---Share Minimum / Investment Strategy---

According to several studies, the average annual return for a retail investor is about 2.5%, although the average annual performance in the broad market, or for a broad-based ETF, is about 9%.

Why is this so? Certainly because many investors simply do not have the long-term horizon or panic during turbulent stock market years. Above all, this is supported by a lack of financial education and insufficient analysis of one's own investments. Purchase decisions based on recommendations of others are never good if one has not made oneself a comprehensive picture of the company. Because those who do not know their investments sufficiently and are not convinced get into panic much faster.

Therefore, you should always develop your own strategy at the beginning. The following considerations/facts are essential:

-Clear consideration of how much fluctuation I am willing to endure and then select the appropriate asset classes and shares.

-Do not constantly change your strategy.

-Confidence in one's own actions. Confidence is gained mainly through knowledge through training, literature, etc..

-Sufficient diversification.

-Do not judge your own strategy after a few weeks/months.

-Choose your strategy according to your own personality and willingness to take risks.

-Don't run after every trend/hype.

-Be prepared to endure certain fluctuations. Because in the end the return is the reward.

-Do not buy in a hurry but take your time.

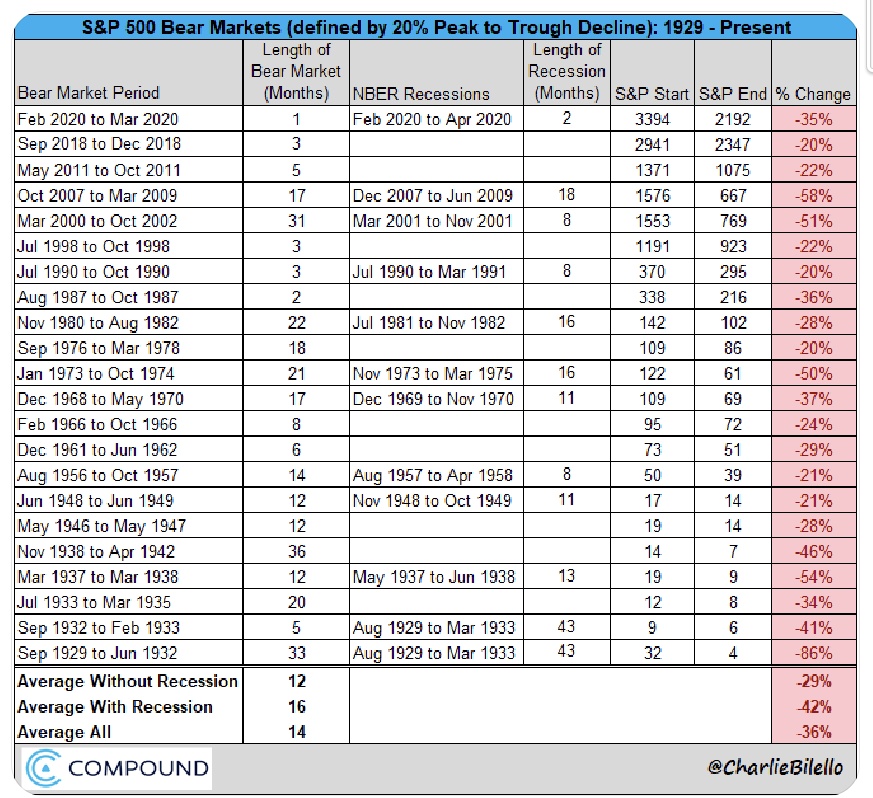

With every stock market cycle, confidence in your own actions grows and so does the return. Because corrections of the last days and weeks we had already enough in the past.

Finally, the following applies:

"Stock market profits are pain money. First comes the pain, then comes the money." Quoted by André Kostolany

Did I forget something in my listing? Then feel free to post it in the comments.

Graphic by Charlie Bilello.