---Macroeconomic fundamentals---

Keynes, Friedman, Modern Monetary Theory and Co - Interest Rates, Government Debt and Inflation.

The problem of public debt in many countries is a recurring topic in economic and political discussions but also in relation to the stock market and the associated investment strategy. Some advocate an excessive monetary policy, others are more in favor of the "black 0". There are also different camps in science. Therefore, I would like to devote some time to this issue in this article and specifically address the following questions:

-Is the public debt of various countries too high?

-Does this pose a danger to the stock market?

-What role do interest rates, inflation and central banks play in this?

-What does this mean for my portfolio?

In order to be able to answer these questions, I would like to go into more detail. I apologize in advance for the theory part. But I think it is extremely important. The topic is complex and can not be summarized in one article. At the bottom of the article therefore also a keyword index for your own research. I try to make the theory part but as short as possible :)

In the discussions, the following camps are represented, whether consciously or unconsciously, on which I would like to go into a little more detail:

1. John Maynard Keynes

2. Milton Friedman

3. modern monetary theory (MMT)

The last time I "worked through" the views of Keynes, Friedman and MMT was during my Bachelor Thesis (long ago). In this article, I would like to briefly explain the views, as they are also essential today to understand the relationship between government debt, interest rates and inflation. I use online sources but also my own knowledge (correct me if there are misrepresentations - study is also a while ago :P). Maybe you will find yourself in one of the camps after this post.

𝟏. 𝑲𝑬𝒀𝑵𝑬𝑺

Keynes pursues the views of the "wise entrepreneur." The latter borrows for investment when the returns earned exceed the interest on the loan. Under the impression of the Great Depression in the 1930s, Keynes declared that the state must intervene with massive spending in the event of an economic slump in order to prevent mass unemployment. The short-time allowance in Germany is considered a prime example of this.[1]

𝟐. 𝑭𝑹𝑰𝑬𝑫𝑴𝑨𝑵

Similar to Keynes, Friedman was one of the greatest economists of the last century. However, unlike Keynes, Friedman is almost the forefather of neoliberalism. Accordingly, he relies on the self-healing of the market. Supply and demand alone can ensure long-term equilibrium. The criticism of Keynes is directed above all at his short-termism. Investments by the state would therefore only help in the short term, but cause damage in the long term.

𝟑. 𝑴𝑴𝑻

Modern Monetary Theory is a relatively recent stream of post-Keynesianism, emerging around the turn of the millennium. Since then, it has turned time-honored wisdom on its head. For MMT says: A state cannot go broke in its own currency. It simply has to create more money when its account is empty. Nor does it need taxes to finance its spending (as Friedman would have it). Instead, the government would simply have to instruct the central bank to increase its account balance. Therefore, investments should not be based on how much money is available, but on whether these investments are necessary. If the answer is yes, then there is hardly any limit - according to the proponents of Modern Monetary Theory. Taxes/revenues are generated by investment and a flourishing economy, not by a debt brake.[1]

𝒁𝒖𝒔𝒂𝒎𝒎𝒆𝒏𝒉𝒂𝒏𝒈 𝒅𝒆𝒓 𝑻𝒉𝒆𝒐𝒓𝒊𝒆𝒏 𝒂𝒖𝒇:

1. inflation

2. interest rates

3. central banks

So what is the case for government debt?

Given negative yields on government bonds, in the past one was in the comfortable position of being able to get additional money for issuing debt securities. Making money through debt, so to speak.

Limits to government debt:

However, even among proponents of countercyclical spending policies, it is undisputed that there are limits to borrowing. For one thing, excessive foreign borrowing must be avoided. For another, there must be no strong inflation.

Problems of today:

Thus, we come to the current situation. Can we still afford a monetary policy based on Keynes or even MMT? After all, we have high inflation right now and interest rates are threatening to rise and with them the yields on government bonds! Can we still finance the debts at all?

-Pro Keynes/MMT:

Proponents of the Keynesian school would say that the U.S. in particular is only borrowing in its own currency. Accordingly, a state cannot go bankrupt in its own currency, because it creates the money via its central bank. The ECB or FED can not run out of money and can not go bankrupt.[1] In addition, inflation also causes a certain debt relief (with low interest rates!).

Unemployment, ailing infrastructure, sluggish digitalization, broken schools and of course the immediate consequences of the current Corona pandemic - to solve all these problems, hundreds of billions of euros are needed. Not to mention the really expensive issues: combating climate change, the transport and energy turnarounds.[1] Without investment, therefore, it won't work. Without these investments, future generations will also face a wide variety of problems.

-Pro Friedman:

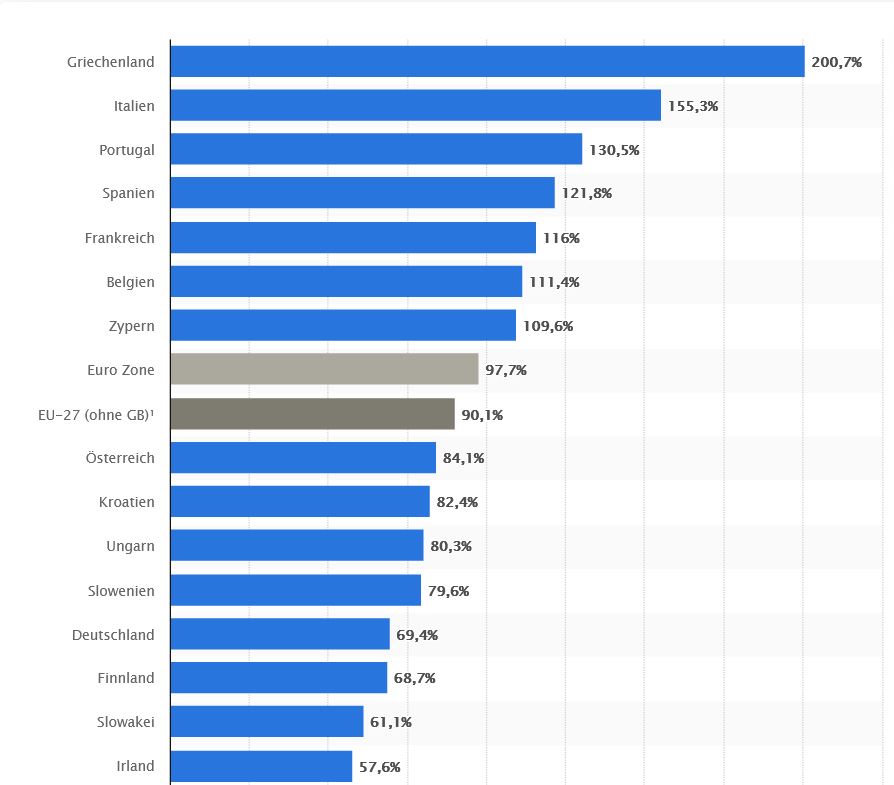

The most common argument of Friedman's supporters would probably be that future generations would have to pay for today's debts. In the same way, the Maastricht Treaty, according to which public debt may not exceed 60% of GDP, would be broken.[2]

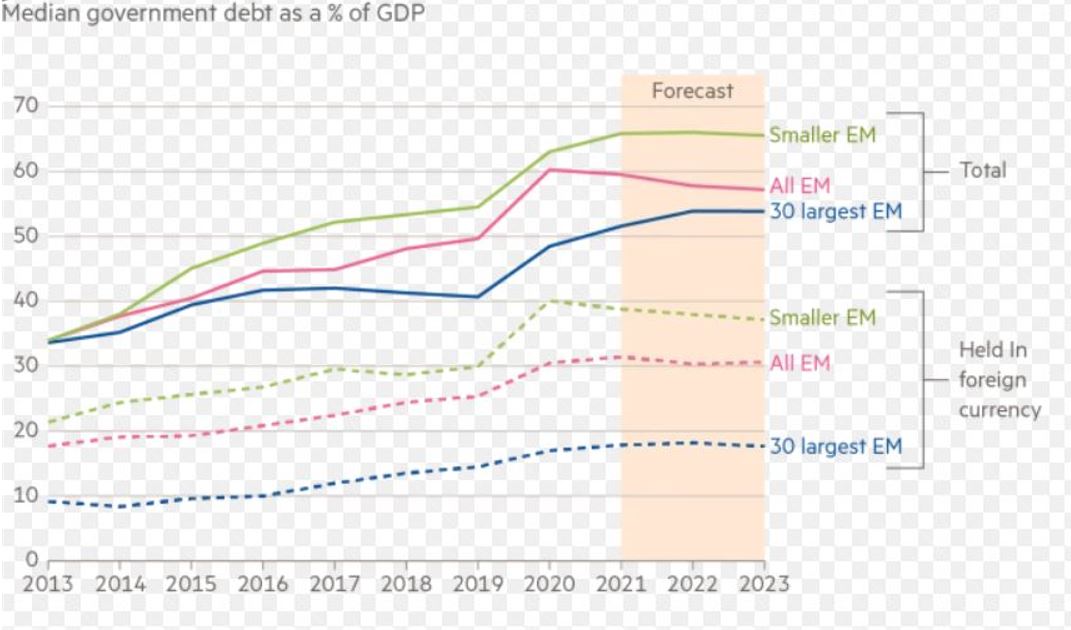

In addition, many countries in the emerging markets are unable to borrow in their own currencies. The risk is therefore higher than in the USA or Europe.

𝑭𝒂𝒛𝒊𝒕:

So what to do? In the end, there is no magic formula here.

A very specific camp in this community would certainly be screaming "All in Bitcoin!" right now. But I don't think much of that, because for me all the cryptos are no substitute for money. Nevertheless, the technology of some cryptos is of course very disruptive and interesting.

Crash prophets would probably proclaim the end of the world and the collapse of the monetary system right after this post. I definitely don't belong to that camp either.

For me, the solution is simply diversification. There are always risks in investing. But I don't see a collapse of the system. The U.S. is increasing its debt limit on what feels like an annual basis.

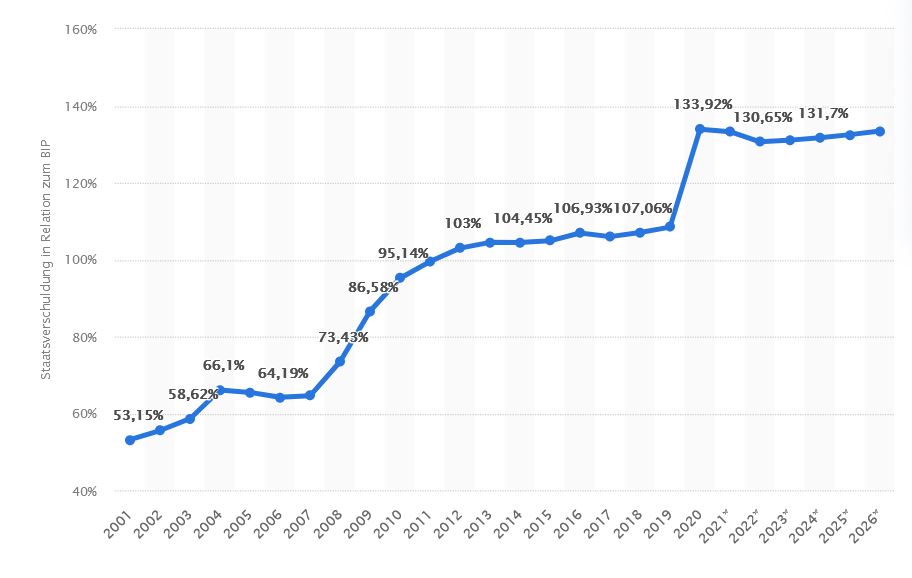

Nevertheless, the level of inflation is worrying. However, we have already had somewhat higher interest rates in the past, with debt levels that have long been ridiculously high. I see the danger more in the emerging markets, although a financial crisis in a lesser EM country would not trigger a world financial crisis. The debt situation of some EU countries is also a cause for concern, which is why the ECB is also holding back on interest rate adjustments. Due to the current developments in Ukraine, the Fed will probably also take the turbo out a bit. Inflation will therefore remain high. A possible consequence of an interest rate hike would not only be a flattening of inflation. The following scenarios would also be possible:

-Deflation: short - interest rates inhibit further investment and thus there is a fall in prices-->demand falls with high supply-->deflation). In contrast to deflation, in inflation the supply/demand relationship would be more balanced. In a deflation, the value of money would steadily increase (Unlike the demonetization of an inflation).

-Stagflation: the economy does not continue to grow with inflation. -->Stagnation and inflation go hand in hand. [3]

Both dangers I see absolutely. And such scenarios can last for several years. We have also had financial crises in the past. There is definitely potential for a future one. But for me as a long-term investor, that's not a problem. So I wouldn't paint the devil directly on the wall.

But you can see that the interplay between inflation, interest rates and the role of central banks is not a simple one. The parameters, in the context of government debt, are complex. There are many books and academic papers on the theories. Maybe the FED or ECB should read one or the other literary work ;)

Which camp are you in? Or do you want to assign yourselves to a camp at all? How do you see the monetary policy of today? The topic offers enough potential for interesting discussions.

PLEASE GIVE A LIKE FOR THE RESPECTIVE THEORY YOU SYMPATHIZE WITH IN THE COMMENT FUNCTION OR COMMENT BELOW WHY YOU TEND TO AGREE OR DISAGREE WITH IT.

I hope you enjoyed the article. If you are interested in the theories I can go into more detail in the future. I wanted to reflect with this post as "crisp" as possible the most important points.

Sources Graphs :

Government debt to GDP ratio EM: https://www.ft.com/content/9cc2826b-dcd2-49c5-a408-7de043d24a79

Government debt to GDP ratio EU: https://de.statista.com/statistik/daten/studie/163692/umfrage/staatsverschuldung-in-der-eu-in-prozent-des-bruttoinlandsprodukts/#professional

Government debt to GDP ratio USA: https://de.statista.com/statistik/daten/studie/165786/umfrage/staatsverschuldung-der-usa-in-relation-zum-bruttoinlandsprodukt-bip/

Other sources:

[3] https://wirtschaftslexikon.gabler.de/definition/stagflation-45364

Index for your research:

-John Maynard Keynes

-Milton Friedman

-Modern Monetary Theory

-Maastricht Treaty on Debt

-relationship of interest rates and inflation

-Function of Central Banks

-Inflation, Deflation and Stagflation