Bonds Invest

I have decided to bet on falling interest rates. Basic idea: The market value of a bond reflects the difference between the coupon and the current interest rate level. The longer the remaining term of the bond, the greater the "leverage". If interest rates fall, prices go up. Law of nature!

As bonds are somewhat neglected here, I wanted to post something about them. Many of the younger people here are not even familiar with bonds as an investment object, as it has been pointless to invest in bonds in recent years in terms of returns. As a teenager in the 1990s, I had a bond from the Hungarian National Bank with a coupon of 9.25%. Back then, every payday was also a national holiday with normal inflation! :)

I will continue to invest in bonds in the near future and report regularly on developments. Anyone who would like to join me on this journey is invited to do so.

However, with interest rates likely to fall, there is now an almost unique opportunity. If interest rates normalize again next year, the price of long-dated bonds in particular will rise sharply. The risk is that interest rates do not fall (prices remain the same) or even rise (prices fall). However, I do not see this happening, as neither the economy nor governments can afford the current interest rates for long and the national banks will therefore have to react sooner or later.

From today's point of view, the best time to enter the market was probably mid-October. Since then, bonds have already risen by several percentage points. The market already seems to be pricing in next year's developments.

Why did I choose this bond now? Initially, I wanted to invest in a 30-year US bond. In October, I had already invested slightly in a Romanian euro bond because of the high interest rates. But it doesn't really fit in with my strategy. It has already risen in price, but in the end it won't be as much as the 30-year bond.

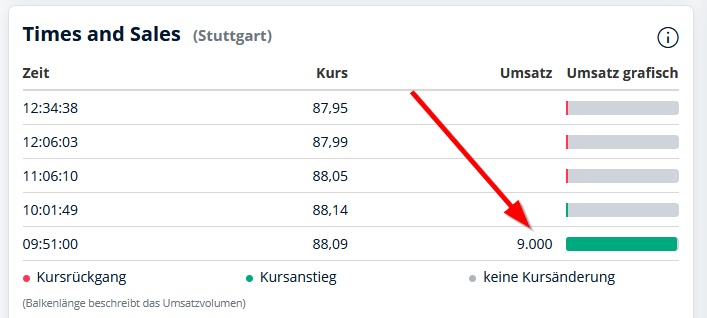

I wanted a bond where the last interest payment date was not too far in the past in order to minimize additional expenses for accrued interest. However, the current bond (30) from November is already at over 107%. I prefer to buy something "under" value. I have therefore opted for the bond from May (interest payment twice a year) with a coupon of 3.625% at a market value of 88.09%. This gives me an interest yield of 4.12%

I also received the profit share for last year with my November salary. On top of that, there were a few reallocations in the portfolio. So now was the right time to get in.

Link to the dashboard: https://app.getquin.com/dashboard/eNaHkgNkAu