Silver as an alternative investment? A slam on the "gold of small investors"... 🥈

Ai ai ai... Here comes our yellow friend @Simpson a post on the subject of silver. He, proud of his collection of coins ("You can too!"😘) - plus a friendly link from @GoDividendwhat I probably have to say about it...) - Difficult decision. Perpetual annoyance from a very likeable user or harsh reality and openness on my part. So I decide to take the high road and shed some light on my view of the precious silver metal. Admittedly, it will be another long story, but this time it won't be a story with a happy ending. At least from a personal return perspective. 📉

Basic message (for the tl;dr faction):

I am skeptical about silver as an alternative investment. Surprise!

And now, buckle up and let's go:

I bought silver in a really big way in 2012. If you look at the charts from back then, you'll see that highs were the order of the day... So my problem: The purchase of "a not inconsiderable amount" of ounces of silver Maple Leaf - purchase 11/2012 was and still is "a mistake" from a capital gain perspective.

Because I had already received certain conditions at that time and yet it is still not enough to achieve a positive return. 😢

That sits. 🤯

Why is that? The reason lies not least in taxation. The current differential taxation for silver coins outside the EU (Maple Leaf, Krugerrand, Eagle, Kangaroo, etc.) was only introduced in 2014. This allows dealers to purchase silver coins imported from a non-EU country with 7% import VAT in accordance with the VAT Act. When selling, only the difference between the selling price (to the customer) and the buying price (i.e. from import) is taxed at 19%. In the case of silver bars, there is generally no differential taxation, so in any case +19% VAT plus the net sales price. Silver coin bars are an exception. These can be offered with differential taxation in the same way as silver coins. However, even if this type of taxation had been possible before, the value of the purchase would still not have been reached today (despite the increase in summer 2020 in the wake of the coronavirus pandemic).😱

In my case, the entry point was 26 euros plus VAT, at that time still 7% (i.e. 27.82 EUR/oz). This is because in the course of the new regulation of VAT in the Value Added Tax Act for (investment) silver, differential taxation only became possible in 2014, but with the consequence that European silver investments were raised to 19% at a uniform tax rate (like silver bars before). If we take all factors into account today and consider the fact that of course no VAT (to private individuals!) is refunded by the buyer when buying, I would realize an average loss of EUR 5 per ounce of silver (AK yesterday at approx. 22 EURO / ounce) from today's point of view (corresponds to: -23.15%, cancelled -2.5%). At the corona high, I could have exited with a loss of "only" TWO EURO per ounce. The emphasis is on could, because at that time it was not possible to buy precious metals in many federal states. Selling to customers was permitted because it was a bank-related service, but buying was not permitted as a bank-related service (from today's perspective: irrational reasons)... So if I had wanted to take advantage of this opportunity, it would have had no effect.

Let's compare with gold: If we had bought an ounce of gold at the same time (11/2012), we would have paid an ounce price of around 1,370 EURO (if you apply today's realistic premiums to the mid-market price). Yesterday, the purchase price for an ounce of gold over the counter was approx. 1,640 EURO. A profit of 270 EURO. Over a period of almost 9.5 years, also a rather modest return, but still 18.14% total return (with 1.96% canceled return). Also astonishing... due to the historically low inflation in the past (until last year), gold was able to achieve a minimally positive return in relation to inflation.

We note: In my view and according to the figures available, silver is the more thankless alternative investment next to gold, in the comparable period.😤

Historically, silver has always been primarily an industrial metal. It is used for all kinds of processes in the manufacture of circuits and contacts, in cameras, airplanes, communication devices, cars and many other, almost forgotten areas of application (e.g. leading metal in the field of medicine due to its antibacterial properties...). And yet, or precisely because of this, it has a difficult time attracting interested investors.

1. on the one hand, the metal is often only used in quality products on a really large, high-quality scale. Copper or other conductive metals are cheaper to obtain, albeit with slightly less favorable conductivity - it cannot be ruled out that alternatives could be developed in the future.

2. silver, like gold, is becoming ever greener. The recycling of the precious metal is therefore becoming increasingly important and cheaper. This will also make producers independent of the large silver nations of Mexico, Peru, China or Russia (or even Poland). The ecological aspect plays an important role here, as does independence from such countries (see the recent precedent of Russia).

3. taxation at a rate of 19% or differential taxation. Why silver is subject to taxation today is a matter of conjecture and speculation. One story about it: "Silver would be the little man's gold, which is why the state would absolutely want to make money from it..." is rather nonsense - but silver is primarily an industrial product. It can therefore be assumed that the sales tax is aimed at value creation (gold already has an inherent value, so an increase in value is more a purely subjective view, and gold also has the nimbus of an alternative means of payment) through silver in industry and the production chain.

4. silver is a cyclical metal. Due to its use in industry, the price of silver, just like platinum and copper, is strongly linked to economic developments and influences. If there is a drop in demand in production, this is just as noticeable as an increase in demand. This results in fluctuations, which are often "stockpiled" during procurement in the industry and are therefore already in stock in the warehouses of industrial producers in good times. This also has an influence on the market price.

Yes, my example is negative because my purchase was historically unfavorable. Nevertheless, this constellation is the perfect example, as the period chosen corresponds approximately to the recommended minimum investment period for silver and gold (10 years plus x). And something else is typical of the example: at the time of purchase, nobody knows whether and when it is the right time to buy into an investment. Statements can therefore only ever be based on the past.

I believe (yes, the contradiction to the intention; but I am allowed to do so for professional reasons alone...😇) that the price of silver may fall again in the next few years for the reasons mentioned above. In my opinion, the current price level can only be derived from the consequences of the pandemic. Otherwise, the silver price does not currently provide a really sound basis for a further rise in the price. We have not seen any groundbreaking technological developments in the past two years (I do not count further developments as these are usually developed in a more resource-efficient way), nor have there been any indications of a heavily regulated quota in silver mining. The opinion of some analysts that the price of silver would double at the same time due to the rise in e-automobility (see Elementum AG 2021) was already taken out of the sails in 2021 with -10.55%. Nevertheless, the reasons for a stable price in the sideways movement can be assumed to lie in the continuing demand from this industry.

With these reasons in mind, an investment in silver should therefore be considered carefully. On the one hand, investors fall behind right from the start when buying silver (19% VAT or differential taxation - this must be factored into the retail price by the dealer), and on the other hand, the development of the silver price is by no means a historical guarantor of returns due to the major influence of the economy and industry. Of course, silver can (or more precisely: may) also occupy a small position in the overall portfolio.

However, investors should be aware of the risk/reward profile and compare it with their personal investment case.

I see silver, like short to medium-term government bonds, as an anchor in the portfolio. Whether it is an oversized anchor (an AIDA cruise ship anchor for a fishing cutter, brings stability - at the bottom of the ocean) or simply a fluctuation-reducing vehicle, clearly depends on the weighting of the metal in relation to the size of the portfolio.

Where a 10% share of gold in the portfolio generally seems sensible, I would rather underweight the share of silver (2.5-5%). If you want to position yourself in precious metals with gold and silver, you should include a ratio of 75% gold and 25% silver in your portfolio.

What did I do with my silver?

Over the past few years, I have simply kept buying individual coins at lower prices. However, I didn't do this in sufficient quantities to be able to significantly reduce my purchase price at the time. This approach still makes sense to me, because I still have a very long, perhaps eternal, investment horizon. In the meantime, I have mentally written off the money I invested in silver. For me, silver represents an opportunity to still be able to achieve a selling price in really urgent cases. Like gold, the material value will probably never be "zero" - at least in my lifetime.

In addition, the panda, the kookaburra and the Luna series are very beautiful collector's items. "Oh, irrationality - I hear you!" 🤭

I don't want to hide the following points:

If an investment in silver had been made in the last 5 years, a market return of 21.34% would have been achieved (gold: +40.20%).

Over a three-year period, silver is slightly ahead of gold at +48.74% (+40.41%). In this respect, our yellow friend has been "lucky again" with his coins.

The MSCI World achieved the following returns in each individual period under review:

2012-2022: +174.48% (10 years)

2017-2022: +54.26% (5 years)

2019-2022: +46.63% (3 years)

To the charts:

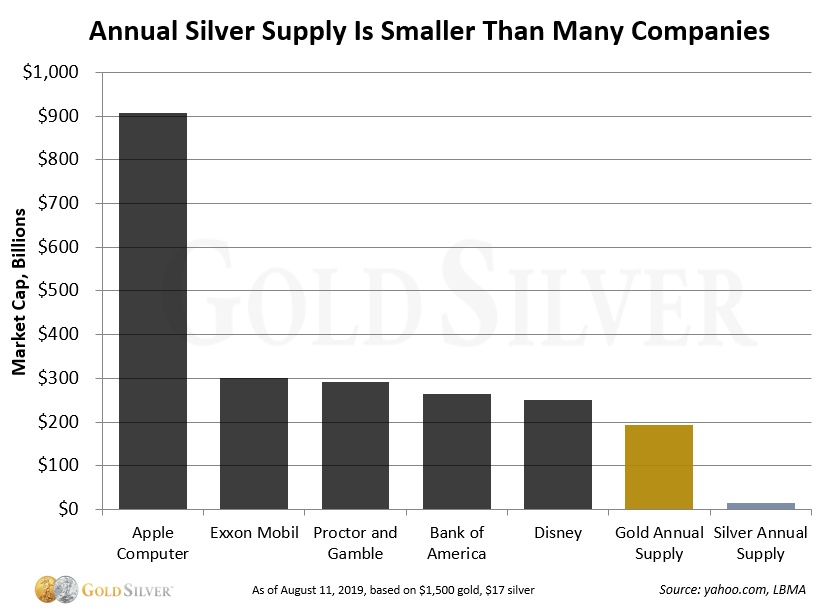

Market cap of silver and gold compared to selected companies, as of 2019 - Noteworthy: we all know the market capitalization as of "today" of Apple...

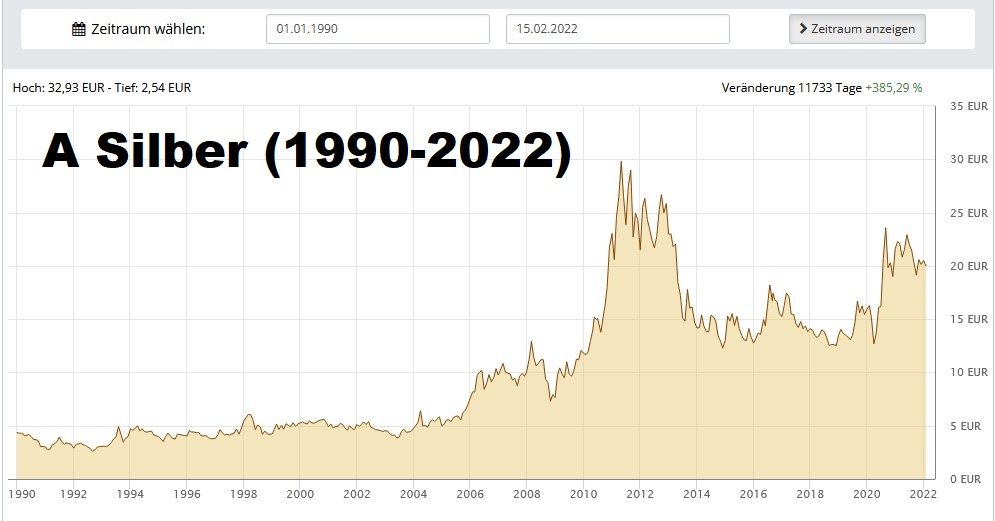

A : Silver price since 1990. Remarkable: Until 2005, i.e. 15 years, the silver price remained almost stable. It was only with the advent of new technology (smartphones, handhelds, more powerful chips, etc.) that the price of silver began to rise. From 2013-2020, the price moved sideways at a low level.

B : Gold price since 1990. Remarkable: Here, too, a long-term sideways trend has been observed, with the emergence of high-tech products but also general prosperity in the industrialized countries, gold has developed a steady price increase until today. Sideways movement also from 2013 to 2020.

C : Silver price since 15.11.2012 until yesterday. Remarkable: The pure mean price return is MINUS 17.60%. Negative return, rather an AIDA anchor for the small fishing boat.

D : Gold price since 15.11.2012 until yesterday. Remarkable: The mid-price return is still +22.20%. This is not particularly strong, but due to the relatively low inflation of past years during this period, the picture is relatively stable in value.

Sources: my experience, my opinion, charts on silver and gold price trends from Gold.de, Annual Silver Supply chart from goldsilver.com (the article on their website also lists some other interesting reasons for the difference to gold investments: https://goldsilver.com/blog/gold-vs-silver-the-5-differences-that-matter-most-to-investors/)

Link to the article by @Simpson: https://app.getquin.com/activity/rKStjvJTJR

[ATTENTION: This text was written after a full-time day at work and after linking yesterday evening. I apologize for any miscalculations, but on the whole it should fit. This assessment of silver as an alternative investment instrument is based on my personal and professional experience and perceptions. It is of course not investment advice or a recommendation. You are responsible for your own money. Any statements on tax aspects are not legally binding].