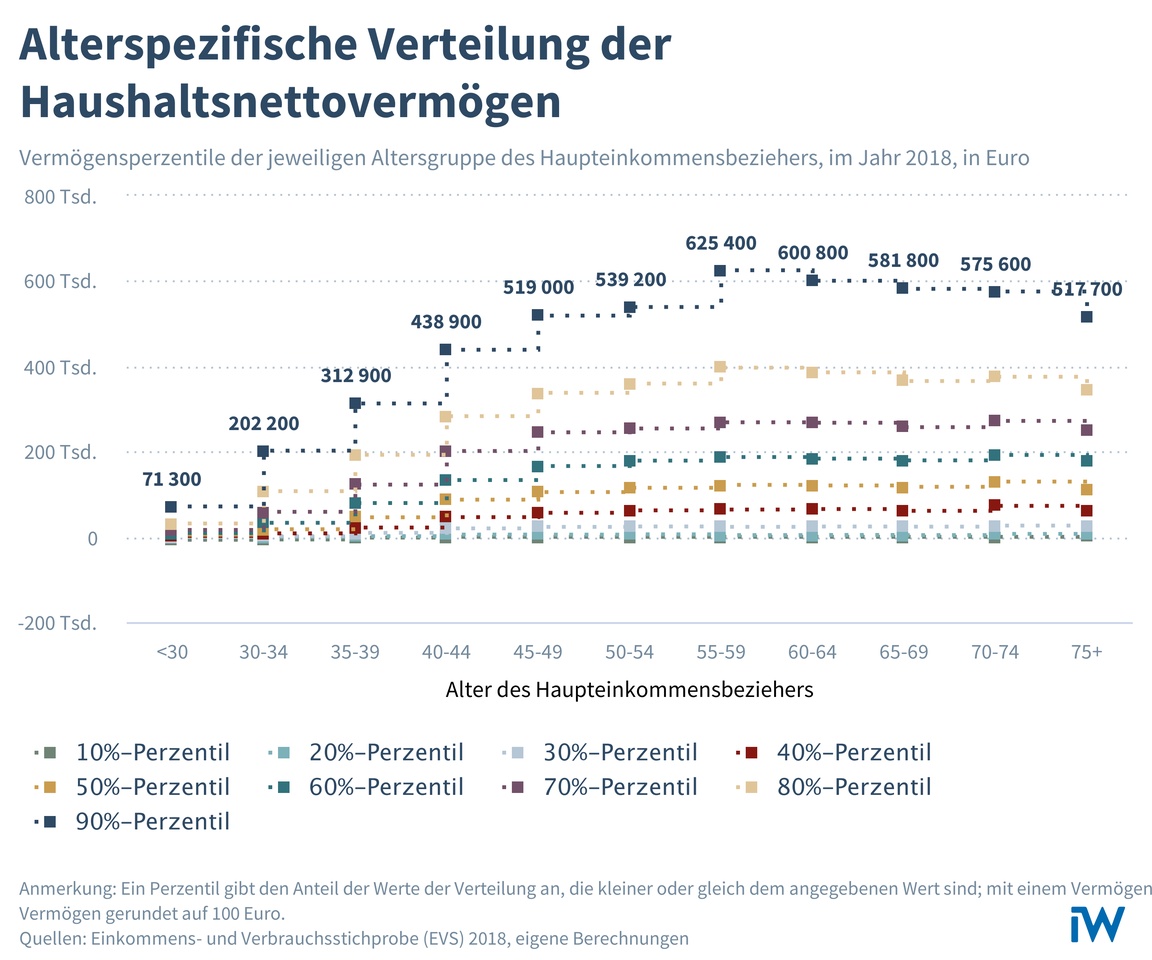

I'd be interested to see how the self-perception and comparison with statistics is here in terms of wealth. "Surveys of self-perception of wealth distribution show that not even 3 percent of households feel they belong to the 20 percent that have the greatest wealth."

I myself couldn't agree more. Even with the value of the top percentile, I would not consider myself particularly wealthy. The wealth threshold to the top percentile is not even enough to buy a house/apartment in many places.

The leap to the real upper class or even wealth is then, in my opinion, many times greater.

Net household wealth = real estate + financial assets - liabilities

There is an interactive version of the graph in the source mentioned below. Highly recommended!