehmenswert. Seitdem ist bereits einige Zeit vergangen und sowohl die Umsätze als auch die Gewinne von Splunk steigen nachhaltig.

Zwischen Cisco und Splunk besteht eine enge Partnerschaft. Mit den stark wachsenden Margen und Gewinnen wird die Übernahme mit jedem Tag teurer.

42 Analystenmeinungen zur Splunk Aktie

Das derzeitige Stimmungsbild der Analysten mit Stand 20.08.2023 auf Consorsbank / FactSets sieht wie folgt aus. Von insgesamt 42 Analysten bewerten:

- 20 kaufen

- 7 übergewichten

- 15 halten

- 0 untergewichten

- 0 verkaufen

Das Stimmungsbild der Analysten ist eindeutig positiv. Mit 27 zu 0 überwiegen Kaufempfehlungen eindeutig.

Das Kurspotential auf Jahressicht wird derzeit mit 123 Dollar bei 7,94 % gesehen. Hier ist jedoch das Update der Empfehlungen nach den Quartalszahlen noch nicht enthalten, die ersten Analysten heben die Prognosen bereits an.

Chartanalyse

Abwärtstrend seit 2020

Die Splunk Aktie befand sich seit ihrem Hoch im Jahr 2020 bei über 225 US-Dollar, mit der allgemeinen Schwäche der Technologiewerte in einem Abwärtstrend. Sie verlor in den letzten 3 Jahren über 70 % an Wert. Im Oktober 2022 erreichte die Splunk Aktie ihr Tief bei 65 US-Dollar am Fibonacci Retracement 23,6 %. Der Kurs begann sich von da aus zu erholen, bildete eine Schulter-Kopf-Schulter Umkehrformation aus und durchbrach mit dem heutigen 15 % Kursanstieg den 3-jährigen Abwärtstrend.

Indikatoren

Die Indikatoren MACD und RSI sind positiv. Im wöchentlichen Chart signalisieren die Indikatoren ein anhaltendes Momentum und Kaufstärke.

Ausbruch aus dem Abwärtstrend

Im Daily Chart, mit einer Kerzendauer von 1 Tag, ist der RSI Indikator mit einem Wert von 71 nach dem Kurssprung von 15 % im überkauften Bereich, sollte sich jedoch innerhalb einiger Tage abkühlen. MACD hat heute im Tageschart ein positives Signal generiert. Sollte der Kurs in den nächsten Tagen nicht mit der allgemeinen Marktschwäche wieder fallen, sieht die charttechnische Lage sehr gut aus und verspricht weitere Kursanstiege.

Zusammenfassung

Umfeld und News

Das Umfeld sieht positiv aus. Mit dem Wachstum der KI Branche und den allgemein sehr guten Zahlen der KI-Unternehmen ist die Stimmung äußerst positiv. Sowohl NVIDIA als auch Splunk konnten mit den vorgelegten Zahlen überzeugen und die Erwartungen des Marktes übertreffen. Auch die Prognosen für das weitere Geschäft sind positiv und werden angehoben.

Mögliche Übernahmefantasien durch Cisco bieten zusätzliches Potenzial, hier gibt es jedoch bis auf die Berichte aus dem Jahr 2022 nichts Neues, daher kann eine Übernahme durch Cisco zunächst vernachlässigt und ausgeklammert werden. Das allgemeine Wachstum der Margen und Umsätze ist dagegen nachhaltig und vielversprechend. Es kann davon ausgegangen werden, dass Splunk auch künftig als ein KI-Infrastrukturunternehmen, welches maschinelles Lernen und Cloud-Platformen anbietet, vom KI Megatrend profitieren wird.

Stimmungsbild der Analysten

Die Analysten sind sich bei dieser Aktie einig, wie selten. Es gibt keine einzige Verkaufsempfehlung, 15 Analysten empfehlen es, die Aktie zu halten, 27 empfehlen einen Kauf oder übergewichten. Die sehr guten und über den Erwartungen liegenden Quartalszahlen sind in die Empfehlungen noch nicht eingeflossen.

Chartanalyse

Auch die Chartanalyse bekräftigt die positiven Eindrücke aus den Zahlen, dem Umfeld und den Analystenmeinungen. Die Indikatoren sowohl im kurzfristigen als auch im längerfristigen Timeframe sind positiv. Nach einem Einbruch der Aktie um über 70 %, dem Erreichen des Fibonacci Retracement Levels von 23,6 % und dem Ausbruch aus dem 3-jährigen Abwärtstrend mit einer abgeschlossenen Schulter-Kopf-Schulter Umkehrformation gibt es auch aus charttechnischer Sicht keine negativen Anzeichen.

Aussicht

Die Aussicht sowohl aus dem positiven Umfeld des stark wachsenden KI Megatrends, der wachsendem Umsätze und Margen, bekräftigt durch die frischen Quartalszahlen und Aussichten der Geschäftsführung, als auch die Analystenmeinungen und das charttechnische Gesamtbild sind positiv.

Risiken

Einzig das Tempo des Anstiegs der KI – Aktien ist besorgniserregend. Hier muss früher oder später mit einer Korrektur gerechnet werden, langfristig erwarte ich aber weitere Kurssteigerungen, denn die KI ist ein Megatrend, der sich in allen Lebensbereichen langfristig etablieren wird.

Dies ist keine Anlageberatung und keine Kaufempfehlung.