From January to August, South America remained the largest export region for BYD$1211 (+0,77%)

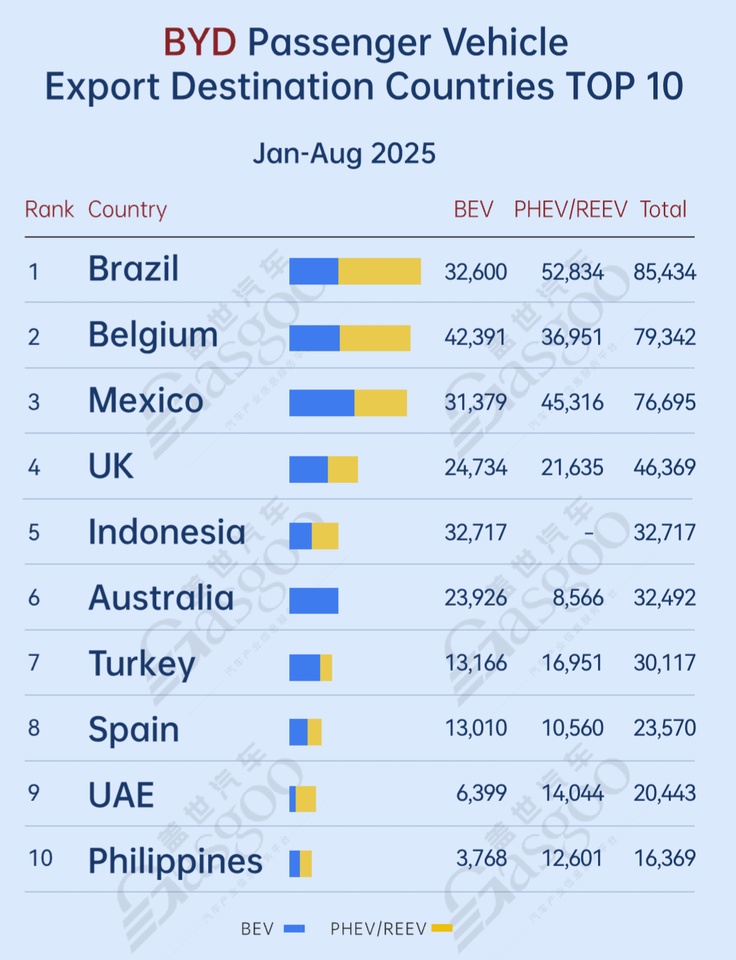

Brazil ranked first with 85,434 units exported - including 32,600 battery electric passenger vehicles (BEV) and 52,834 plug-in hybrid electric passenger vehicles (PHEV). Although exports rose slightly to 4,398 units in August, the pace was still dampened by higher local import duties.

Mexico followed with 76,695 units (31,379 BEVs and 45,316 PHEVs) and developed into another important market in the region.

》In Europe, Belgium, the UK and Spain remained important target markets《

Belgium ranked second worldwide with 79,342 units and served as an important entry point for Chinese NEVs in Europe.

The UK recorded steady growth with 46,369 units, driven by political support and the increasing spread of electric vehicles.

Southeast Asian markets such as Indonesia (32,717 units) and the Philippines (16,369 units) also stood out, reflecting strong underlying demand.

The Indonesian market was dominated by BEVs, in line with national electrification efforts, while plug-in hybrids were more popular in the Philippines due to local driving conditions, fuel prices and consumer preferences.

Taken together, these trends point to significant long-term growth potential in the region.

In the Middle East, the UAE continued its upward trend, climbing from 10th to 9th place with 7,401 units exported in August alone. The country is becoming a new pillar of BYD's global expansion, supported by the UAE's Energy Strategy 2050 and ongoing investments in charging and refueling infrastructure.

》From a powertrain perspective, demand varies greatly between regions《

In Europe, there is a balanced mix of BEVs and PHEVs, Indonesia prefers all-electric models, while Turkey, the United Arab Emirates and the Philippines tend to favor plug-in hybrids.

As BYD strengthens its localized production, service and charging ecosystem overseas, this diversified market pattern is expected to deepen further and create a solid foundation for sustainable export growth.