Alternative Investment

All of us here on qetquin invest our money in different ways. Stocks, cryptos, ETF's, precious metals, P2P etc etc.

Today I would like to introduce you to an investment company where I myself have invested only a small part of my money.

We are talking about group investments in small startup companies.

How can you imagine investing in startups in a group?

Quite simply, on the crowdlanding platform Scramble. Thereby you provide your money for several startups in a group. You virtually give them a loan with other participants of this group.

Scramble Investments

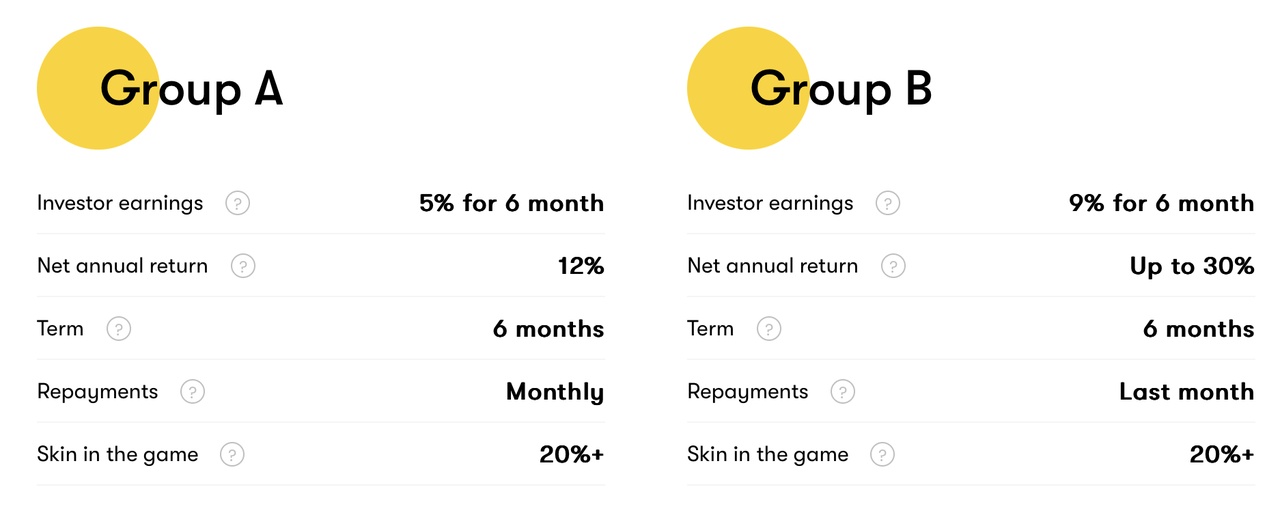

Scramble offers so-called group investments (group A and group B). There you can choose between 2 groups. In these groups are numerous startups, so you already provide for broad diversification. I.e. should a startup fail, it is less dramatic than if you had only invested in one startup and you are still widely invested in other companies.

Group distribution

Group A are more defensive companies, in group B there are the speculative companies. Therefore, group B has a significantly higher return of up to 30% per year. In comparison, in group A there is only 12% return per year.

Financing rounds

Every month there is a new funding round on Scramble. The funding rounds last only a few weeks until the goal is reached. The last funding round went up to 70K€ and was reached. For the month of November there is currently another round up to 100K€. For each round you can look at the startups, read background information on the site.

Funding

The financing round in October was as already mentioned at just under70k€. Of these financings in each month Scramble always invests 20% itself. Thus, Scramble itself is dependent on the success of the startups. The selection of the companies is made by the platform itself. Since Scramble itself invests 20% of the total volume every month, the requirement and motivation of the platform should be quite high to find decent startups.

Risk

Investors from group A receive repayments from day one, so the risk decreases with each payout. Each founder from the startups is liable with his private assets. In the hardest case, the founder would have to pay 20% of the loan out of his own pocket.

Per founder this repayment increases by another 20%, i.e. if there are 4 founders in this startup, each founder would have to repay 20%. This would be lower for this single company in the group.

First loss capital... If there is a failure, investors of group A will be treated preferentially. Group A gets paid first. 15% of the money is contributed by group B, but group B is paid out last. I.e. if 15% of the repayments remain unpaid, group A still gets the full repayment and group B goes empty-handed. But group B also gets 18% more return.

Payout

Group A gets money back on the first day and receives a payback every month, group B has to wait 6 months for the payout.

1000€ example for 6 months + free flat (5%)

1.month 15,88€ (1,5%)+ 5€ extra on 100€ Invest

2nd month 47,05€ (4,7%)

3rd month 47,05€ (4,7%)

4th month 47,05€ (4,7%)

5th month 47,05€ (4,7%)

6th month 748,87 (79,7%)

Yield will be paid as soon as all repayments have been completed.

Informative

A month ago the platform published an update about the last investments from January to July. In these months there were 100% scheduled redemptions. Scramble wants to keep the rate of defaults low and preferentially looks for companies with high inventories, thus the companies have at least a gross margin of 35%.

Source: https://scrambleup.com

I didn't include my referral link for once 🤓 If interested just get in touch.

My first major contribution. Gibts tips? Always here with it. Otherwise like to leave a 👍🏼 there. 😘