So dear friends,

In the spirit of sustainability, I would like to introduce you to another company:

UPM Kymmene

FI0009005987

UPM-Kymmene Oyj is a Finnish manufacturer of paper, pulp and wood products and is one of the world's leading forest and paper companies. All of the Group's products are made from 100% renewable raw materials.

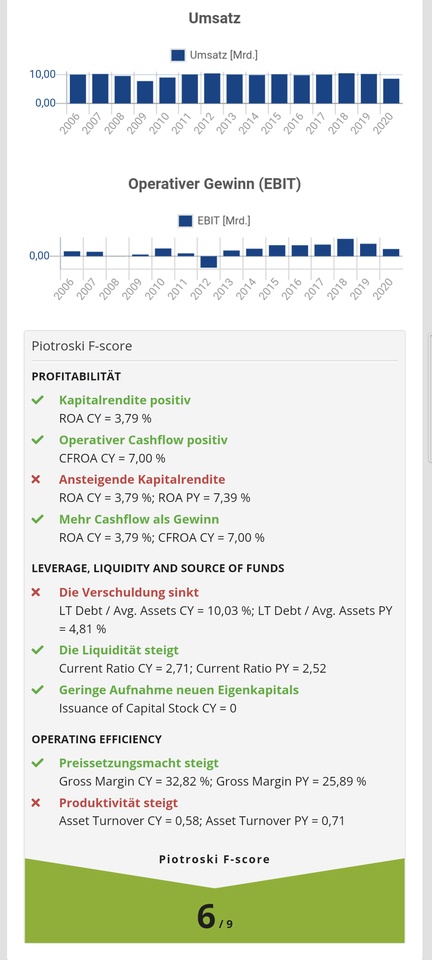

Key figures:

P/E ratio 2021e: 14.2

P/E ratio 2022e: 17.4

ROCE: 8.64%

Debt < 4x EBIT: 0.4! Debt quasi non-existent/irrelevant

Gross margin: approx. 32

Net margin: ca 19% (Q3 2021)

Targets: Climate change mitigation and sustainable forestry (two trees are planted for one felled) and fossil fuel-free future.

According to Q3 2021 report:

"UPM started the basic engineering phase of a next-generation biofuels refinery in January.

UPM joined The Climate Pledge in February, committed to reach the targets of the Paris Agreement 10 years in advance."

Segments (not exhaustive):

Biofuels

Energy (low-emission electricity for Northern European market)

Biocomposites

Biochemicals

Biomedicine

Bio forestry

Specialty/Printer/Communication Paper

Pulp/3D Bio Printing

UPM has not been a growth company in the past. Sales are also dependent on the price of wood (see 2020, when the price was low), which of course could increase this year due to inflation. UPM benefits from this, partly through its own production. Despite all this, UPM is a cyclical company. However, UPM seems to me to be well equipped for the future.

Competitors: For example, Svenska Cellulosa or Holmen AB.

Conclusion: UPM is very well positioned. The balance sheet looks very strong! Nevertheless, there is competition, especially in the north. For one or the other dividend hunter, UPM is a gem. However, I also see long-term potential in the share price, even though we are talking about a cycler in the value sector and not a growth company. One should be aware of that. If you value sustainability and want an unagitated company, you won't do badly here either.

Disclaimer: I am invested myself.