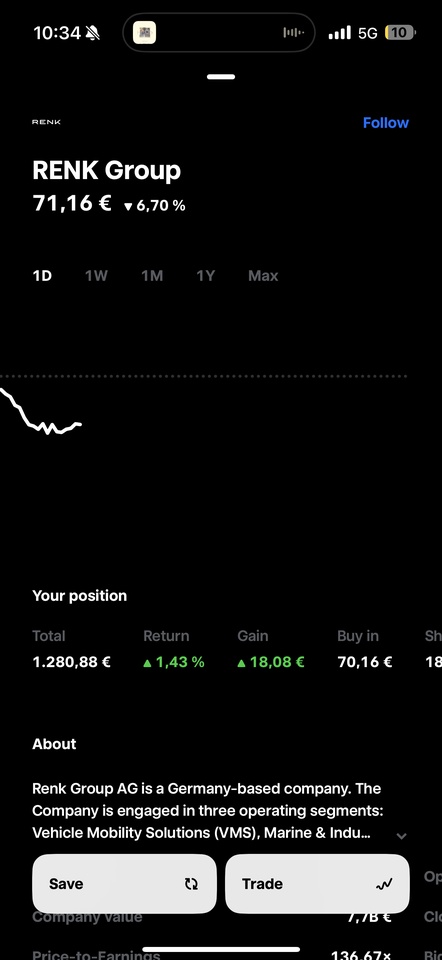

On June 10, the $R3NK (-0,34%)-share fell by -6.7 %. I added to my position at € 70.16, based on an analysis from a well-founded Reddit post (r/mauerstraßenwette). My position currently stands at €1,280.88, with a slight book profit of +1.43%.

Why I got in:

RENK is a German company with decades of expertise in propulsion systems for tanks, navy and industry. The "Vehicle Mobility Solutions" and "Marine & Industry" segments in particular are benefiting from the geopolitical rearmament cycle in Europe.

Reddit points that convinced me:

- Clear growth potential: RENK supplies Leopard 2, Puma & Co - systems that are in massive demand in the EU right now.

- IPO effect not yet played out: RENK has been on the stock exchange since the beginning of 2024 - many institutional investors have not yet fully invested.

- Strategic tailwind: Defense is (unfortunately) becoming a priority in Europe again. RENK supplies key technology, not an interchangeable product.

Risks that I see:

- Political change could slow down the trend

- Relatively high valuation (P/E ratio > 130)

- Limited diversification in the portfolio

I consider RENK to be volatile in the short term, but strategically strongly positioned. My entry after the -6.7% dip was deliberately speculative.

📷 See screenshot: Entry at € 70.16, current position slightly up.

No investment advice. DYOR.