The dry bulk market in early March 2025 presents a divided picture. Capesize rates surge to three-month highs, fueled by robust iron ore demand, while Panamax grapples with oversupply and a tariff-driven shift in China’s soy sourcing from the U.S. to Brazil. Supramax delivers a mixed performance amid subdued cargo flows, as newbuilding activity plummets and escalating U.S.-China trade tensions drag bulker stocks lower. Investors navigating this space face a blend of Capesize strength, sub-Cape struggles, and macroeconomic headwinds—volatility remains front and center.

This update explores Capesize, Panamax, and Supramax developments, alongside trade and investment factors. From rate spikes to tariff impacts, here’s the latest—opportunity meets risk in this shifting market.

⏬ Capesize Market: Surge Tempers Midweek

Capesize rates soared 33% this week, reaching $20,084/day on the Baltic Exchange—a 22% jump since Monday—driven by iron ore demand from Australia and Brazil, plus West African bauxite. West Australia saw steady enquiries for mid-late March, with C5 peaking at $10.50/tonne midweek before settling at $9.50/tonne; C3 (Brazil-China) climbed to $23/tonne for early April, narrowing the Pacific-Atlantic divide. Modern, fuel-efficient ships are assessed at $22,600/day, with March FFA contracts trading near $20,000/day, suggesting potential upside. South Atlantic and North Atlantic tonnage tightened, boosting the BCI 5TC by $3,660 week-on-week, despite a midweek dip to $15,711. Bad weather in North China thinned Far East spot tonnage, and a vanishing contango aligns spot rates with futures—yet sub-Cape weakness could stall the rally. Investors might see momentum here, though long-term risks tied to China’s stimulus linger.

⏳ Panamax Market: Oversupply and Tariffs Weigh

Panamax markets remained muted, bogged down by excess tonnage and sparse demand. In the Atlantic, rates slipped below $10,000/day as ECSA tonnage piled up, despite a slight uptick in NCSA grain activity—cancelled Indonesian cargoes further soured sentiment. Pacific rates eroded as grain voyages dwindled, with Japan-delivered 82,000-dwt trips falling from $12,500 to $10,500, despite minor relief from split Australian coal cargoes. China’s 10% tariff on U.S. soy is boosting Brazilian exports—Brazil-China routes hit $34.071/tonne, while U.S. Gulf-Qingdao dropped to $44.014/tonne—shifting tonne-miles southward. A 1-year period fix for an 82,000-dwt in China achieved $14,000, but broader softness persists without a seasonal lift. Stocks like Golden Ocean fell 4.8% amid trade war fears—Panamax faces choppy waters unless cargo flows rebound.

⏱️ Supramax Market: Mixed Signals Prevail

Supramax and Handysize markets kicked off quietly, with uneven activity across regions. The Atlantic saw flat Continent-Mediterranean rates and a softening US Gulf, where a 63,000-dwt petcoke run to India fixed at $17,000, while South America balanced out with a 61,000-dwt at upper $12,000s plus a $200,000s bonus. Asia’s Indonesian coal pricing uncertainty subdued Supramax, with a 63,000-dwt NoPac round at $12,500, though Indian Ocean demand pushed a 64,000-dwt to $15,500 plus $155,000 bonus. Handysize shone in Asia—a 37,000-dwt to Japan hit $11,000—contrasting US Gulf weakness at $8,500 for a 37,000-dwt East Coast run. Tightening Handysize availability offers a glimmer, but Supramax cargo scarcity limits gains—Brazil’s soy shift could nudge sub-Cape tonne-miles, yet momentum remains elusive. Investors might find selective stability here, tempered by broader caution.

🌐 Trade & Investment Context: Tariffs and Trends

Trade tensions are reshaping dry bulk dynamics. U.S. tariffs—20% on China, 25% on Canada/Mexico—met China’s 10-15% levy on U.S. farm goods, tanking stocks like Himalaya Shipping (-5.4%) and hitting sub-Cape grain hardest. Brazil’s soy exports, nearing 99.6M tonnes in 2025, gain as U.S.-China soy trade fades— milder than 2018’s 25% tariffs but still impactful. Newbuilding orders crashed 95% year-on-year to 130,000 dwt in January 2025, with a 10.5% orderbook and 14% higher 2025-26 deliveries pressuring rates. U.S. fees on Chinese ships and China’s NPC stimulus talks (ending March 11) loom—steel vs. consumer focus is unclear. Investors might weigh Capesize resilience against sub-Cape tariff risks and fleet growth concerns—macro events will steer the course.

🚨 Outlook: Uneven Paths Ahead

Capesize could climb further if China’s iron ore push and tight tonnage hold—FFAs and rising deal flow signal confidence, but sub-Cape drag may temper gains. Panamax faces a slog unless Brazilian soy offsets U.S. losses and tonnage eases—trade wars cloud prospects. Supramax offers pockets of steadiness, with Handysize a bright spot, though cargo scarcity caps upside. A newbuilding slowdown hints at future balance, yet 2025 bearishness looms with 3% fleet growth and flat shipments possible. Investors might lean into Capesize strength, brace for Panamax weakness, and watch China’s NPC—volatility’s here to stay.

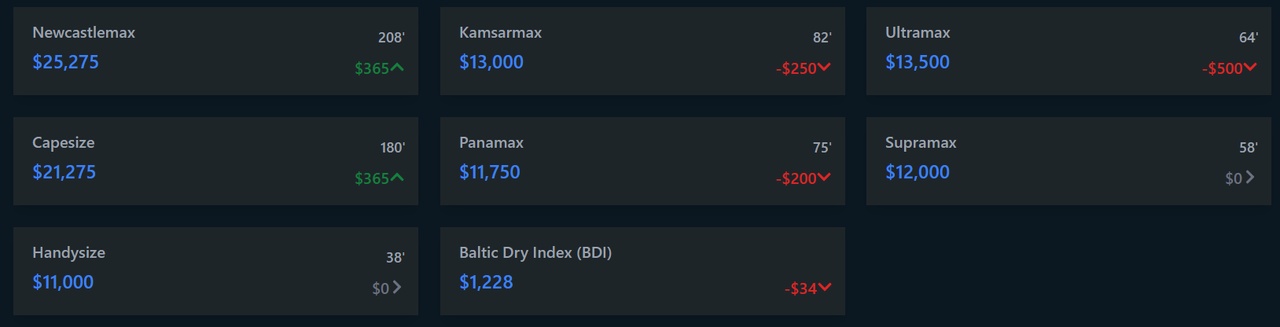

1 Year T/C Dry Bulk - March 5th

💬 What’s Your Read?

Bullish on Capesize strength, or bracing for Panamax weakness? Share your take—let’s break it down! 🚢