𝐑𝐞𝐧𝐝𝐢𝐭𝐞 - 𝐎𝐮𝐭𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐨𝐝𝐞𝐫 𝐔𝐧𝐝𝐞𝐫𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞?

Today a post about one of the most important metrics in the investment industry - returns. How can you outperform the overall market and what factors cause underperformance?

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 𝐮𝐧𝐝 𝐞𝐢𝐧𝐟𝐥𝐮𝐬𝐬𝐧𝐞𝐡𝐦𝐞𝐧𝐝𝐞 𝐅𝐚𝐤𝐭𝐨𝐫𝐞𝐧

Stock return: "The return on a stock investment between two points in time is the result of the price performance and any dividend paid in the meantime." [1] This initially results only in the gross return. Any taxes or other fees that may have to be paid must be subtracted from this and then result in the net return.

For me, this definition results in three basic factors that influence the return:

1. invested at all?

This factor is about the question whether one is invested at all (initially independent of the specific assets). In a phase of zero interest rates and a high inflation rate, this is the decisive factor for being able to generate positive returns at all.

2. which asset classes/assets are invested in?

This factor also plays a decisive role. In addition to the decision for specific asset classes, the decision for specific assets from these classes is also relevant. For example, if one decides to invest in the asset class equities, there are thousands of listed companies available as investments. These differ not only by industry and field of activity but also, for example, by whether the company pays a dividend to shareholders or not.

3. how long has been invested?

Time as a factor plays a role in the return insofar as stock markets, crypto markets, etc. have a certain volatility, which acutely affects the return (positively or negatively).

Example: Max Musterstonk decides to invest part of his capital (10,000€). Therewith he has laid the first foundation for a positive return (actually not yet with the decision alone but only with the concrete investment itself). In the following Max decides for an accumulating MSCI World ETF and invests the 10,000€ in it. With this, he has chosen an asset class (stocks or a concrete ETF) as well as an asset itself (an accumulating ETF, which tracks the MSCI World Index) and invested capital in it. Now time comes into play as the last factor: In the short term, the ETF can move in either direction and the 10,000 euros can become more or less capital. In the long run, however, such an asset tends to perform well, generating an average gross annual return of about 7%. After 10 years of holding, the 7% return p.a. and compound interest effect will result in 19,672 euros (still untaxed).

𝐁𝐞𝐢𝐬𝐩𝐢𝐞𝐥𝐡𝐚𝐟𝐭𝐞 𝐁𝐫𝐮𝐭𝐭𝐨𝐫𝐞𝐧𝐝𝐢𝐭𝐞𝐧

> MSCI World Index - 11.17% p.a. between December 1978 and January 2022 (not adjusted for inflation) [2].

> S&P 500 - 9.94% p.a. between early 1900s and early 2022 (not adjusted for inflation) [3]

> S&P 500 - 6.82% p.a. between early 1900s and early 2022 (adjusted for inflation) [3]

> Berkshire (Warren Buffett) - 20% p.a. between 1965 and 2021 (not adjusted for inflation) [4]

> ARK Innovation ETF (Cathie Wood) - 28.6% p.a. between 2015 and present (not adjusted for inflation) [5]

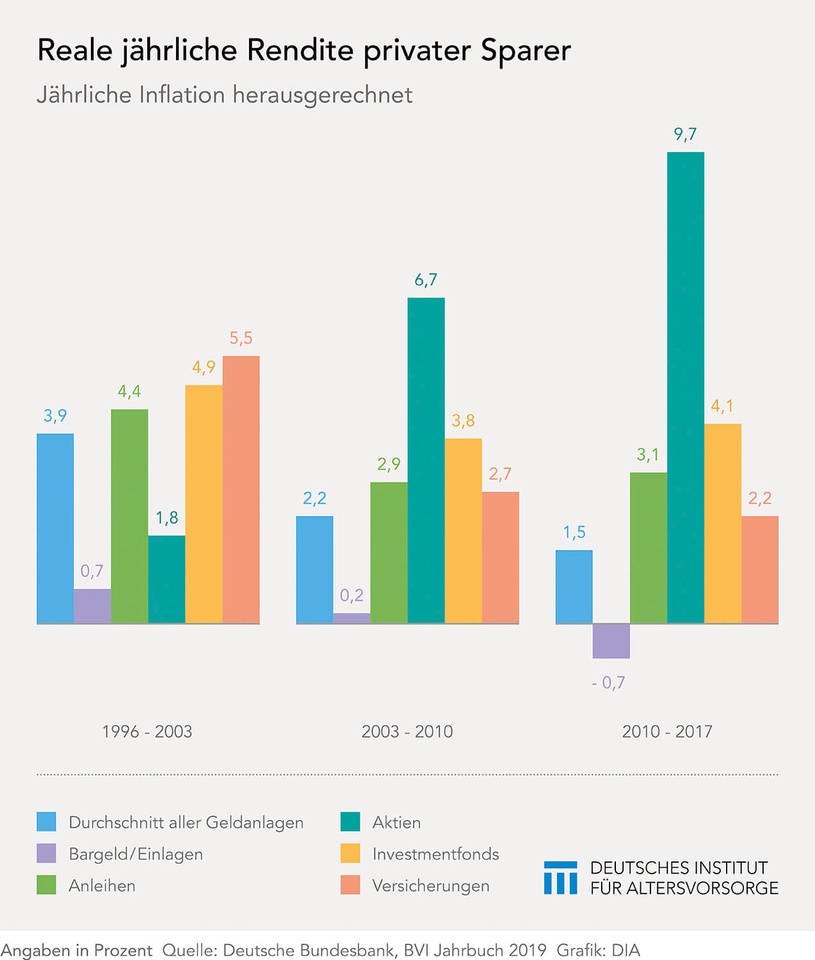

> German retail investors (Equities) - 6% p.a. between 1996 and 2017 (adjusted for inflation) [6]*.

> German retail investors (all financial investments) - 2.53% p.a. between 1996 and 2017 (inflation-adjusted) [6]*

* also visible in the attached image.

It can be seen that German private investors have not performed as badly as the popular opinion always makes it out to be (assuming they have bet on stocks). With other investments, however, an underperformance was practically preprogrammed.

In the following, we will look specifically at the reasons for outperformance or underperformance compared to the overall market.

𝐆𝐫ü𝐧𝐝𝐞 𝐟ü𝐫 𝐎𝐮𝐭𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞

1. timing the market (short-term).

In the short term, volatility in the stock markets can be very high (we can see it quite well right now). In such an environment, high performance can be achieved through short-term or medium-term trades. With leveraged products this performance can be even higher. Of course, such an outperformance is very difficult to achieve and long-term success with such methods is almost impossible.

2 Time in the market (long term)

Time heals all wounds. In terms of the stock market, it can be said that short-term corrections or even a crash of the stock market have never had a long-term effect on stock prices. In the long run, (almost) everything recovers. Of course, one can sometimes catch a black Wirecard sheep or the like, but solid companies that also do solid business will improve their stock market value in the long run rather than deteriorate. However, outperformance in the long run is only achievable with the right assets (otherwise you would perform just like the overall market).

3. excellent stock picking

Outperformance of the overall market can be achieved by selecting the right stocks (stock picking). Cathie Wood (German: Karin Holz) does this for example with her ARK Innovation ETF. This has generated a gross annual return of almost 29% since inception in 2015 (yes despite the current correction). However, it is also clear that the period since 2015 is not yet very meaningful for a longer-term investment.

4. knowledge advantage

Outperformance can also be achieved through a knowledge advantage in different ways. This knowledge can be, for example, know-how in a specific area of expertise. For example, an experienced software developer can most likely assess the activities and products of a tech company better than a layperson in the field, or a doctor can assess the activities and products of a healthcare company. However, a knowledge advantage can also arise apart from technical know-how. Here, for example, insider knowledge should also be mentioned. This is usually more of a temporal knowledge advantage than a technical one. A prominent and current example is the purchase of Activision shares by Berkshire at the end of last year. It is quite possible that a certain insider knowledge led to the purchase and to a considerable return since purchase.

5. luck

You have to be lucky in life (and in your asset selection). Quite a few have made a fortune through Tesla or Bitcoin. Whether this was always due to excellent stock-picking (or crypto-picking) is something I'll leave up in the air.

𝐆𝐫ü𝐧𝐝𝐞 𝐟ü𝐫 𝐔𝐧𝐝𝐞𝐫𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞

1. too little time in the market

Underperformance due to too little time in the market is something virtually all of us have had. When you buy a stock, you practically start with 0% performance (due to order fees and spread even rather in the negative range and thus you have underperformance for the time being). Bad timing can lead to a performance that remains below the performance of the overall market for a longer period of time.

2. not always in the market

The stock market can often be frustrating and so it is not uncommon for investors to liquidate their assets and get out. During the time investors are not invested, they are more likely to underperform than outperform (but outperformance is theoretically also possible when overall markets fall and you do not capture the negative return by not participating).

3. stock-hopping

If you switch too often from stock to stock, you will most likely also underperform the overall market. Likewise, frequent switching or changing of assets or strategy will also reduce performance.

4. wrong investment or bad stock picking

As can be seen in the picture [7], stocks have been unbeaten in recent years in terms of performance (except for cryptocurrencies, perhaps, but these have not yet been taken into account in the statistics). Whoever bet on the wrong investment here, most likely had to accept an underperformance.

If you decide to invest in stocks, it can still happen that you choose the "wrong" stocks, which underperform the overall market over a longer period of time, in contrast to excellent stock picking.

5. waiting for event or price xy

Here you lose performance by waiting for a certain event or a certain price and not being invested during this time.

𝐅𝐚𝐳𝐢𝐭

There are many reasons for outperformance or underperformance (probably a few more than listed here but has gotten long enough). Very few will manage to outperform the overall market with every single investment. The important thing is to start investing and stay on the ball for the long term. In this sense, I wish all who have read to the end a fat outperformance 🚀🚀🚀.

𝐑𝐞𝐟𝐞𝐫𝐞𝐧𝐳𝐞𝐧

[1] https://wirtschaftslexikon.gabler.de/definition/aktienrendite-29952

[2] https://backtest.curvo.eu/market-index/msci-world

[3] https://www.officialdata.org/us/stocks/s-p-500/1900

[5] https://ycharts.com/companies/ARKK/performance

[6] https://www.dia-vorsorge.de/einkommen-vermoegen/realrendite-fuer-private-anlagen-sinkt/

[7] https://www.dia-vorsorge.de/wp-content/uploads/2019/09/2019_Realrenditen_deutscher_Sparer.jpg