Today I would like to explain my investment thesis for the small cap $HITI (-4,91%) stock. I have had a position since January of this year, but the really big shares were only bought around May/June, when the share price was quite low. My average purchase price is 2.18 euros and is currently up around 30%. I currently have a 34% weighting in the company, making it the second-largest position in my portfolio. Even if it was never planned that the position would have such a large weighting, but if you like a company's share price at EUR 3 and it then develops more and more fundamentally, but the price continues to fall due to Trump tariffs, negative sentiment in the sector and a lack of institutional investors, then you have to be brave and add to it.

What does High Tide actually do?

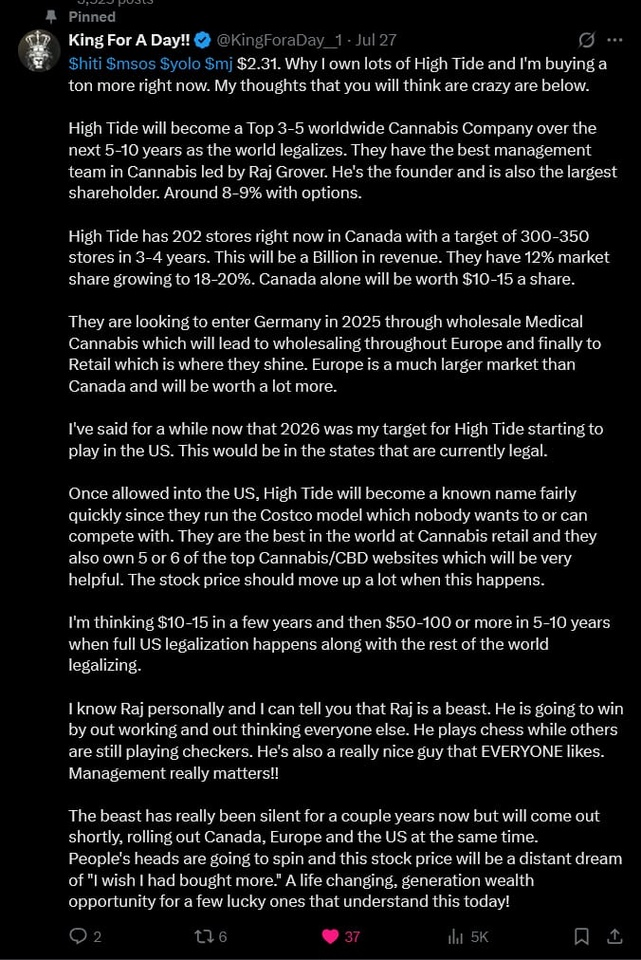

High Tide is a Canadian cannabis retailer. The company was founded in 2009 by Raj Grover. They currently operate 211 stores across the Canadian provinces. They also have an e-commerce store where they sell accessories and weed, but this is not doing so well and now only accounts for 3% of sales. They operate a Cotsco-like discount model in their retail locations, where customers receive discounts on selected products once they have signed up. This model has a free model (Cabana Club) and a paid model (Elite Membership) where an annual fee of 35 Canadian dollars is payable for even greater discounts. The fee of the Elite model adds up completely to the bottom line, i.e. it is actually pure profit.

The current figures

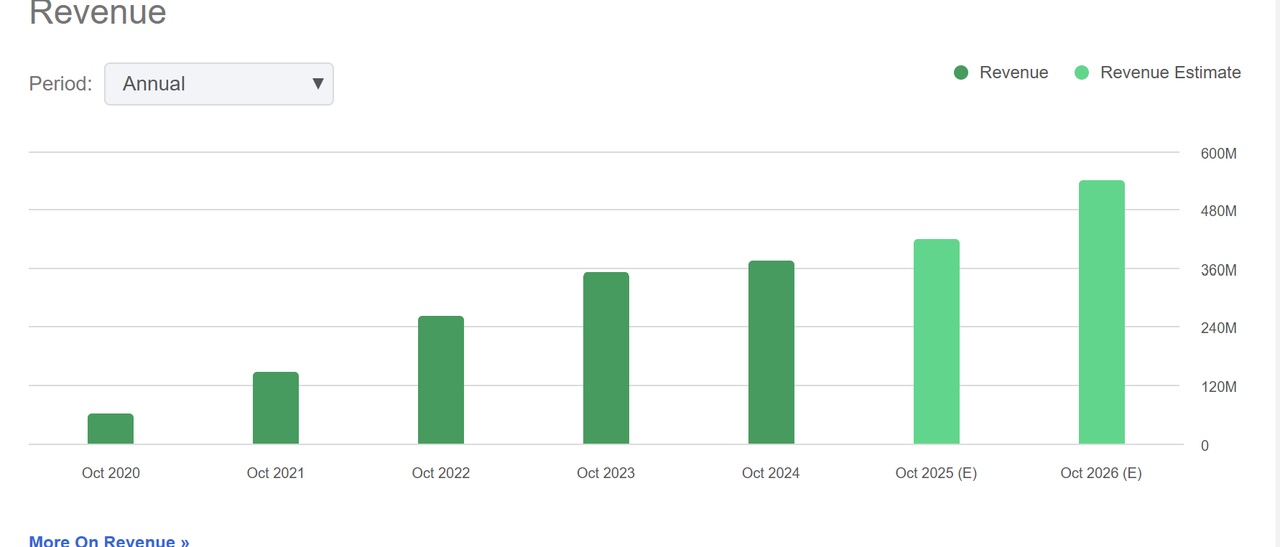

current market cap: 290 million US dollars

Sales 2025(e): 420 million US dollars (plus 12% y/y)

Adj . EBITDA 2025 (e): 28.5 million US dollars (plus 2.5% y/y)

FCF 2025 (e): USD 15.9 million (-19 y/y)

Net income 2025 (e): -0.03 US dollars (-30% y/y)

So while the topline was able to improve, the margins in particular fell in Q1 and Q2. I see this as a short term headwind, as these have since stabilized again and will continue to rise in the coming quarters, which should then also pull the bottom line upwards.

Future growth

Following the decision in 2023 to curb growth in order to become free cash flow positive, growth was accelerated again once this target was reached. In the past, High Tide has grown primarily by simply opening new stores and further improving the economics in the existing stores. While they opened 50 new stores per year in the early days, this was throttled down to 17 in 2023 to meet profitability targets. Now they seem to have found their sweet spot at 20 to 30 new stores p.a. In 2024 there were 29 new stores and this year they will probably come out similarly high. The increase in the store count plus the increase in sales in the existing stores through their cotsco loyalty programs should ensure around 20% growth p.a. in sales alone from now on. FCF, BITDA and EPS should grow a little faster as margins will be expanded over the next few years through elite membership and in-house SKUs, which they are gradually rolling out from now on.

Targets in Canada by 2029

- Increase stores from 211 to 350

- Convert 40% of Cabana Club Members to Elite Members

- We are currently at approx. 5% (120,000) --> could therefore rise to over 1 million in the long term

- Elite Members have recently grown at 100% y/y and Cabana Club at 33% y/y

- Same store sales increased from 2.8 million Canadian dollars to 3.5 million.

- in-house SKU's (7% higher margins on average) to 25% of sales (currently 2.5%)

- Successful lobbying in politics to be allowed to increase the permissible store count in some provinces and to obtain tax relief

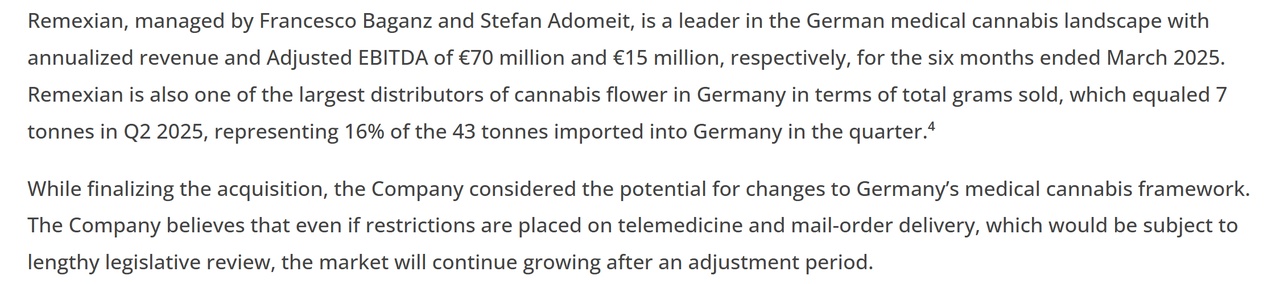

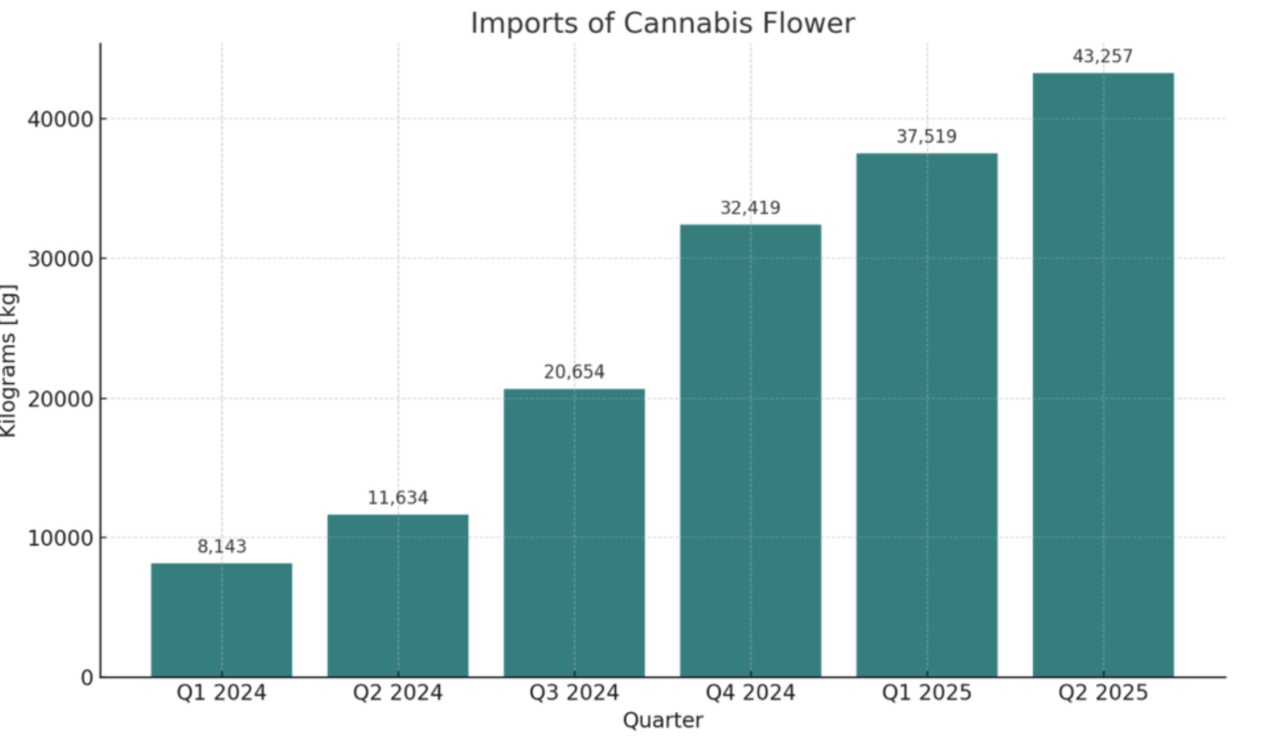

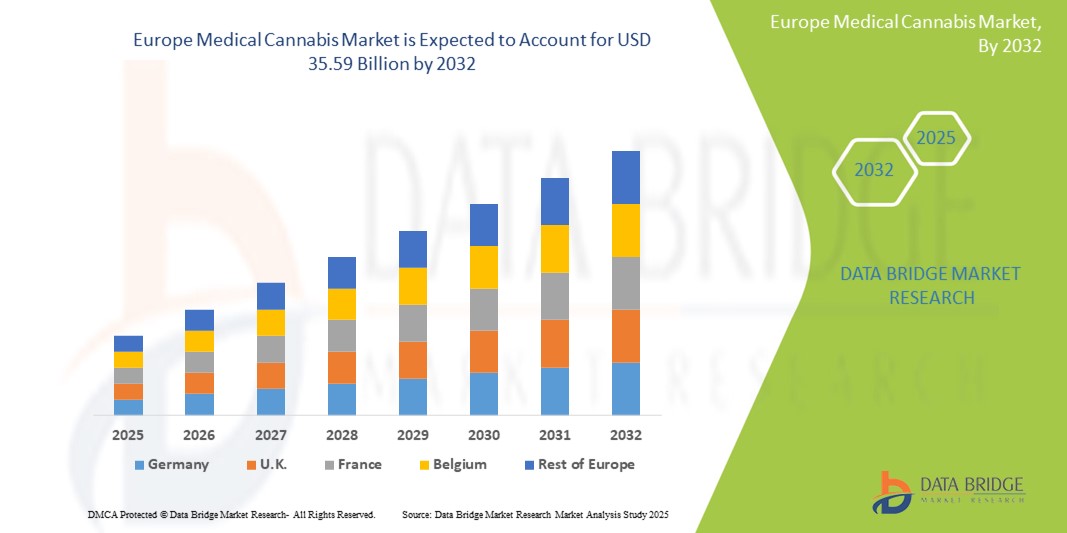

In addition to all this growth in Canada - which is admittedly quite "nice" - there is the real inflection point that I have been waiting for a long time and which is now materializing: International expansion. In September, High Tide acquired a 51% stake in Remexian Pharma. A leading distributor and wholesaler of medical cannabis in Germany with 16% market share. Raj wants to expand its market share to at least 20%. This acquisition currently contributes EUR 70 million to the top line and EUR 15 million EBITDA to the bottom line. Furthermore, Remexian will be used as a gateway to expand into other European cannabis markets. The market in Germany and Europe is growing extremely fast.

Import growth of cannabis in DE

If we take this into account, a relatively relaxed 30% sales growth should be achieved over the next 4 to 5 years. While the bottom-line should grow even faster. And I think that's still a conservative estimate.

2026

2026 should be the eagerly awaited inflection year for High Tide. With the acquisition of Remexian and 30 new stores, sales growth continues to accelerate. We are also likely to see the first year of profitability on a GAAP basis.

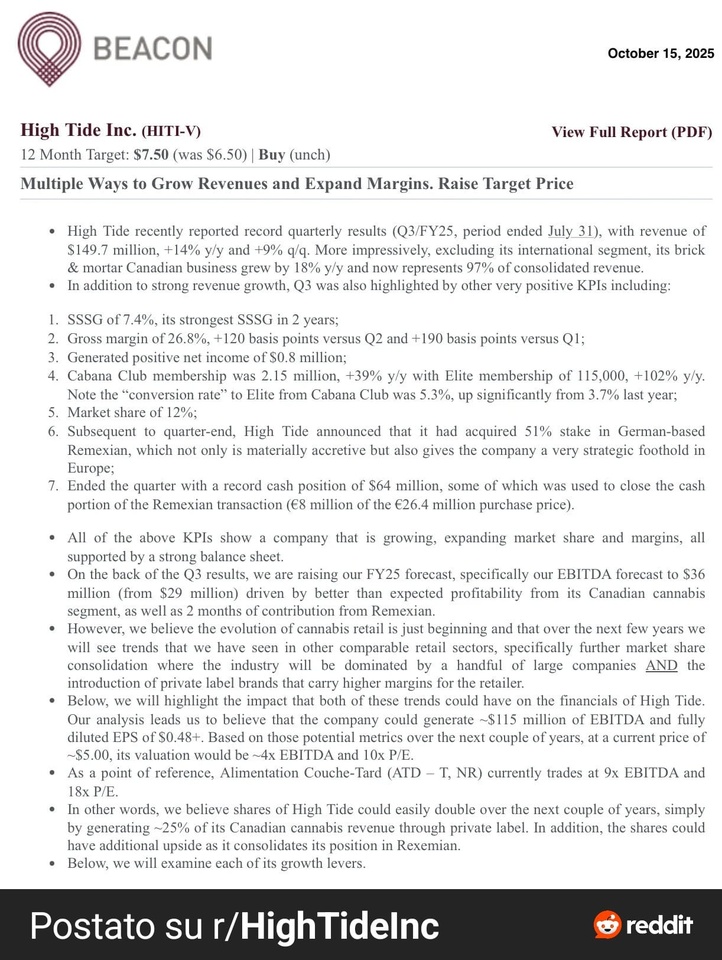

Beacon Report High Tide (in Canadian dollars)

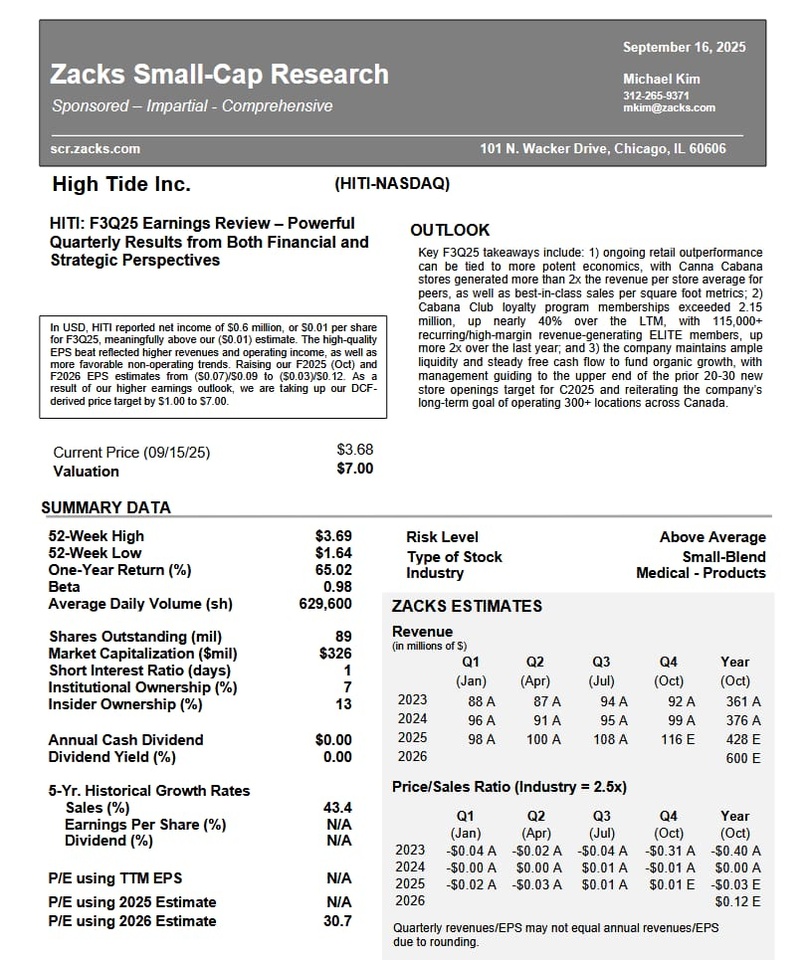

Zacks Report High Tide (in US dollars)

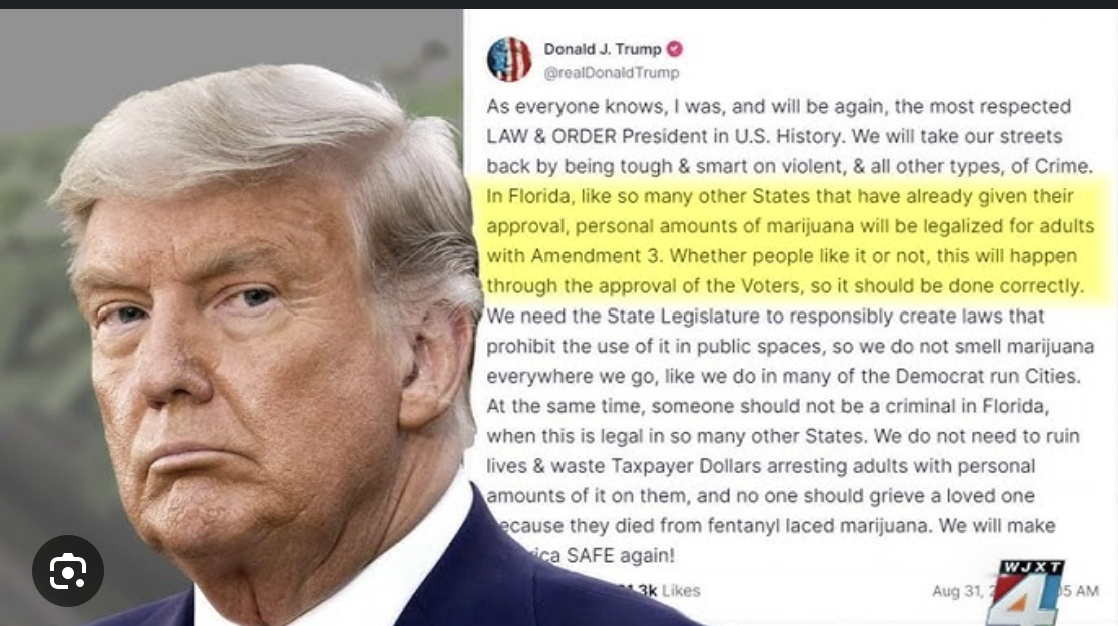

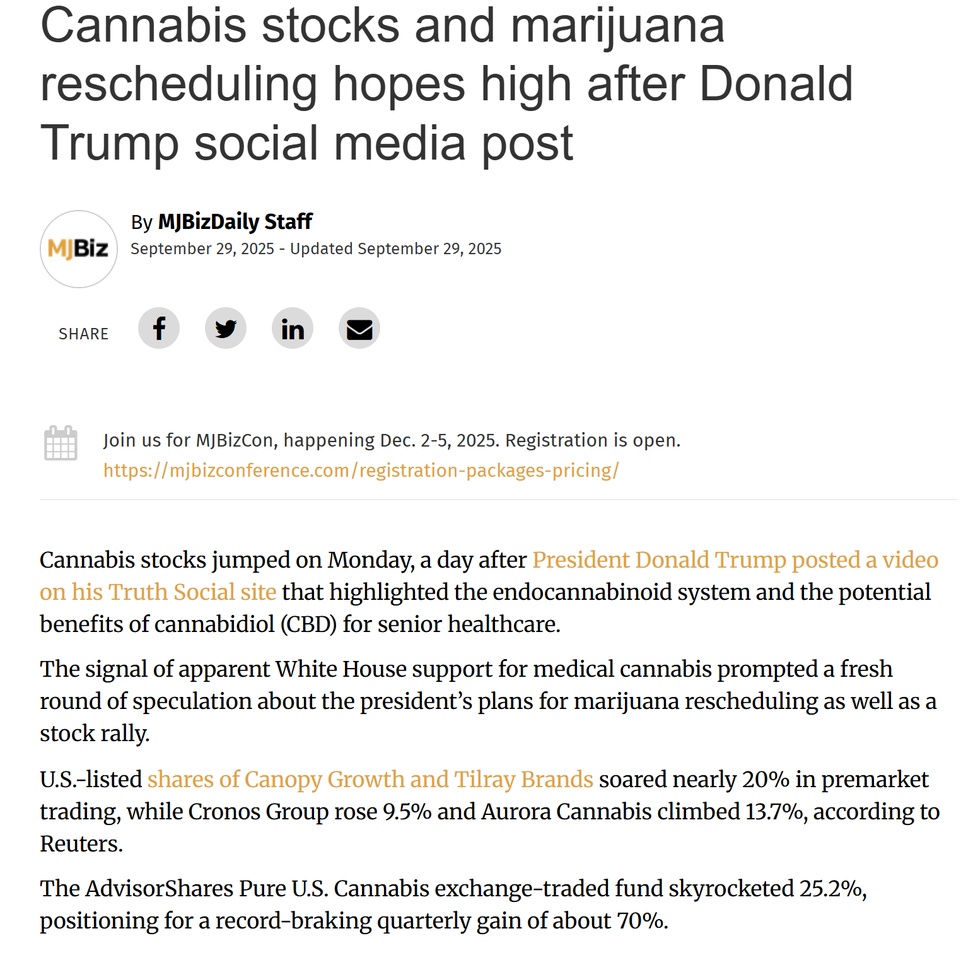

Cherry on the cake: Descheduling and legalization in the USA

Not the core of my investment thesis, but would be a nice extra. Donald Trump has repeatedly communicated his desire to relax cannabis regulations, perhaps even one day legalize it completely. But many have promised that before him, so I'm not interested in the babble. I think that High Tide will have its hands full for the next few years, even without the USA. Expanding Canada and Remexian ... you know the drill. But if that happens and the US opens up, oh boy, the course will probably look like IREN's at the moment. Even de-scheduling from a tier 3 drug to tier 1 - so no real legalization, just a regulatory "loosening" - should help the rate quite a bit.

But let's see, Trump talks a lot when the day is long.

Risks

The mood in the industry is poor. Many investors got their fingers burnt during the cannabis hype phases in 2018 and 2021 and have been avoiding the industry ever since. Many institutional investors are not allowed to invest in cannabis. Many of the companies in the industry have been doing nothing but burning cash for years and are constantly having to dilute their shareholders. On the other hand, all these things also ensure that really good companies in the sector are completely ignored (like High Tide). Due to the negative sentiment, however, it could be that "cheap" stocks simply remain cheap because investors continue to lack confidence in the sector.

The sector remains naturally vulnerable to regulation of any kind. As for legalization movements at the state level, we are still early. It won't be in a straight line, but there will always be setbacks. Like currently in DE, where the CDU has passed a tightening of the CanG in the cabinet (still has to go through the Bundestag and will probably be watered down for High Tide, thankfully). If there is no de-scheduling in the USA, the entire sector will of course be sent down, including High Tide.

Furthermore, it is sometimes not easy for companies to raise capital for expansion, for obvious reasons. If they are able to raise capital, it is usually at abnormally high interest rates, which have a huge impact on profits. The high excise tax in Canada is another reason for the unprofitability of many companies in this sector.

The big picture

We are facing a generational shift. Alcohol consumption among young people and GenZ is going down, weed consumption is going up. I think that more and more countries will "open up" in the next few years and High Tide will not be able to keep up with the expansion.

Sorry, it's half a bible. Nevertheless, I hope someone has read it. Would love to hear your opinion :)