𝑺𝒕𝒂𝒕𝒊𝒔𝒕𝒊𝒔𝒄𝒉𝒆 𝑴𝒂𝒏𝒊𝒑𝒖𝒍𝒂𝒕𝒊𝒐𝒏 (𝒖𝒏𝒅 𝒆𝒎𝒐𝒕𝒊𝒐𝒏𝒂𝒍𝒆𝒔 𝑯𝒂𝒏𝒅𝒆𝒍𝒏)

https://docs.google.com/document/d/1Mx7AynRV4MzgPdW3vD-hl09duInzZgk3hFJPvxdEZv8/edit?usp=sharing

𝐅ü𝐫 𝐚𝐥𝐥𝐞 𝐦𝐞𝐢𝐧𝐞 𝐭𝐥𝐝𝐫'𝐬: Read Part III and Conclusion only.

Since relatively random emotional questions pop up on getquin every now and then (X has fallen, sell now?) and rational statistics is somehow hardly mentioned, I am compiling here some of the content relevant to the stock market, among others from both business psychology and statistics as well as some books, studies and websites.

Actually, I also wanted to go into posts of Finfluencern in the context, but that comes again independently of this.

𝐈 𝐔𝐧𝐭𝐞𝐫𝐬𝐜𝐡. 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐤𝐞𝐧 𝐮𝐧𝐝 𝐝𝐢𝐞 𝐣𝐞𝐰𝐞𝐢𝐥𝐢𝐠𝐞𝐧 𝐌𝐚𝐧𝐢𝐩𝐮𝐥𝐚𝐭𝐢𝐨𝐧𝐬𝐦ö𝐠𝐥𝐢𝐜𝐡𝐤𝐞𝐢𝐭𝐞𝐧

𝐈𝐈 𝐖𝐢𝐞 𝐦𝐚𝐧 𝐯𝐞𝐫𝐬𝐮𝐜𝐡𝐞𝐧 𝐤𝐚𝐧𝐧 "𝐟𝐚𝐥𝐬𝐜𝐡𝐞 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐤𝐞𝐧" 𝐳𝐮 𝐯𝐞𝐫𝐦𝐞𝐢𝐝𝐞𝐧

𝐈𝐈𝐈 𝐩𝐬𝐲𝐜𝐡𝐨𝐥𝐨𝐠𝐢𝐬𝐜𝐡𝐞𝐫 𝐄𝐱𝐤𝐮𝐫𝐬 (𝐧𝐚𝐜𝐡𝐤𝐚𝐮𝐟𝐞𝐧/𝐯𝐞𝐫𝐤𝐚𝐮𝐟𝐞𝐧)

𝐈𝐕 𝐅𝐚𝐳𝐢𝐭

I)

𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐤𝐛𝐞𝐫𝐞𝐢𝐜𝐡𝐞 𝐮𝐧𝐝 𝐢𝐡𝐫𝐞 𝐁𝐞𝐞𝐢𝐧𝐟𝐥𝐮𝐬𝐬𝐮𝐧𝐠

Basically, statistics can be broken down quite easily:

Have data clearly presented (descriptive statistics).

Looking for specifics and correlations (exploratory statistics)

And then draw conclusions (inductive statistics)

One could attribute "false", influenced statistics to the 3 levels of statistics

1)

The simplest fraud method, but also the quickest to disprove, works by simply falsifying numbers or incorrectly compiling/ omitting relevant information.

Example a) Donald Trump:

For Donald Trump, it sounds better, of course, to present it as if 1.5 million people were present at his inauguration . The fact that those present were estimated to be around 250k according to TV images does not matter to him.

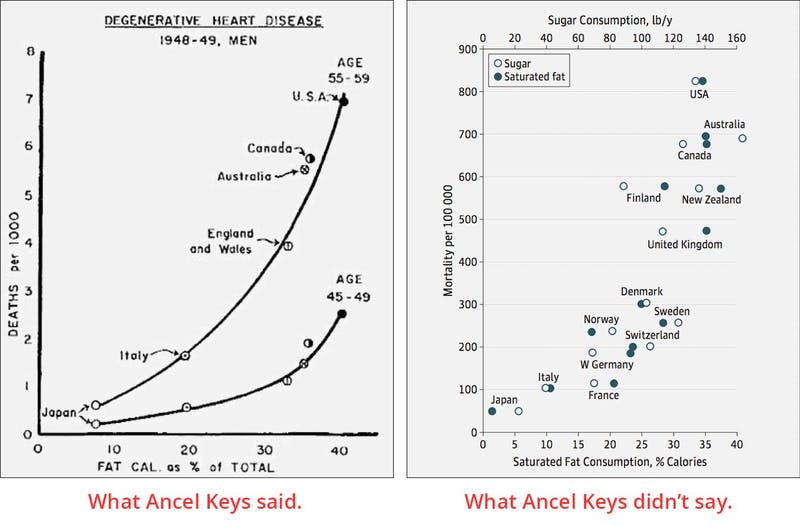

Example b) Ancel Keys:

Carry out and document an experiment correctly, but then only mention the numbers that please the client. Still not enough for the next level, but at least it is smarter than simply making up numbers.

Ancel Keys was a doctor who studied the relationship between animal fats and cardiovascular disease. Thesis: animal fats are to blame for heart attacks.

He collected figures for 21 countries (https://gerritkeferstein.com/wp-content/uploads/2021/01/Bildschirmfoto-2021-01-14-um-08.44.48-1024x399.jpg) but since these alone did not prove much, he simply omitted all countries that did not fit the curve. (See images below)

The study happened to be commissioned by the margarine industry. 🤡

2)

Use all data, but do not look for specifics, i.e., the "forget" exploratory statistics.

Example Heilbronn:

Heilbronn has one of the highest per capita incomes in Germany. Why? Because Dieter Schwarz pays taxes there. When calculating the income, a social product size is divided by the population size, the income of the Schwarz family alone pulls the average higher. Of course, this does not make the inhabitants of Heilbronn any richer.

3)

Errors in inductive Statistics can often only be recognized if one really deals with the subject oneself (checked up to the last footnote). To use the right numbers, to recognize correct deviations, but still come to a questionable conclusion, usually requires an emotional bias or conformity drive (peer pressure and the need to agree with other people).

Example Covid19 infection:

I come home from a vacation from a country where Covid19 has broken out, so I have to get tested here. Out of 100 healthy people tested, 99 are found to be actually healthy. In contrast, in the case of an actual disease, the test result is always exact.

After research, we find that even only one in 1000 vacationers has been infected, which makes infection seem unlikely. But then the test is positive. The gut feeling says; the probability that I was actually infected is 99%, so I am as good as sick. But think further:

If 100,000 tourists were in the vacation area, 100 are infected and tested positive, 999 are not infected and tested positive (because 1% of 99,900= 999). Thus 1098 people are tested positive, but only 100 are really positive. (9%)

Thus, by thinking more carefully, the probability has decreased by -90% and is now only 9% that I was really infected with a positive test.

II)

𝐖𝐢𝐞 𝐯𝐞𝐫𝐬𝐮𝐜𝐡𝐞 𝐢𝐜𝐡 𝐚𝐥𝐬𝐨 𝐢𝐧 𝐙𝐮𝐤𝐮𝐧𝐟𝐭 𝐟𝐚𝐥𝐬𝐜𝐡𝐞/ 𝐞𝐦𝐨𝐭𝐢𝐨𝐧𝐚𝐥𝐞 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐤 𝐳𝐮 𝐯𝐞𝐫𝐦𝐞𝐢𝐝𝐞𝐧?

Of course, there is no simple solution here, however, one can find some ways to minimize the risk and identify relevant numbers.

First of all, it is recommended to at least additionally, but preferably exclusively and first of all, use the primary sources to use. Do not look for articles or sites that have cribbed Apple's quarterly numbers or their earnings report, look directly at https://investor.apple.com/investor-relations/default.aspx search for the financial statements:

https://www.apple.com/newsroom/pdfs/FY22_Q1_Consolidated_Financial_Statements.pdf

Of course, understanding such a balance sheet is more difficult than a pre-chewed text, but the risk of an emotional purchase is reduced by doing own research with factual sources.

Buying only on the basis of an analyst's opinion is nothing else, as one's own decision-making ability is being compromised on the basis of alleged expert knowledge.

Before buying stocks only based on analysts, one should remember that even funds do not often beat the broad market in the long run so far. If one buys individual stocks at all, this is probably due to an overestimation of one's own abilities😶. If one buys these however on opinion of an expert, it is actually even justified with the assumption of the abilities of a strange person.

Opinions of experts in certain economic areas to use as background knowledge, on the other hand, is reasonable, as long as their opinion appears in the decision only as an item on the pro / contra list AND these were checked for your qualification as well as your intentions.

(A mobility expert is thus logically to be treated with caution as an analyst, if he works at the same time as an external consultant of VW).

To recognize influenced statistics, it also helps to know other types of statistical tricks. If you want to look into this further, here is a list of the most common ones, this post is already way too long:

https://de.statista.com/statistik/lexikon/definition/8/luegen_mit_statistiken/

III) -𝐄𝐱𝐤𝐮𝐫𝐬-

𝐍𝐚𝐜𝐡𝐤𝐚𝐮𝐟𝐞𝐧 𝐨𝐝𝐞𝐫 𝐕𝐞𝐫𝐥𝐮𝐬𝐭𝐞 𝐫𝐞𝐚𝐥𝐢𝐬𝐢𝐞𝐫𝐞𝐧

The human being is actually not able to react to course changes in the short term due to his emotions. Spiegel puts it this way:

"When faced with a strong negative stimulus, such as a plunge in stock prices, the amygdala triggers a short, violent response without much reaction time: Fight or flight."

Meaning what? To buy a stock, you should assume some kind of bull scenario, it's not enough "the price is bound to go up." So you have to have reason to believe that growth is higher than expected, debt can be reduced faster, the research lead is higher than priced in, or, or, or.

Buy, hold AND CHECK

If this case does NOT occur, (Paypal did not achieve as much growth as expected) the next step would be to compare the long-term thesis with the short-term data and decide if it still holds. (as written in II: directly based on the quarterly figures).

If no: thesis no longer realistic = sell

Does it matter if the share price has fallen 50%? If one is sure of one's investment thesis and can continue to justify it, why should it matter. Depending on how likely you think this thesis is compared to your other investment theses, you can buy more, thus increasing the position size in relation to the other shares.

( Charlie Munger also invests according to this quite simple value investing strategy.

https://www.youtube .com/watch?v=JavygKq74sk&t=840s )

Additional relevant comments would be the following:

,,Selling a losing position is tantamount to admitting defeat. As long as the stock is in the portfolio, the losses can be recovered - hope dies last. This is often compounded by the problem of "selective perception": bad news about one's own shares is ignored, while good news is overrated.

Which brings us back to the issue of statistical influence. Not only the numbers, which the company presents, can be influenced, also the numbers [and colors, red is to lead to panic, reflex-like action. Why do you think the neo-brokers have these colors... oh well, they earn money on transaction fees...] which are visible in our depot, influence us unconsciously.

-excursion end-

IV)

𝐅𝐚𝐳𝐢𝐭

1) Statistics is really only ever helpful if you check the important stuff against primary sources and deal with it. Otherwise, it quickly leads to hasty decisions and burns 💵

2) Add to that the human brain, which is so afraid of losing money, that without content guardrails in investments we very quickly unfortunately do just that.

What else do I learn from this? Longterm stocks are only checked on the basis of newly published figures and otherwise the chart is trusted (more on this in the TA post).

Discussion thesis: A SL makes sense to limit losses, but I should only use it in the medium term (i.e. try to avoid the negative phases of the stock to get more profit from the positive ones). Because a long-term SL would mean uncertainty in the investment decision and thus make it null and void.

Or?

#learn

#basics

#stockanalysis

#stocks

#psychologyinfinance

Sources:

https://docs.google.com/document/d/1h7TSza-1SqeVOulPiWNDrQQb2cncgTYrEEd1cH4qUMk/edit?usp=sharing