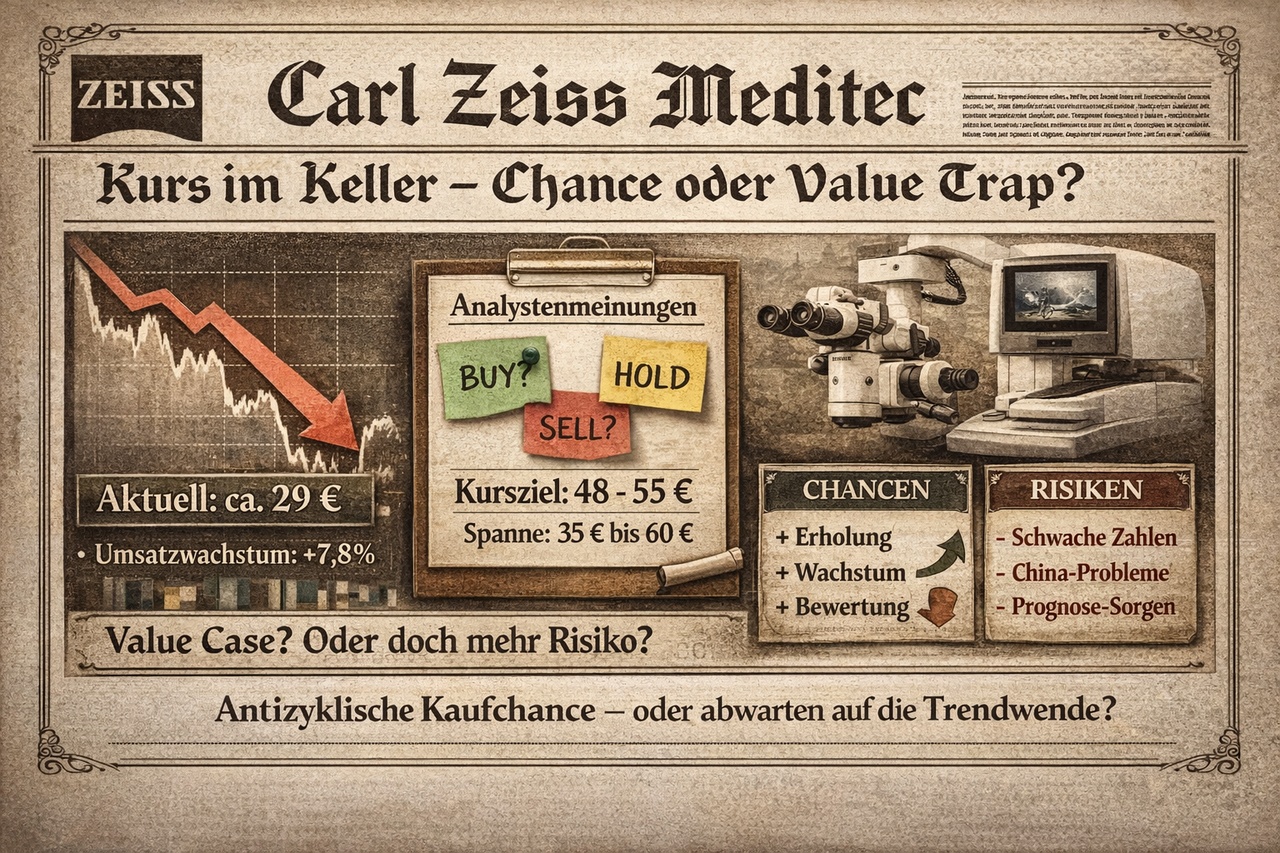

The share $AFX (+0,89%) (Carl Zeiss Meditec) have come under massive pressure in recent weeks and are currently trading at around € 29. This was triggered by a weak start to the new financial year, depressed margins and increasing uncertainty in the China business. The market is thus clearly pricing in an operating dip - the key question is whether this is already exaggerated.

Fundamentally, the company remains solidly positioned. In the 2024/25 financial year, Zeiss Meditec generated revenue of € 2.23 billion, which corresponds to growth of around 7.8 %. On a positive note, the significant increase in incoming orders shows that the structural demand for ophthalmic medical technology continues to exist. However, the quality of earnings is problematic: Q1 2025/26 was significantly weaker, sales and EBITA fell noticeably and management has communicated that the previous annual guidance is unlikely to be achieved. No operational tailwind is therefore to be expected in the short term.

On the valuation side, the situation has eased considerably. Depending on estimates, the expected P/E ratio is currently between around 17 and 20, which is historically rather moderate for a quality MedTech stock. The dividend yield is around 1.3% and plays a subordinate strategic role. The decisive factor is looking ahead: analysts expect profits to rise again in the coming years, provided that margins and business in China normalize.

The analyst consensus is clearly cautious. The majority of ratings are Hold, with a few Buy and a few Sell ratings. The average price target is in the range of around € 48-55, with a rough range of € 35 to over € 60. In mathematical terms, this results in a high upside, but only on the assumption that the operating business stabilizes. The market does not yet believe that this recovery will take place - otherwise the share price would not be at this level.

Classification:

The risk remains elevated in the short term. Weak quarters, possible further forecast adjustments and macroeconomic uncertainties argue against an aggressive immediate entry. In the medium to long term, however, Carl Zeiss Meditec remains a qualitatively strong company with structural growth in ophthalmology. The current valuation offers a value case with a catch.

Conclusion:

Currently not a clear buy, but a watchlist candidate with staggering potential. Investors should bet on several tranches and wait for operational confirmation. A real revaluation of the share will only come when margins and guidance create confidence again. Until then, Zeiss Meditec remains cheap - but not without risk.

Finally, a question for everyone:

Do you see the current share price as an anti-cyclical entry opportunity with patience - or are you, as an investor or interested party, waiting for an operational turnaround before adding capital?

#Zeissmeditec