Stock / ETF : UnitedHealth ($UNH (+3,35%)

)

General information:

Ticker : $UNH (+3,35%)

Market Cap : 273.87 Billion USD

EPS : 23.92

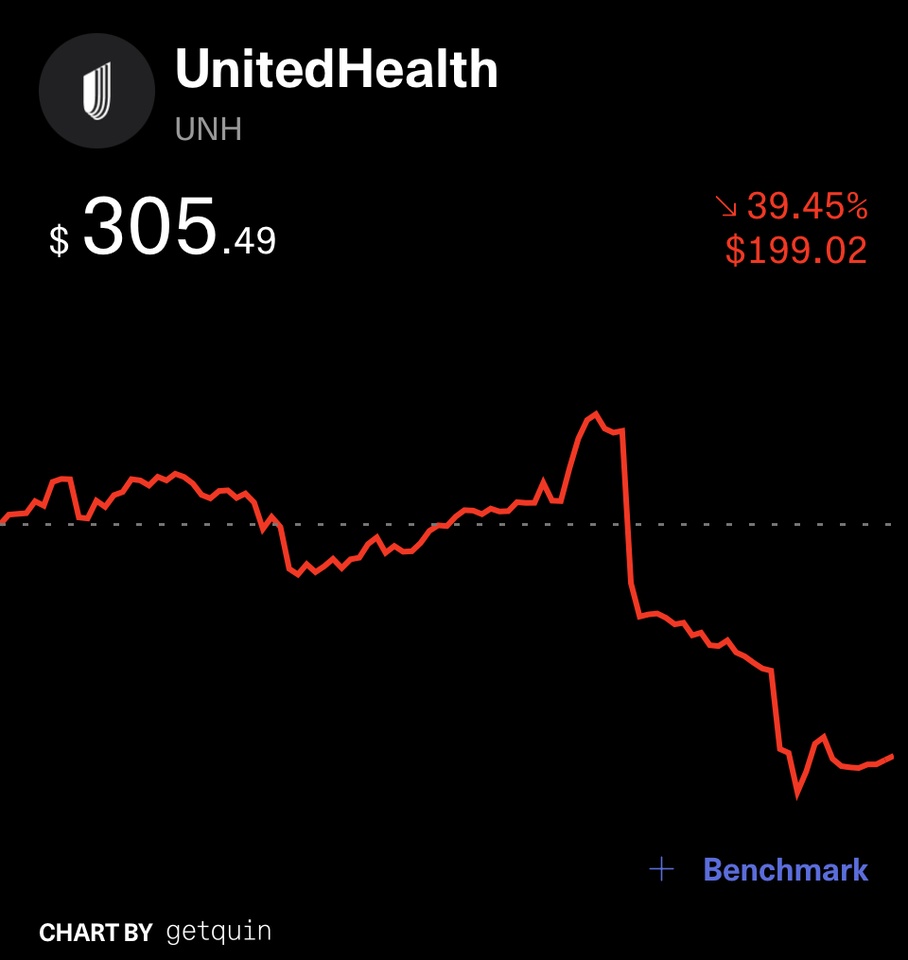

1y Return : -38.61%

1m Return : -23.01

Position : Buy (Long Term)

Sector: Healthcare ( Medicine )

Chart Art :

Reasoning :

Currently, United Health is priced very low at a measly $305.09 share price. The stock has gone down by 38.58% in the past year. At this low price, some people will view the stock as very negative and not worth purchasing. But I disagree. I view this loss as merely a discount that enables me to purchase a part of this innovative, lucrative company easier and cheaper.

Currently, Barclays has a price target of $642 for $UNH. The massive giant Barclays which is usually right, has set a massive target for UNH, which it is likely to reach. Also, the stock’s price to earnings ratio is below its five year average, suggesting potential undervaluation. Furthermore, UnitedHealth is still investing into innovative technology and digital health services through its Optum Division.

Currently, the reason why the stock is going down is because of fear in the market. Due to external issues like the Trump Tariffs and Geopolitical issues, a wave of fear has spread throughout the market, greatly impacting the healthcare giant. However, this downturn doesn’t reflect the real stock. It just reflects the fear relating to the stock. I believe that the stock will rebound, and that now, when the stock is almost 40% cheaper than last year, is the time to purchase the Healthcare Giant UnitedHealth.

Reminder : This is not financial advice. Investing is risky so try at your own will and vocation.