But how?

And when are you so "rich" that you should "protect" your assets - and from whom?

This question has been on my mind from time to time over the last few days. So I thought I'd share my research (which doesn't have to be completely error-free) with you and link the article to the question: does anyone here know a lot about this - beyond the "dangerous half-knowledge"? If so, I would be happy and grateful if any misrepresentations could be commented on quickly...

First of all: How did I come up with the idea of dealing with this topic?

Together with my brother, I took a closer look at an apartment building and calculated it - as an investment property to rent out.

We quickly came up with the question of how to divide and organize the property in a sensible way so that "the situation" would be clear in the event of a dispute. We came up with the idea that a GbR or GmbH could be a possibility.

Why? Because then the GmbH owns the property; a [legal] person in the land register and we, as two shareholders, can divide the parts of the company easily between us, without a declaration of division of the property, without various personal entries in the land register, etc.

In addition, as the name suggests, a GmbH has limited liability.

In the end, nothing came of the property, but the thought continued to occupy me - how can assets be well managed, divided, partially sold or inherited? How do "the rich" do it?

"The rich" protect their assets through companies, for example.

While I, as a normal person who goes to work and pays taxes, can in the worst case get a top tax rate of 42%, companies are generally taxed at a much lower rate.

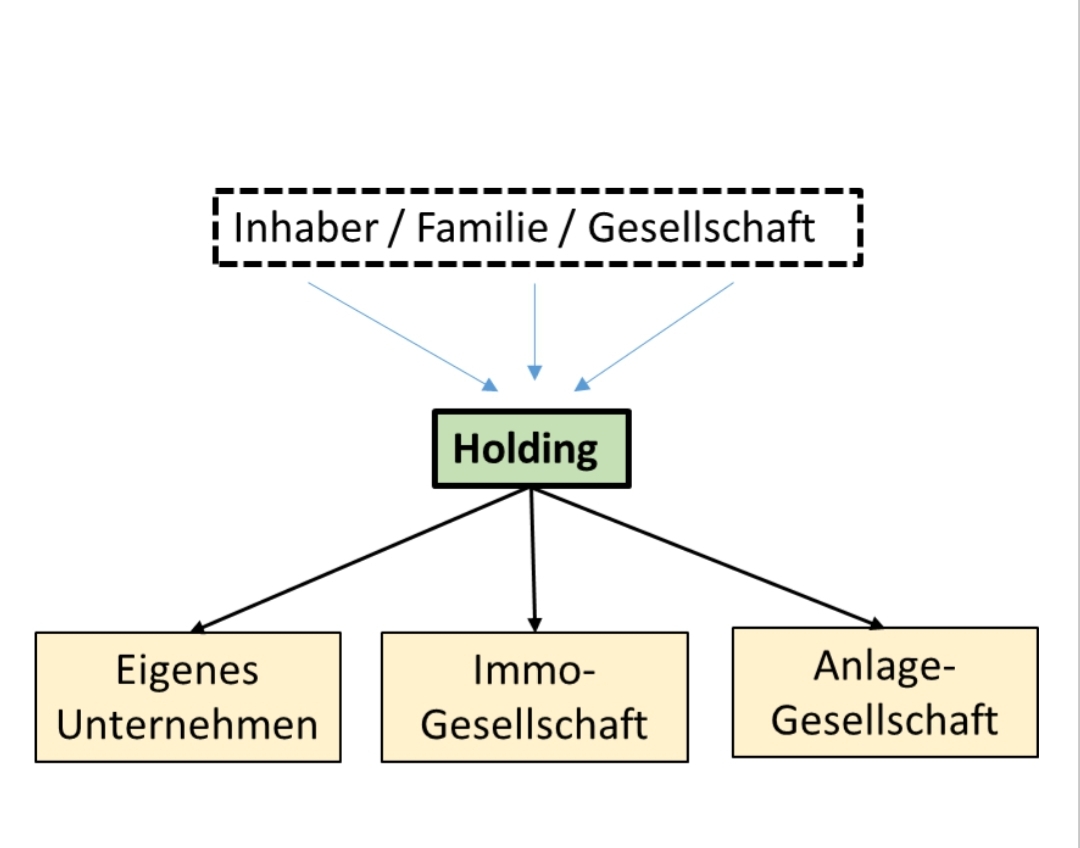

The "corporate network" - holding company and GmbH

First a very rough summary, more details later:

We set up a holding company (i.e. a company whose only task is to hold shares in other companies).

We also set up an asset-managing GmbH that is not commercially active and therefore only pays 15% corporation tax - the other 15% trade tax is not payable as there is no commercial activity.

The GmbH now buys a property and rents it out. After deducting all costs such as interest and maintenance expenses, a profit remains. This profit would be taxed at the personal tax rate of up to 42% for a private individual.

In an asset-managing GmbH, however, only 15% corporation tax is payable.

The lower tax burden of the GmbH means that new cash assets can be built up more quickly and therefore a new property, shares or company shares can be purchased more quickly.

This example already shows that a positive effect arises above all if the asset is held for a long period and the income is retained.

Now we have the "problem" that the GmbH also has certain liability risks. These cannot be completely eliminated. But: As a shareholder of a GmbH, I can distribute profits to myself (as a private individual). However, these are subject to capital gains tax of 25%. So it makes relatively little sense to first pay 15% corporation tax and then 25% for capital gains?

Yes and no: because the "network" is not intended for regular payments to private individuals.

Now our holding company comes into play.

Instead of a private partner, we now use the holding company as a partner (shareholder) of the GmbH. It is therefore a company that owns a company.

If the holding company holds at least 15 % of the shares in the GmbH, 95 % of the profit distributions from the GmbH to the holding company are not taxed. Only 5% is subject to corporation tax and trade tax - effectively a total tax burden of 1.5% arises on the transfer to the holding company.

But why the transfer from the GmbH to the holding company?

Primarily to eliminate the last liability risks. Has a GmbH distributed profits (let's say for 20 years, distributions every year) and then something goes "wrong", the GmbH gets into difficulties and has to file for insolvency? In that case, the accumulated assets are no longer part of the GmbH's assets, but have been put "in safekeeping" for just 1.5% tax. And this happens years in advance. If the GmbH itself had the money "on the high edge", it would immediately be part of the insolvency estate.

Other GmbHs with participation by the holding company

Of course, the whole thing can be further expanded with additional companies - e.g. a GmbH that is responsible for "brokering" the properties (i.e. is commercially active), a GmbH that handles particularly risky parts such as the construction or renovation of a property, etc.

Now the whole thing was very real estate-heavy. What about shares?

In most cases, investing in shares through a holding company (formally: acquisition of company shares by the holding company) is only worthwhile for growth stocks, as only the capital gains are tax-free.

Since, as described above, tax relief on dividends also depends on the holding company holding at least 15% of the company, it is rather unlikely for us normal people to hold 15% of a listed company. If this were the case, dividends would also have these tax advantages. However, if we hold less than 15% of the company, 15% trade tax and 15% corporation tax would apply, which would be more than the capital gains tax.

@DonkeyInvestor This is how you get your money,

After you count your car as a company car, of course :).

The keyword is "partial income method" - that would be a whole new, complete topic post. But in essence it means that under certain circumstances you only have to pay tax on 60% of the investment income from the holding company if you withdraw it privately. Maybe there will be an article on this :). Otherwise, the subsidiary of our permanent survey winner can certainly provide information

As you can see, the topic is complex. Perhaps there is a tax consultant among us with specialist knowledge of corporate tax law who can correct any errors in the presentation.

In all the examples I have now left out solidarity tax/church tax - just for your information :)

You can find different information on the net as to when such a network can be worthwhile (or initially only a VV GmbH) - approx. 100,000 net assets that generate income is probably the lowest limit. So not sooooo much - how was it: the first 100,000 are the hardest.

Good night! #learn