Money Market ETF instead of overnight money - a promising alternative?

In today's dynamic financial world, it's important to explore alternatives to traditional overnight money. Have you ever considered money market ETFs?

Money market ETFs are based on the money market rate of a currency area. The interest rate used as a reference is the rate at which banks borrow money from each other on a daily basis. This interest rate is calculated and published daily by the central banks of the respective currency area according to a fixed rule. For the euro area, this is often the so-called Euro Short-Term Rate, or €STR for short. The €STR is the interest rate at which banks can borrow money overnight on the interbank market in the euro zone. It currently stands at 3.395%.

While overnight deposits often have restrictions on both the amount of the deposit and the investment horizon in order to receive the promised interest rate, this is not the case with money market ETFs. The investment volume is not limited.

Most importantly, investments that are linked to money market interest rates are not subject to price risk due to a potential change in the corresponding money market interest rate. The reason for this is that in the case of overnight money, the remaining term is only one day.

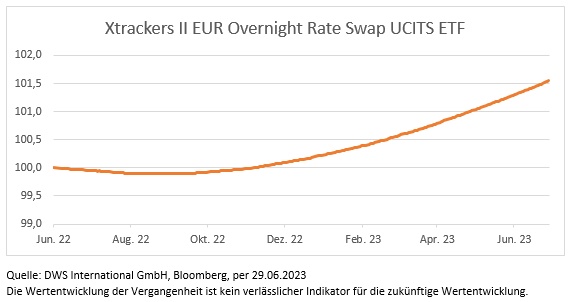

The Xtrackers II EUR Overnight Rate Swap UCITS ETF, for example, tracks the performance of a deposit. $XEON tracks the performance of a deposit that earns interest at the short-term euro interest rate (€STR). Due to the very short maturity of one day, there is no interest rate risk with these instruments. In principle, the longer the maturity, the more the price of a bond fluctuates when interest rates change. With so-called overnight rate ETFs, i.e. money market ETFs with a capital commitment of less than one day, there is no such risk. The ETF yield is currently ~3.38% per annum. This is calculated as follows: €STR 3.395% + One-off Spread 0.085% - Total Expense Ratio (annual flat fee) 0.10%. The One-off Spread is an additional adjustment factor added to the Euro Short-Term Rate, resulting from the conversion from the previous short-term interest rate EONIA.

ETFs, like other securities, come with various risks. The value of their investment may fall as well as rise and past performance is not a reliable indicator of future performance. If, for example, interest rates were to fall again, then the promised annual return on the ETF would also be lower.

Moreover, this is a swap-based ETF, i.e. we enter into a swap contract, i.e. a contract in which two parties agree to exchange payment streams (cash flows) on certain terms, with an investment bank that promises to deliver the EUR short term rate return. As such, the ETF is subject to what is known as counterparty risk.

However, it is important to emphasize that the swap transaction is countered by a so-called basket of high-quality collateral. In this case, these are government bonds. Any differences between the basket of collateral and the performance of the underlying index are checked on a daily basis.

The bonds contained in the collateral basket are also part of the so-called special assets, i.e. if the issuer becomes insolvent, the investments are protected and not part of the insolvency estate. It is important to emphasize, however, that investors are not protected from a loss in value.

Enclosed you will find the key facts:

$XEON Xtrackers EUR Overnight Rate Swap UCITS ETF (ISIN: LU0290358497):

- Investment objective: to earn interest on a deposit at the "risk-free rate" EUR Short Term Rate (€STR).

- Accumulating share class and distributing share class available

- Annual all-in fee (TER = Total Expense Ratio) of 0.10% p.a.; no additional swap costs are incurred

- Collateral basket consists primarily of government bonds and can be viewed daily on the website

For more details on the Xtrackers EUR Overnight Rate Swap ETF, please visit our website.

Product Risks:

The funds are not capital protected. The value of your investment can go down as well as up. Past performance is not a reliable indicator of future performance. The Funds enter into a derivative transaction with a counterparty. If the counterparty is unable to make payments (for example, in the event of insolvency), this may result in a loss in your investment. The Funds are linked to interest rates, which can be volatile. Interest rates respond to various economic, fiscal, monetary and political factors. This may result in a loss (up to a total loss) with respect to your investment

______________________________

IMPORTANT NOTES

This document is a promotional communication. Please read the prospectus and the BIB before making a final investment decision.

DWS is the brand name under which DWS Group GmbH & Co. KGaA and its subsidiaries conduct their business. The respective responsible legal entities offering DWS products or services are identified in the relevant documents. The information contained in this document does not constitute investment advice.

The complete information on the funds can be found in the respective sales prospectus as amendedThese and the respective "Basic Information Sheet (BIB)" constitute the sole binding sales documents of the funds. Investors may obtain these documents, including the regulatory information and the current constituent documents relating to the funds, free of charge in written form in German from DWS Investment GmbH, Mainzer Landstrasse 11-17, 60329 Frankfurt am Main, Germany, and, in the case of Luxembourg funds, from DWS Investment S.A., 2, Boulevard Konrad Adenauer, L-1115 Luxembourg, Germany, or electronically in appropriate languages at: http://www.dws.de

http://www.etf.dws.com Austria: https://funds.dws.com/at Luxembourg: www.dws.lu .A summary of investor rights for investors is available in German at. https://www.dws.de/footer/rechtliche-hinweise/ available. The Management Company may decide to revoke the distribution at any time.

Forecasts are not a reliable indicator of future performance. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analyses that may prove to be inaccurate or incorrect. The funds referred to in this document each track the performance of the index referred to in their name. All expressions of opinion reflect the current assessment of DWS International GmbH, which may change without prior notice. This document is a promotional communication and not a financial analysis. Consequently, the information contained in this document does not satisfy all legal requirements to ensure the impartiality of investment recommendations and investment strategy recommendations and is not subject to any prohibition on trading prior to the publication of such recommendations. As explained in the relevant prospectus, the distribution of the above funds is subject to restrictions in certain jurisdictions. This document and the information contained herein may only be distributed or published in jurisdictions where such distribution or publication is permitted by applicable law. Thus, this document may not be distributed, directly or indirectly, within the USA or to or for the account of US persons or US residents.

Xtrackers® is a registered trademark of DWS Group. The registered office of Xtrackers II (RCS No.: B-124-284), a company registered in Luxembourg, is located at 49, Avenue J.F. Kennedy, L-1855 Luxembourg, Luxembourg.

DWS International GmbH, 28.06.2023, CRS: 096674