Do the Vikings beat the European stock indices?

Many small investors follow an ETF investment strategy. The 70/30 formula is often preached (World/EM) or a further admixture. This admixture is usually a Europe ETF, since Europe is significantly underrepresented in the MSCI World (compared to the GDP share in the world economy and the share in the MSCI World).

However, as a rule, Europe ETFs have the reputation of underperforming the World.

This is true:

Here's a comparison of the two best-known Europe ETFs with the World:

Stoxx 600:

1 year: ~ 5%

5 years: ~ 21%

MSCI Europe:

1 year: ~ 7%

5 years: ~ 25%

MSCI World:

1 year: ~ 3%

5 years: ~ 64% (!)

-> This results in a return of the World in the last 5 years of about 13% p.a. while it is true for the Europe equivalents only 4.2% and 5%.

So a clear underperformance!

But how can Europe be covered more efficiently and with more value?

There are many possibilities. For example, many focus on individual countries in Europe (DAX (DE), or Cac 40 (FR)). But even these indices have significantly underperformed the World in the last 5 years. (picture 2)

Furthermore, one has a strong cluster risk with these countries (e.g. in France this year's election).

So now I was looking for a reasonably diversified and cheap ETF that could keep up with the World.

In doing so, I first came across the index:

MSCI Nordic Countries

This index contains the 4 Scandinavian countries:

1: Sweden (44.5%)

2: Denmark (33,6%)

3: Finland (12%)

4: Norway (9.7%)

-> Of course no diversification like in the World but better than single country bets.

Also the performance can keep up with the World:

1 year: ~ 8%

5 years: ~ 50%

Note:

World letze 5 Jahre ca. 13% p.a.

MSCI Nordic letze 5 Jahre ca. 10% p.a.

MSCI Europe letze 5 Jahre ca. 5% p.a.

So you can see that the Nordic can keep up much better than the Europe. (picture 1)

Over the last 20 years, the MSCI Nordic has even outperformed the World!

Over the past 20 years, the MSCI Nordic has risen by 230 percent. By comparison, the MSCI World gained 153 percent during this period, while the MSCI Europe gained 129 percent.

But what is the reason for this?

There are both economic reasons and social reasons:

1. the Scandinavian indices have very good sector diversification.

MSCI Nordic vs. MSCI World

Industrials: 26% vs. 10%

IT: 7% vs. 22.5%

Health Care: 20% vs. 13

Financials: 18% vs. 13.5%

Materials: 8% vs. 4.5%

Energy: 5.5% vs. 4.5%

Consumer: 8% vs. 7%

Communication: 4% vs. 8%

-> you can see a great diversification even though there are only 85 companies in the index. I personally also like the different focus of the index on Health Care and Industry instead of IT.

In combination with the World, the Nordic complements itself so nicely in the sectors.

2. high resilience of the Nordic markets.

In case of crisis, countries can efficiently support markets and economy due to low debt and own currency (except Finland).

Public debt

Germany: 70%

Denmark: 39.5

Sweden: 36

Finland: 68%

Norway: approx. 41%

-> the low debt levels of the Nordic countries indicate their resilience in crises and the general health of their economies.

Data: 3rd quarter 2021; https://de.statista.com/statistik/daten/studie/163692/umfrage/staatsverschuldung-in-der-eu-in-prozent-des-bruttoinlandsprodukts/

3. ESG pushes outperformance

ESG criteria are now considered mandatory for many investors. They are also willing to pay a premium for it. Scandinavian companies are global leaders in the implementation of these criteria and can/could accordingly benefit from the trend.

Social reasons:

1. leader in the democracy index

In addition to the financial stability mentioned above, these countries also have political stability. Stability.

In the Democracy Index 2020, the countries ranked as follows:

Norway (1)

Sweden (3)

Finland (6)

Denmark (7)

For comparison:

USA (25)

Data: 2020; https://de.m.wikipedia.org/wiki/Demokratieindex

1. Strongly represented in the Global Innovation Index

Scandinavians are also tops in innovation. See Sweden (Spotify, Oatly,...).

In the above index, the countries occupy the following places:

Sweden (2)

Finland (7)

Denmark (9)

Norway - not in the top 10

For comparison:

Germany (10)

This strong innovative power of the actually small countries guarantees that they will continue to play a role in the future.

3. also at the top of the Happy Index

Norway (8)

Sweden (7)

Denmark (2)

Finland (1)

Data: https://urlaub.check24.de/reisewelt/10-glueckliche-laender

Critique of the MSCI Nordic Countries index:

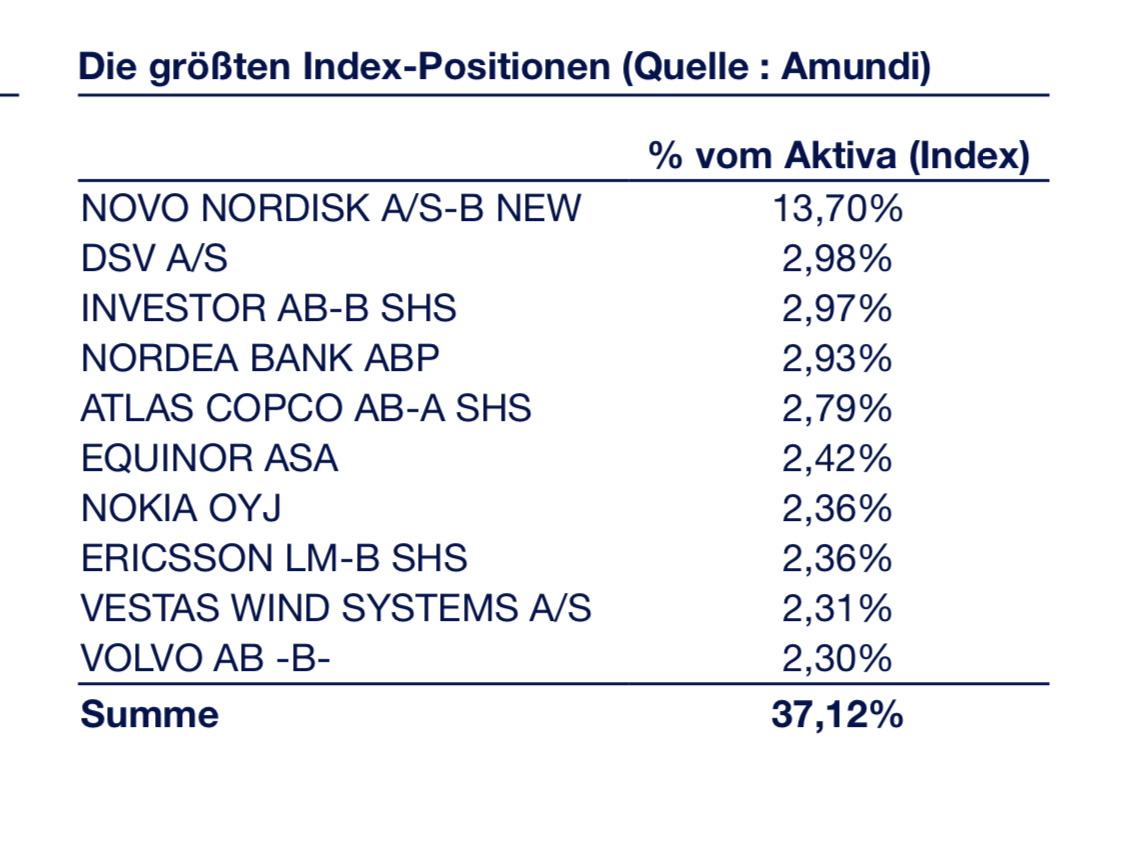

One minor criticism: Novo Nordisk is the largest position with almost 14%(Figure 4). Quite large for an ETF. Must be aware when investing. Also, you always have some currency risk as Sweden, Denmark and Norway have their own currency.

Conclusion: all these facts about financial and political stability, innovation and society make the Scandinavians very interesting for me. Based on these mentioned facts, the historical outperformance of MSCI Nordic versus Rest of Europe should continue for the next few years.

I personally am not invested in the ETFs, but I am invested in a Finnish stock called Neste, which embodies the Nordic modern character well. I believe that this index can be a very good alternative to complement a classic MSCI World portfolio.

There are two ETFs on this index:

1: IE00B9MRHC27 -> Deutsche Bank, cost 0.3% Distributing

2: LU1681044647-> Amundi, costs 0,25 accumulating

Sources:

1. https://www.msci.com/documents/10199/6bd9ad54-61be-4bdf-afcd-7465994bcb95

https://www.msci.com/documents/10199/cad25553-6265-4a1b-9942-cb5be891015d

3. https://etf.dws.com/de-de/IE00B9MRHC27-msci-nordic-ucits-etf-1d/#Performance

4. https://www.justetf.com/de/find-etf.html?query=MSCI++Nordic

No investment advice

Edit: Somehow the wrong images were uploaded...