In recent days, some price charts look as if it was a children's birthday party in the trampoline park. I myself have not been very restrained in recent weeks and have stocked up according to my investment principles.

And still I am tormented by the question: Maybe it's a bad idea to get in right now? @CaptainSchuetze I asked the question why the tech stocks are falling so much right now and if you look at the interest/inflation post of @TheAccountant89 also just turn the eyes.

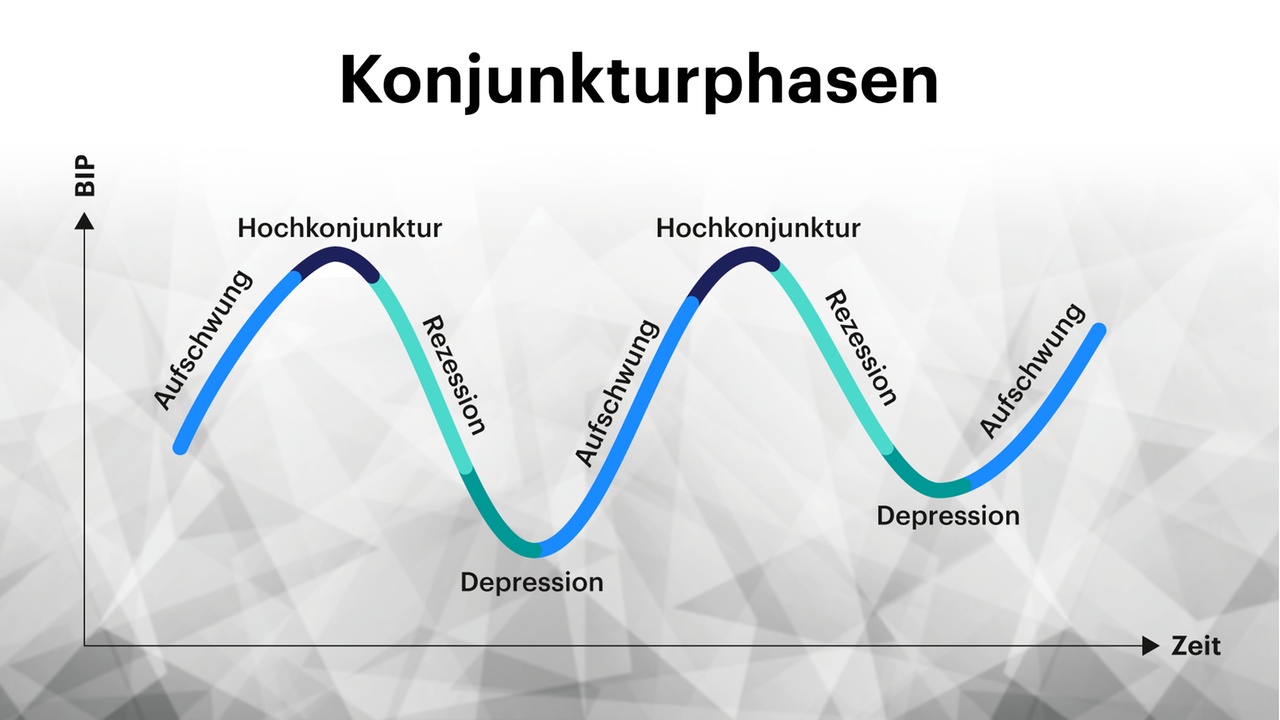

Therefore times an attempt with a very old, very well-known, but historically also valuable basic economic theory to classify where we are just: The four phases of the business cycle.

The four phases are:

a - Recession (aka downturn)

b - Depression (economy hits the floor)

c - Expansion (aka upswing)

d - Boom (aka boom)

--- a) Recession is characterized by: ---

1. weakening of the economy with pessimistic economic forecasts

2. decrease in demand and full inventories

3. investments decrease

4. wages decrease (in real terms) and/or prices increase = inflation!

5. interest rates rise

Now point 1, 2 and 3 are not to be observed. On the contrary, inventories are empty, we are rather talking about supply bottlenecks.

Fixed capital formation is also on the rise in Germany and at a high level in the USA (according to destatis and tradingeconomics).

The mood of the managers has recently had to take a damper due to the sanctions and the war of aggression in Ukraine, but is at a normal-high level.

Point 4 - Inflation definitely and not too scarce. Therefore, even the current good salary rounds do not have much to laugh at the end.

Point 5 - Interest rates rising? Yes in the US definitely, in the EU probably soon too. This is completely normal when there is relatively high inflation. But the fact that the European Central Bank is holding on to stable interest rates for a long time shows that even the studied economists in Frankfurt have doubts about whether inflation will continue and/or where it will come from, because the supply bottlenecks are made by global crises and not explained by the domestic economy as usual.

-> According to this theory, the probability that we are currently in a recession or that one is on the horizon is possible, but manageable: only 2 out of 5 points will be reached, and 3 will not.

--- b) Depression: ---

The characteristics are

1. production is strongly declining

2. there is deflation

3. and high unemployment

4. many companies are in economic distress and illiquid

5. no or hardly any investments

To 1.) No, if then only because of raw materials

2.) Exactly the opposite

3.) Both in Germany and the USA there is a very high employment rate

4. and 5.) Also not the case. Currently, one rather reads that state aid is being repaid.

-> We can probably rule out: 5 out of 5 points do not apply.

--- c) Expansion/upswing: ---.

1. optimistic expectations of market participants

2. increase in incoming orders from companies and increased production

3. decrease in unemployment

4. growing willingness to invest

5. rising prices and wages with stable/low interest rates

Regarding 1), it will be difficult to find a consistently positive opinion in phases of war. However, as described above in the recession, sentiment is at a normal-high level, but just not top either. Rather not a point?

To 2) The warehouses are empty, we are talking about supply bottlenecks and are just dumping everything on the market that can be paid for. Because Corona has built up a lot of obstacles, we are now making up for lost time.

Regarding 3) and 4) Unemployment? Top values! Next stop: shortage of skilled workers. Investments as well.

To 5) We can even observe this with the prices at the REWE around the corner. Wages are also rising (see Destatis), but not as strongly as prices, and that is actually the indicator. Interest rates will then finally knock this aspect on the head.

-> Thus we have 3 fulfilled indicators and 1x rather against + 1x very against.

--- d) Boom aka boom: ---

1. market volume reaches maximum

2. small companies are forced out of the market and mergers are forced

3. high demand for goods

4. rising prices of goods, rising wages, high interest rates

5. maximum utilization of production capacities

6. maximum demand for labor, machinery and raw materials

Point 1) can only ever be answered with historical hindsight and is therefore omitted.

2) Yes, there are more corporate takeovers and M&A deals again; on both sides of the Atlantic (Statista sends its regards).

3) Keyword supply bottlenecks to the third ;)

4) Yes + Yes + Will probably follow soon

5) If raw materials are available, the production capas are currently at maximum.

6) Also yes. Skilled labor shortage, low unemployment and co are mentioned several times.

-> here 5 of 5 points are fulfilled, whereby only the interest rates would still be debatable... so 4.5 perhaps?

I will not go into the consequences of my point distribution in this article, especially since the realization is still new to me that the chance that we are possibly somewhere at the end of the expansion and thus perhaps already in the boom, is given and not so unlikely.

I look forward to your constructive comments and discussions on where the economy (D / EU / US) currently stands and what comes next.

What I do in no case herewith is an investment advice or investment tips give. Maybe but times the bulls among us to challenge.

Many greetings

Marcel aka Gen_Y

PS: If someone tells me how to write bold or underline, then the next article will be easier to read ;)

Sources: destatis.de,

de.statista.com,

finanzen.net,

de.tradingeconomics.com,

goingpublic.de,

handelsblatt.com