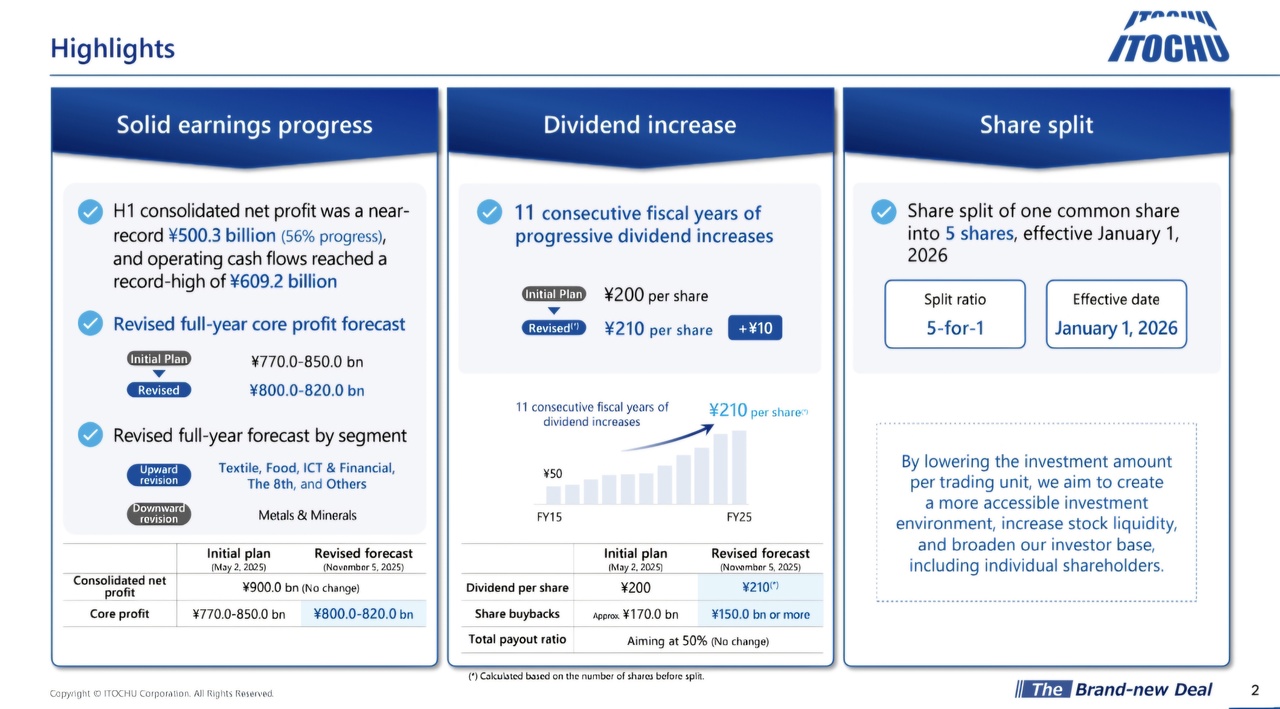

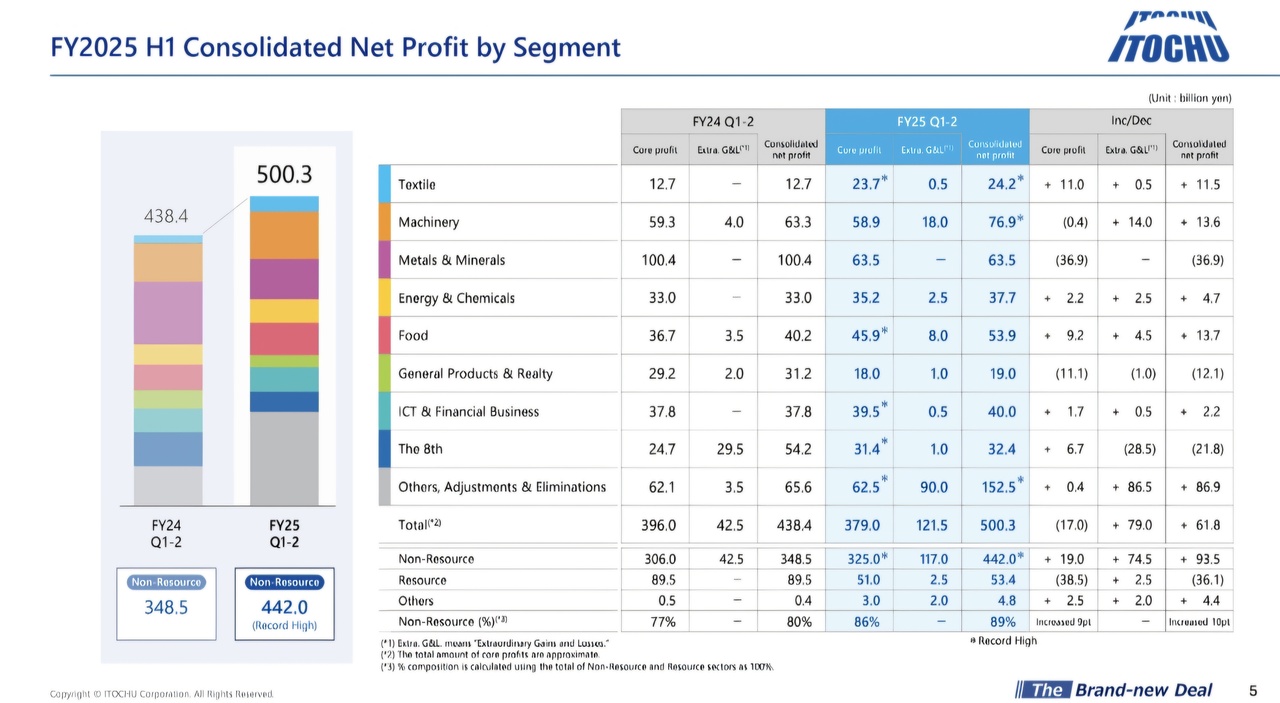

The Japanese trading giant Itochu $8001 (-6,28%) has once again presented solid figures. The company achieved a consolidated net profit of around ¥500 billion, an increase of +6% compared to the previous year. The non-resource business, which includes textiles, food and financial holdings, performed particularly strongly.

Operating cash flow also rose to a record ¥609 billion, underscoring Itochu's strong balance sheet and cash management. Net income for the full year was raised slightly and is now in the range of ¥800 billion to ¥820 billion.

For shareholders, Itochu remains a reliable dividend stock: the payout was increased for the eleventh consecutive time - to ¥210 per share, plus a planned 5-for-1 stock split on January 1, 2026.

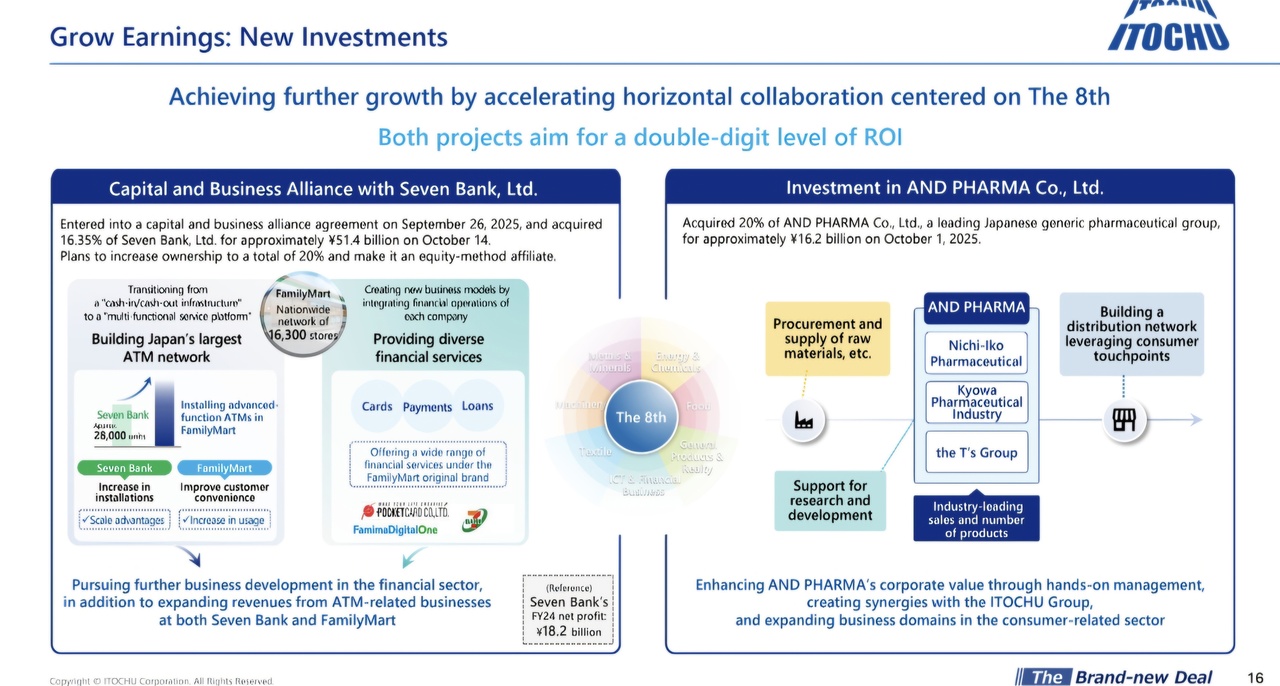

Despite headwinds in commodities and exchange rates, the management is optimistic. New investments - such as in Seven Bank and AND Pharma - are expected to generate additional growth and double-digit returns.

Itochu proves once again that diversification and a long-term management strategy pay off. With stable profits, solid returns and a clear commitment to shareholder remuneration, the company remains a reliable dividend stock in the Japanese market. 🇯🇵