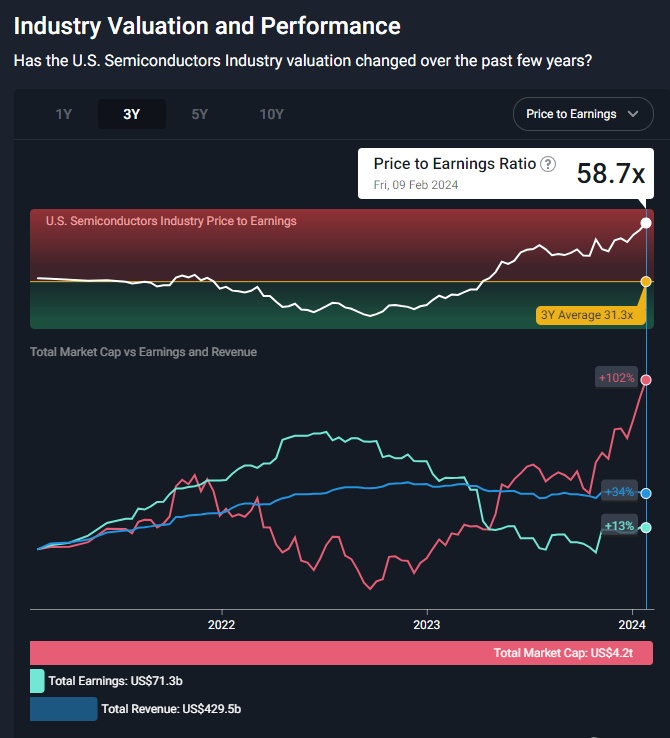

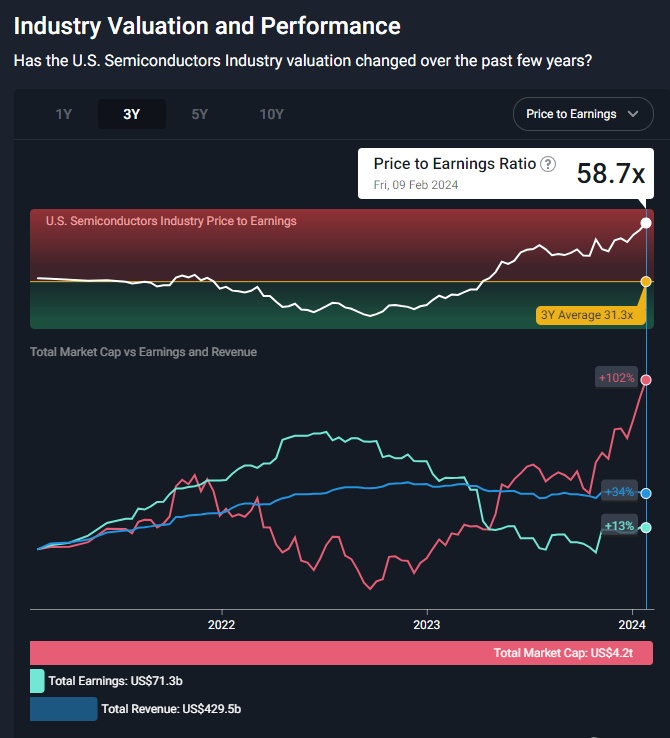

In the past year, the P/E ratio of the semiconductor industry has been twice the average P/E of the last 3 years. The fundamentals of major companies like $NVDA (-0,85 %) are very solid, but I don't think they justify current prices. #semiconductor

In the past year, the P/E ratio of the semiconductor industry has been twice the average P/E of the last 3 years. The fundamentals of major companies like $NVDA (-0,85 %) are very solid, but I don't think they justify current prices. #semiconductor