A few thoughts on $VICI (+0.25%) 💭

I came, I saw, I conquered or what?

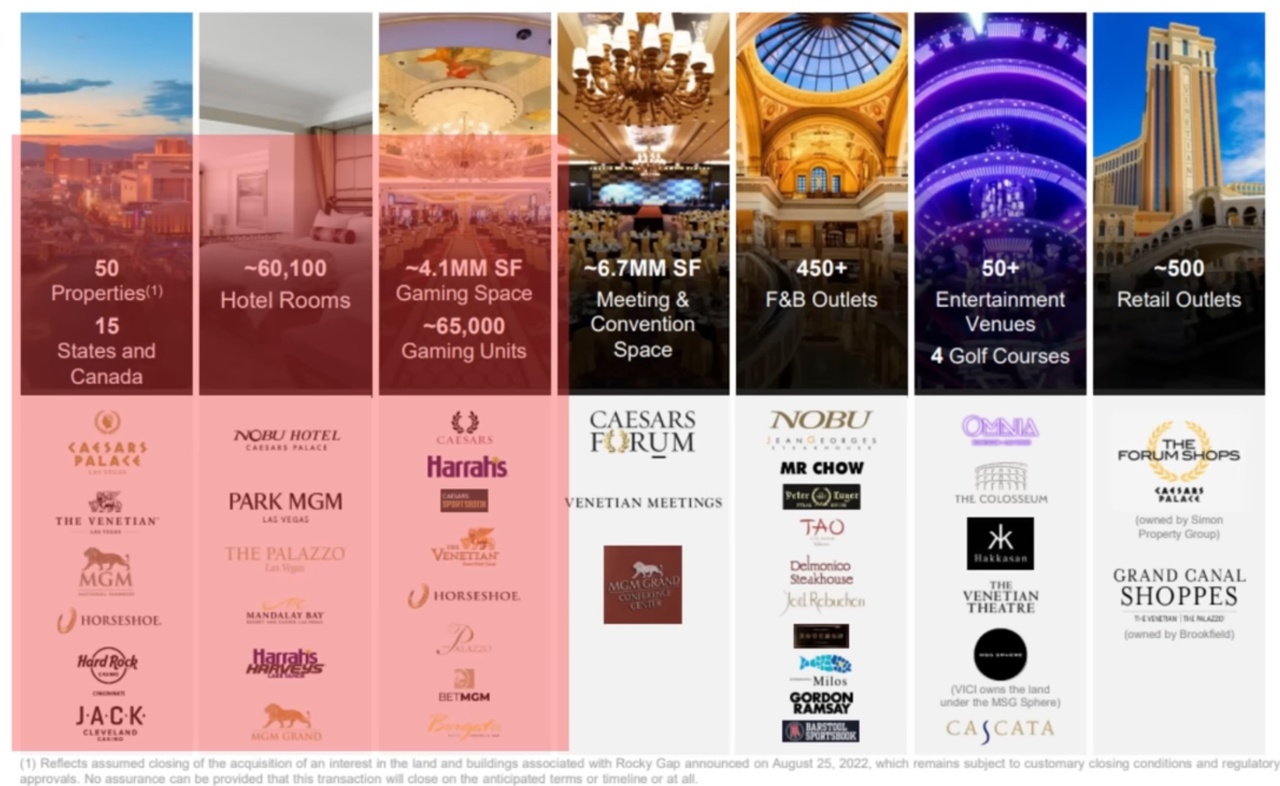

Vici lives up to this quote. Vici is a US American Reit with a focus on casino real estate. Reits invest in real estate and benefit from tax advantages. Vici's most famous project is clearly... the Ceasars Palace property in Las Vegas (see picture).

The share is on my watchlist and is currently at the top of my next buy list.

Why? Because of its gigantic moat, everyone knows Las Vegas and Ceasars Palace even though they haven't even been there.

Since 2021, the share has been bobbing around and hasn't shot up, although Vici should be doing like most Reits, right?

Vici is attractively valued right now and currently pays a dividend of more than 5%.

Business:

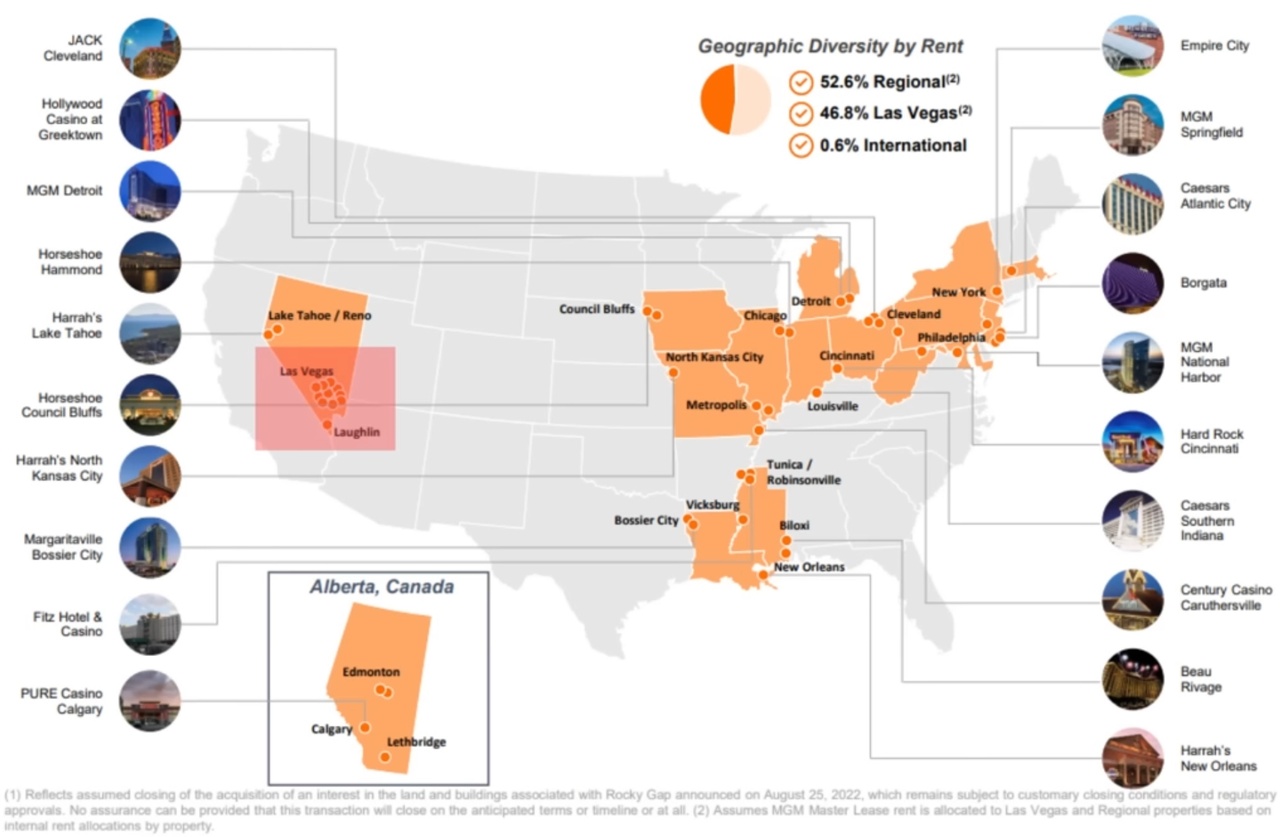

Investments mainly in casino properties scattered all over the US (see picture). However, most of Vici's rental income comes from Las Vegas. Almost 50% of all income comes from there.

Sounds almost like a cluster risk, doesn't it?

Hm 🤔 , but who should compete with Las Vegas? It is THE gambling metropolis, after all.

However, Vici now wants to continue to add properties with potential for pleasure to its portfolio, in line with the company slogan "Invest in the experience" (see image).

As already mentioned, most of the income comes from the casino properties, where Vici is already working with some really high-caliber players (see picture).

Around two months ago, the news broke that Vici had invested $150 million in Canyon Ranch (see image). ACanyon Ranch is a company for relaxation, wellness etc. Now Vici wants to expand Canyon Ranch and perhaps there will be more places to relax there. The plan is to build 15 new clubs over the next 10 years.

So nothing stands in the way of growth through new locations, including the expansion of existing clubs.

So I will soon be setting foot in the company for the first time, as the saying goes...

"The house always wins" 🤑

Who's in, who's not yet and why, why, why?