Today it should be about Amazon. In principle, I will reproduce my investment case here and thereby disregard basic principles and fundamental data, also because these have probably already been posted 100 times here. Instead, I will deal specifically with the points that are bullish for me and of course also look at the opposite side. In principle, I see three points in Amazon: 1) A stable and sustainable business model, with 2) an attractive valuation and 3) risks that still allow an investment.

Brief overview:

1) Fortress Amazon (moats, Why is Amazon's business model so secure?).

2) Valuation (Colorful mix about the valuation of the stock)

3) Opposite side (What are the risks?)

4) Conclusion

1) Fortress Amazon:

Amazon does not only have one moat, Amazon's business model is based on two massive moats at once, making it one of the safest Big Tech companies in my opinion. The two relevant business activities, the cloud computing division AWS and the core business of mail order, are both equipped with a constantly growing, proprietary infrastructure.

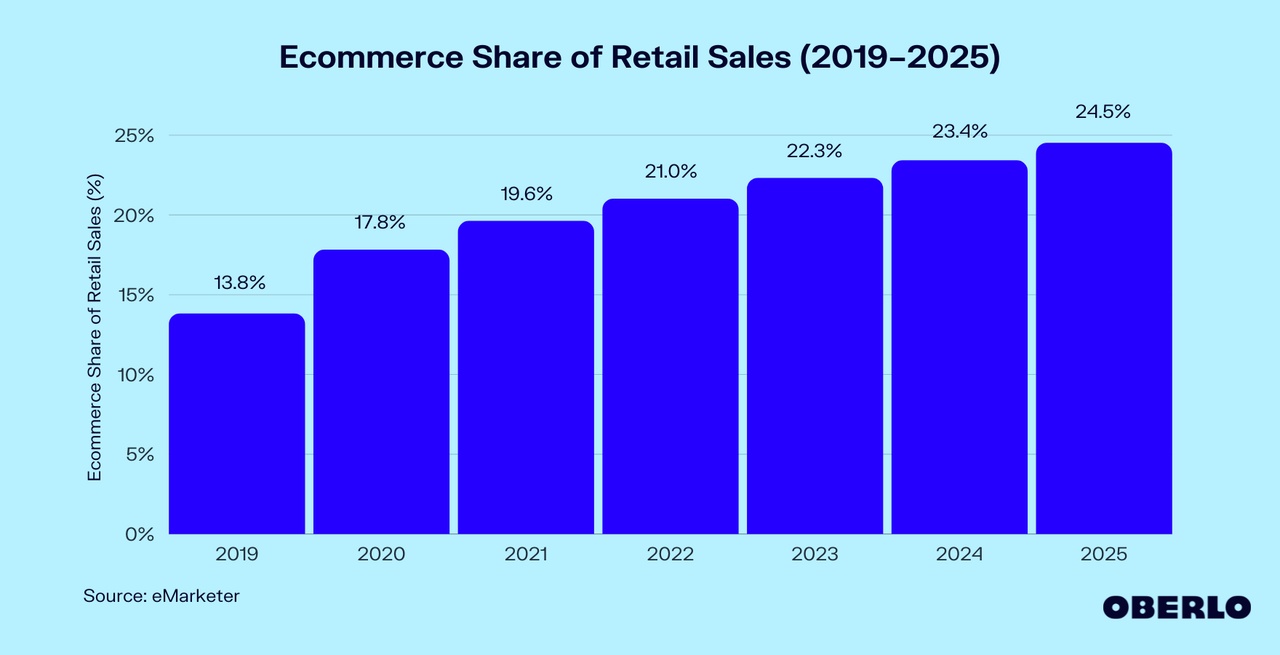

The mail order business is increasingly supported by its own logistics infrastructure. With over 175 logistics centers, between 80-90 Amazon Air cargo planes, and an incredibly large fleet of semi-trucks (U.S.) and smaller last-mile vans, Amazon manages to get deliveries to consumers in many major metropolitan areas around the world within one or even the same day. Amazon has been investing in its logistics network for years and continues to stay on the ball. In 2020, the warehouse space was expanded three times as much as in 2019. With subcontracts to smaller service providers, they manage to offer just the last mile deliveries very cheaply (disgusting practice). This leads to Amazon becoming the largest package delivery service in the US this year (ahead of FedEx and UPS) and now delivering over 70% of its packages in the US itself. In summary, this years-long focus on logistics makes Amazon the fastest e-commerce provider, and the whole thing is cheaper, safer, and more predictable than relying on third-party providers like DHL, FedEx, or UPS. This competitive advantage gives Amazon an uncatchable position in logistics and e-commerce, making it ultra-stable in a growth market (p. Figure 1).

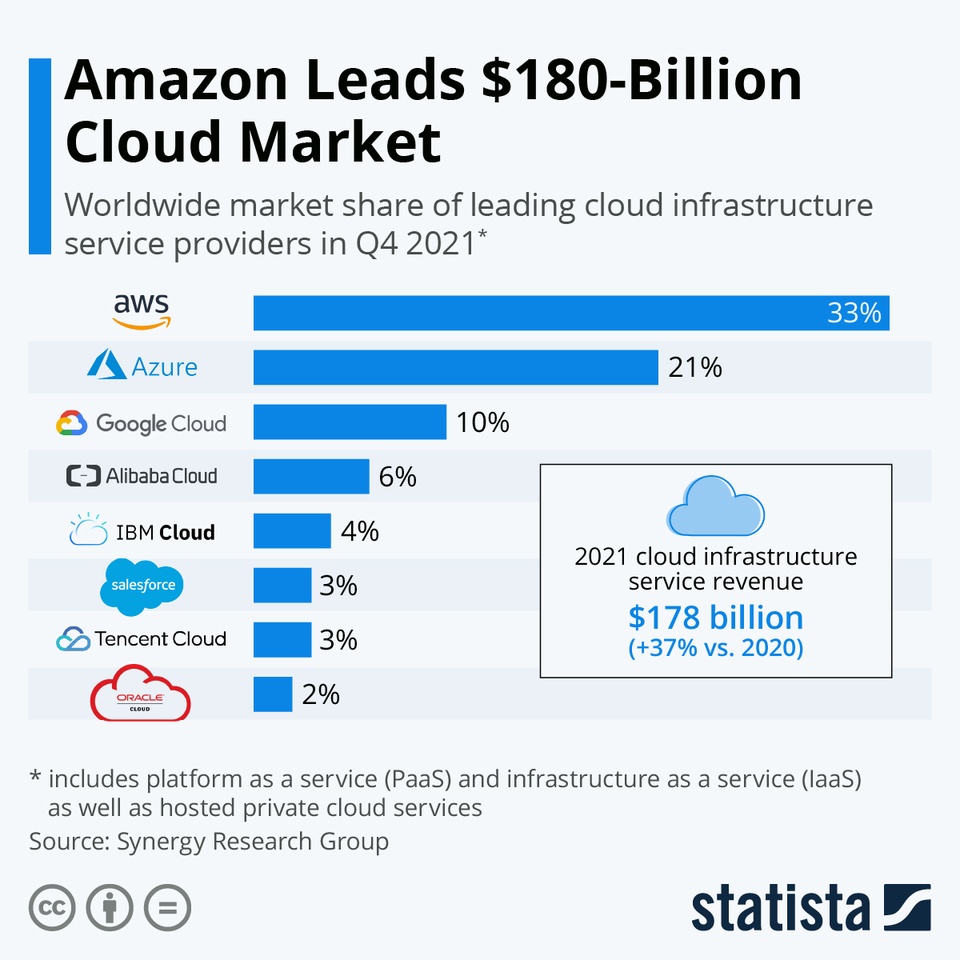

The second mainstay, just relevant for the net margin and thus the profit of the company, is the cloud computing division AWS. This business activity is also based on the early focus on infrastructure. Amazon's early investments have enabled AWS to work its way up to become the undisputed market leader in the cloud computing business for several years (see Figure 2). Microsoft and Alphabet can continue to follow suit, but AWS' market share has been stable for several years, so Amazon's leadership is not currently under attack. With a global infrastructure of data centers and nodes, AWS is currently the cloud business provider that can offer the simplest and fastest secure cloud infrastructure. Since Amazon continues to pump money into this business, it is also difficult to catch up with Amazon here and is very stably positioned in another growth market.

2) Valuation:

Amazon currently has a P/E ratio of 68.9 (06.04) and a 2023 P/E ratio of 45.3. Of course, this is not exactly low, but I always have to think of an interview by Warren Buffet. He once said about Amazon that he regretted not investing in the stock because the price was too high for him. Big tech is always expensive by comparison, but it has paid off as an investment so far and will continue to outperform in my opinion. The market position of Amazon, but also of the other big tech US companies, is simply too dominant and is driven by future trends such as digitization, e-commerce, etc.

Also, I would like to comment here on some points I took from the new video series on Amazon by Joseph Carlson. This presented a few points on why Big Tech is generally and always undervalued. The first is that the risks of widespread regulation are priced in. However, I think this is overstated (more on this later as well). However, his arguments are also that institutional investors usually underweight Big Tech and for several reasons. 1) Diversification (even though Big Tech alone accounts for 25% in the S&P 500, for example). 2.) Active fund managers cannot charge 1/10 or 2/20 (1% TER and 10% performance fee or 2% TER and 20% performance fee, respectively) if they stupendously invest only in big tech companies. This is because investors could easily do this themselves, so active fund managers usually tend to overweight "hidden gems" and if big tech is in the portfolio at all, they underweight Amazon, Alphabet and co.

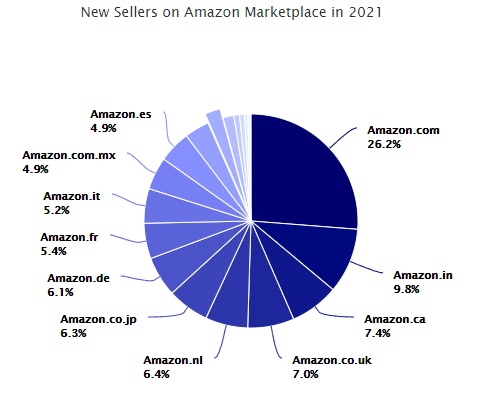

In addition, the point must also be made here that Amazon could already achieve much more attractive valuations if they did not continue to invest so heavily. Amazon's capex (capex = capital expenditures) was over $60 billion in 2021 and will be at similar levels this year and according to estimates in 2023 and 2024. So you can see that Amazon continues to pour incredible amounts of money into growth to extend its lead in its core business activities, which continue to grow. Amazon's capex is also about the same as Apple, Microsoft AND Alphabet combined. This also shows that Amazon continues to be a growth play and the gains are made when it fully controls the markets in which it operates. It is also interesting to note here that Amazon makes 10% of its revenue in India, for example (p. Figure 3), but is not yet making any money here at all. Many markets and products continue to be a purely negative business for Amazon, which it continues to operate and can balance out with other markets in order to remain the undisputed number 1 in e-commerce in the future. India, whose e-commerce business is expected to triple by 2025, will therefore only become attractive for Amazon in the future, as will other markets, and the margins in these "new" markets will only slowly increase over time.

Lastly, let's talk about other ways Amazon could do its investors a favor. Here, something was done recently for the first time in a long time. For example, the long-desired stock split (20:1) was announced, which makes the stock easier to trade and offers real advantages in the options markets. In addition, a small buyback of $10 billion was also announced. However, this is firstly very little and corresponds to only about 0.5% of Amazon's market cap, furthermore, it does not mean that Amazon really invests $10 billion in its own shares, as the company has also not always fully utilized the authorized amount in the past. In addition, Amazon has been expanding its shares somewhat for years (stock compensation for employees), so buybacks can at most keep the number of outstanding shares stable.

3) Risks:

However, I would also like to give a small overview of the risks again. Risk number 1 is currently that Amazon has a quite cyclical business model, so that this could well come under pressure in the event of stagflation or recession. Risk number 2 is an increase in union activity. A few days ago, a works council was set up for the first time in a logistics center in New York. Currently, however, it looks more like this is an isolated case. Last, and often mentioned by many observers of the company, are the regulatory risks. In my opinion, however, these are overestimated. The fundamental argument against this is that the U.S. is currently not interested in putting obstacles in the way of its large companies. Amazon is one of the largest private employers in the U.S., so harsh regulatory intervention would endanger jobs. Accordingly, I think this is unlikely. More likely is a forced spin-off of AWS, which should be positive for investors, as AWS would be worth more on its own than integrated into the parent company. However, big tech is of course constantly regulated and will continue to be regulated in the future. The EU in particular is a pioneer here and recently dealt another blow to platform businesses and market-dominant companies with the Digital Markets Act. However, Amazon and Co. can usually react quickly and easily to such minor regulations.

4) Conclusion:

The Amazon share is still a buy in my opinion. The risks are there, but the upside of the share is much higher. With Amazon stock, you get a stake in a broadly diversified company that operates two core businesses and is ultra-stable in both of them. Both of these core businesses, cloud infrastructure and e-commerce, are growth markets and are driven by several macro trends (digitization, e-commerce, IoT, etc.). The valuation of the stock seems higher than it is. Amazon is debt free, has a good cash balance, is already generating a more or less stable free cash flow and continues to invest in itself, neglecting its investors. This shows me that the fat years are still to come here and investors still have the opportunity to get shares in a stable growth monster.