Ever wanted to know how inflation and rising interest rates affect a growth stock like Tesla?

I'll go into each common reason why growth stocks are punished when interest rates rise, and try to debunk some of it as it relates to Tesla.

1. inflation

Increased input prices can be well suppressed by Tesla through a dominant role in suppliers as the largest current and future e-car builder, plus they enter into long-term commodity contracts like other OEMs. Through numerous price increases since Corona, they have shown they can pass those prices on to their customers (M3 SR +21%, MY LR +14% in 2021). Higher prices could suppress demand, but this cannot be seen with Tesla as they still have long lead times and record low inventory (from 11 days down to 4 days inventory from Q4 20 to Q4 21). It was also said in the earnings call that they currently have so much demand for existing models that it doesn't make sense to pursue new lower cost models like the $25k Compact Car for now.

2. interest rate hikes

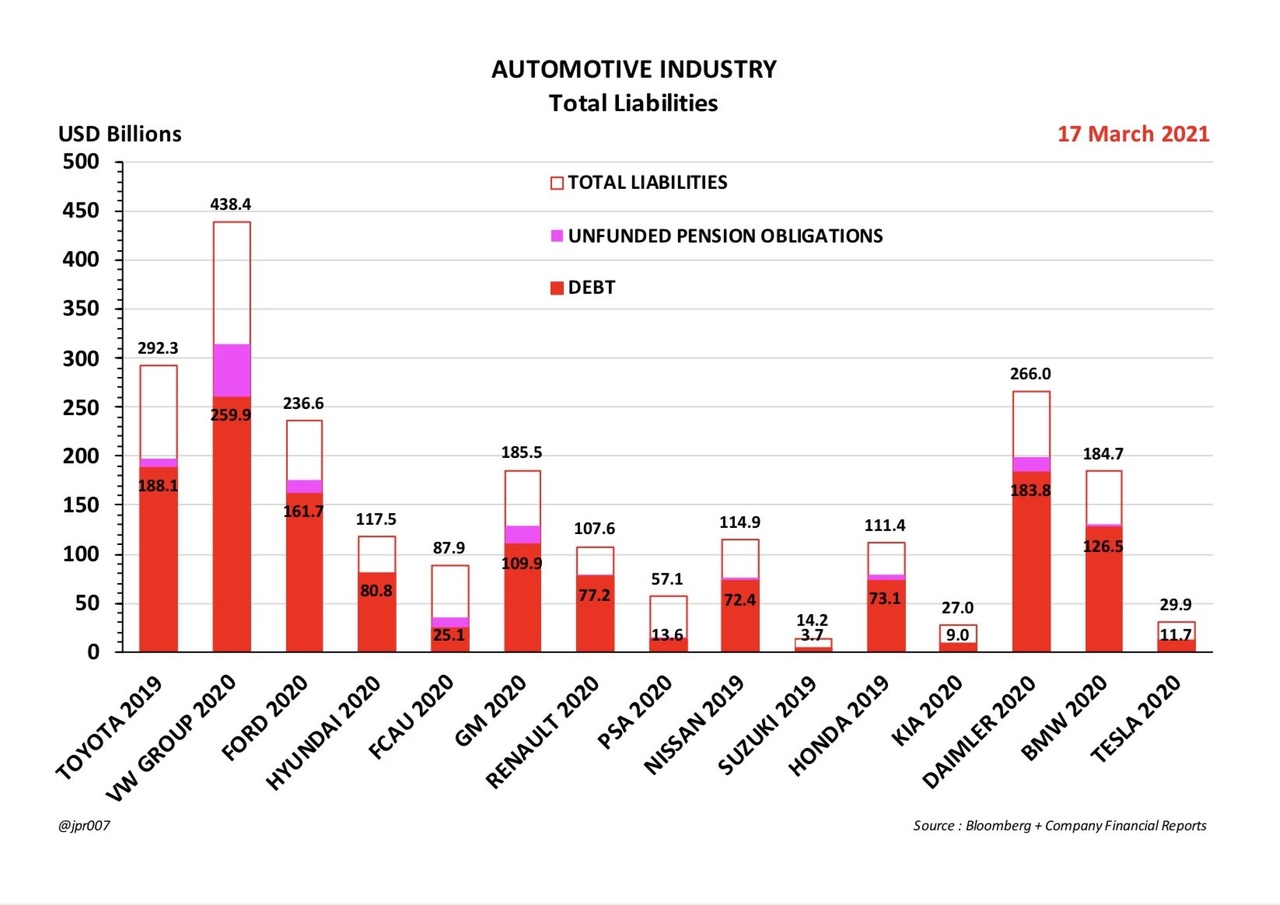

To counter inflation, central banks are expected to raise interest rates. Here, Tesla has the advantage over traditional carmakers that they have virtually no debt [Fig. 2]. This is the downfall of some companies when they have to refinance at higher costs. Tesla is net debt positive, meaning cash in the bank is higher than debt. Moreover, with $17.5B in cash and significant free cash flows each quarter (+$2.8B in Q4), they don't have the need to raise fresh money for expansion. The business is sort of self-funding, as management confirmed in their latest quarterly report: "We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses."

3. discount factor

As interest rates rise, future earnings also become worth less, as they must be discounted more relative to the risk-free interest rate on government bonds. This makes value stocks that generate their cash flows currently and consistently in the following years worth more compared to growth stocks that will generate most of their profits only in 5 or 10 years.

DF = discount factor

Rf = risk-free interest rate (10y US Treasury note)

β = beta (Tesla approx. 2.0 [Yahoo finance])

RP = equity risk premium (approx. 5.0% [Implied Equity Risk Premiums, Aswath Damodaran])

DF = Rf + β * RP

Assume Tesla makes EPS of $100 in 2030 (as an example, doesn't matter for the calculation). Then these profits are worth different amounts at different interest rates. In the calculation, we increase interest rates from 2% to 3% (currently 1.9%).

DF1 = 2% + 2.0*5.0% = 12%

$100/1,12^9 = $36,06

DF2 = 3% + 2.0*5.0% = 13%

$100/1,13^9 = $33,29

$33,29/$36,06 - 1 = -7,7%

So in this case, a 1%P rate increase makes a -7.7% difference in today's value.

To this I can say firstly, to define volatility as risk is in my opinion bullshit, and in no way reflects the real risks of the business. Secondly, the central banks will have a hard time raising interest rates more than a few percentage points, because otherwise the countries will get into financing difficulties. Basically, inflation is very welcome to countries as a stealth tax. Third, the DF is also your return, just take a DF of at least 15% for investments, who wants to earn less?

4th Valuation

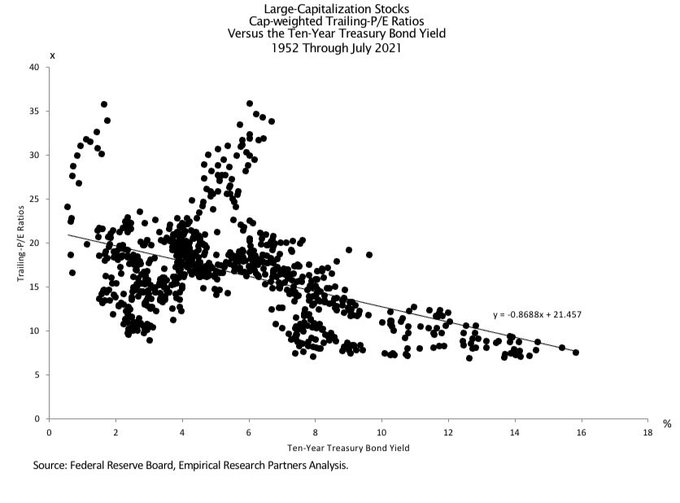

It is well known that the appropriate valuation is debatable, nevertheless the risk-free interest rate changes the valuation at which shareholders are willing to buy shares. In other words, as interest rates rise, P/E ratios fall. The correlation is not perfect, but at least there is an indication that the P/E ratios in the S&P500 decrease by ~4% when interest rates increase by 1%P [Figure1]. So for Tesla with beta 2, one can assume ~8%.

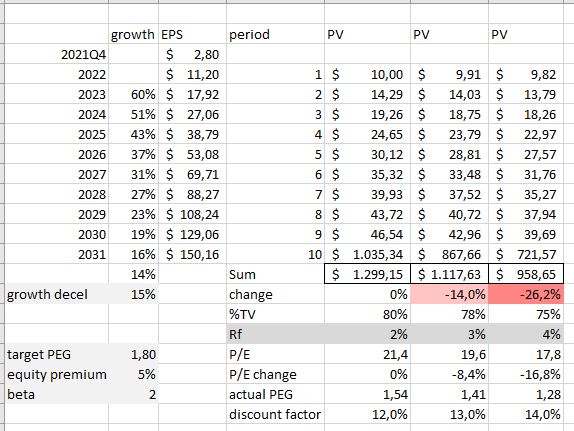

If you create an admittedly crude discounted future earnings model with this assumption, you get about -14% in present value for every 1%P in higher interest rates [Figure4].

This sounds like a lot until you realize that the 10y Treasury Yields have been in a strong downtrend for more than 30 years and in my opinion cannot stay very high for a long time [Figure3]. That would lead to completely different problems, states and economy have already adjusted too much to low interest rates. But in 10 years, of course, many things are possible.

I don't know what interest rate level the individual analysts are working with, but the average PT of the top analysts on Tipranks is $1187, if you price in there 1%P hike (-14%) you get $1020, which is still +14% from today's price of $895.

I am sure Tesla is still a good investment right now with interest rates at 2%, 3% and even 4% and am invested accordingly. NFA