When is the bottom found in the market?

This is probably one of the most frequently asked questions in market phases like the one we are currently experiencing. The bad news first: I don't know either!

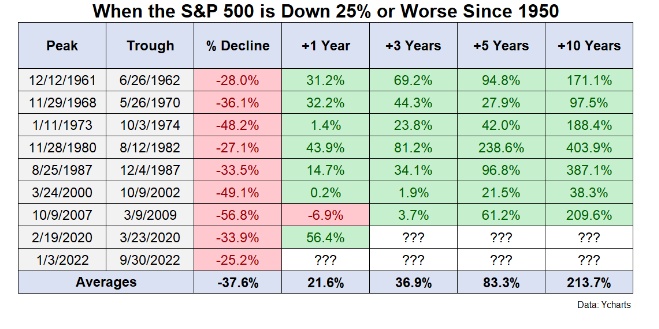

Therefore, it is better to ask yourself: When is probably a good time to get back into the market completely? About this question I came across the attached chart (source: https://awealthofcommonsense.com/2022/10/animal-spirits-long-term-bullish/). This shows how the S&P 500 has developed in the past in different annual periods, after it has fallen at least 25%.

Important: The development in the following columns shows the development from the time when the 25 % was fallen below! So in 7 out of 8 cases, where the S&P fell at least 25%, we had a positive return again one year after the S&P fell below 25% - and in some cases very clearly. And after three years, we even had a positive return again in all cases.

In the current bear market, the S&P fell below 25% at the end of September.

Some critics will rightly say:

- These are only data from the past. They don't count for the future.

- In this crisis, everything is different!

- China will still invade Taiwan.

- etc.

It may well be that you are right. But even you don't know 100%.

And I would like to add another point of criticism: In 2000, the S&P fell by 25% from approx. 1,500 to approx. 1,125. One year later, it was minimally above this level (+ 0.2%). But then it fell even further to below 800 points in mid-2002. If there had also been a 2-year column in the chart, there would easily have been -50%! But: After three years the S&P was starting from the 25% minus then nevertheless again in the green area and from then on it went again steeply uphill.

Since none of us can predict the future exactly, I find it nevertheless good to approach the matter with a mathematical approach or with probabilities. Therefore, I draw the following conclusions for myself:

- Can it go down further? Yes, definitely.

- Will we be higher in the S&P a year from now than we are today? The probability is relatively good.

- In three years, are we higher in the S&P than we are today? The probability is very good.

Since I am a friend of being fully invested (time in the marktet and such...), but have built up some cash through the last bear market ralleys, I have decided for myself based on the above assumptions -. and this is of course no investment advice!!! - to put my cash into the market via savings plans (thanks to TR for the new weekly opportunity!) over the next four months.

Why four months?

- By then the interest rate cap should be reached (or at least foreseeable)

- Inflation should be declining for technical reasons alone, because then the 2023 values are compared to the 2022 values, which are increased by inflation.

- I have no influence on things like China/Taiwan and Putin anyway.

I am curious about your opinion!