Here is my review of the $BATS (+0,7%) figures

Top and bottom line estimates were exceeded.

Summary of the financial results (HY25)

- Revenue**: £12.069m, -2.2% vs HY24 (due to currency impact); +1.8% at constant exchange rates (CC).

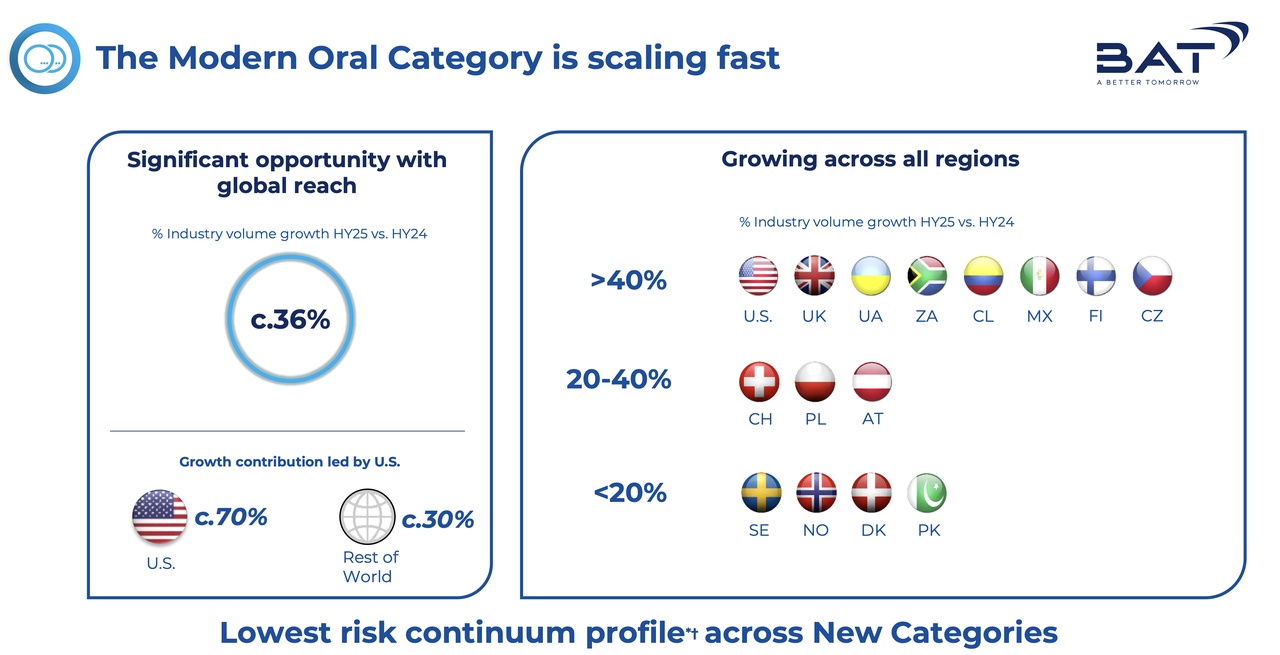

- New categories: Sales at £1.651m, stable vs 2024; +2.4% at CC, driven by Modern Oral (+40.6%).

- Smokeless products**: 18.2% of Group sales (+70 basis points vs. FY24).

- Profit from operations

- Reported: £5.069m, +19.1% (due to lower exceptional items and an update of provisions for the Canadian litigation).

- Adjusted (for Canada, at CC): £5.435m, +1.9% vs HY24.

- Operating margin: 42.0% (reported, +7.5 percentage points); adjusted for Canada at CC: 43.2% (stable).

- Earnings per share (diluted EPS)

- Reported: 203.6 pence, +1.6 %.

- Adjusted (for Canada, at CC): 162.1 pence, +1.7 %.

- Cash flow

- Net cash from operating activities: £2.309m, -27.0% (due to tax payments in the US and payments related to the Franked Investment Income Group Litigation Order).

- Free cash flow (before dividends): £1.234m, -42.1%.

- Operating cash flow conversion rate: 75% (HY24: 78%), target of >90% for the full year 2025.

- Debt

- Adjusted net debt: £29.749m, -9.8% compared to HY24.

- Target: leverage ratio (adjusted net debt/adjusted EBITDA) of 2.0-2.5x by the end of 2026.

Strategic highlights

- Progress in RRP

- 1.4 million additional consumers of smoke-free products, 30.5 million in total

- Sales share of smoke-free products: 18.2 % (+70 basis points).

- Contribution of the new categories (Vapour, Heated Products, Modern Oral): £179m, +38.6% at CC.

- Contribution margin of the new categories: 10.6 % (+2.8 percentage points).

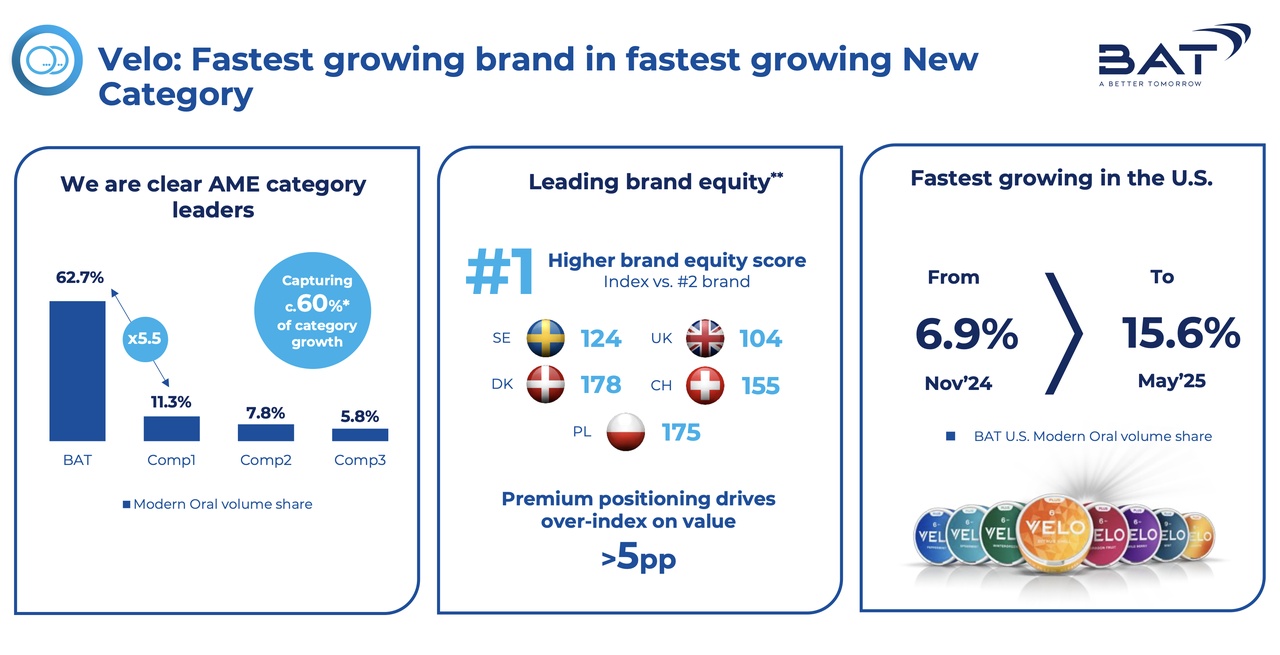

- Velo: Strongest growth brand in the fast-growing Modern Oral category.

- Sales growth in the USA: +384 %.

- Volume share in the USA: from 6.9 % (Nov. 2024) to 15.6 % (May 2025).

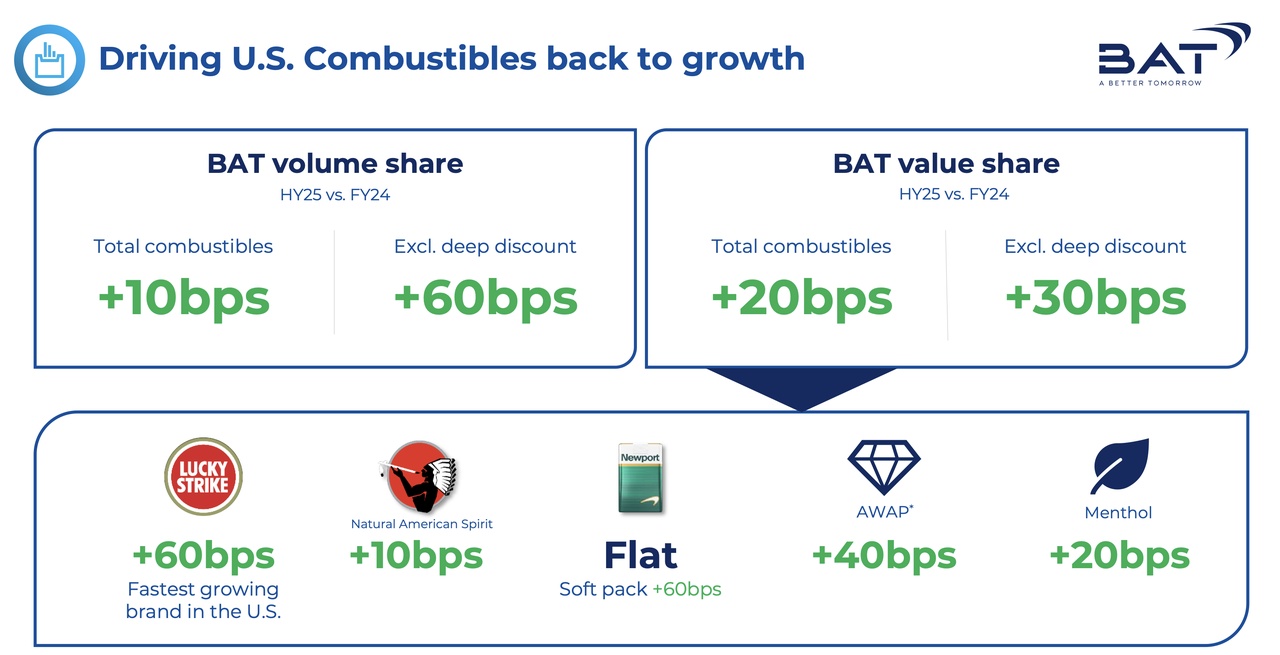

- USA: Return to sales and profit growth (+3.7 % sales, +3.2 % adjusted operating profit at CC).

- AME (Americas and Europe, excl. USA)Strong performance, sales +3.5 % at CC, adjusted operating profit +10.4 %.

- APMEA (Asia-Pacific, Middle East, Africa): Sales decline of 4.8% at CC due to regulatory and tax challenges in Australia and Bangladesh.

- Share buyback program: Increase of £200m to £1.1bn for 2025.

- Dividend policy: Progressive dividend growth (+2.0% for 2025).

Outlook for the full year 2025

- Revenue growth: Upper half of 1.0-2.0% range (at CC).

- Operating profit (adjusted, for Canada): Growth of 1.5-2.5% (at CC, including an expected currency impact of 1.0-1.5%).

- Currency impact: Expected negative effect of approx. 4% on adjusted operating profit.

- Net financing costs: approx. £1.8bn (adjusted, for Canada).

- Capital expenditure: Approx. £650m.

- Cash flow conversion: Over 90%.

- Long-term target: £50bn free cash flow (before dividends) between 2024 and 2030.

Strategic priorities

- Focus on quality growth: Investments in the largest profit pools (USA, Velo, Premium Heated Products, Vapour).

- Digital transformation: partnerships with Microsoft, SAP and AWS; 40% reduction in IT costs through strategic partnerships

- Sustainability: Progress towards a smoke-free world, supported by innovations such as Velo Plus, glo Hilo and Vuse Ultra.

- Cost savings: Fit2Win program with target of £2bn savings by 2030, including £500m annually by 2028.

Financial performance

Sales performance:

- Total sales decreased by 2.2% to £12,069m, mainly due to a negative currency impact of 4.0%. At constant exchange rates, sales grew by 1.8%, driven by:

- USAUSA: +3.7 %, supported by strong price mix effects in combustible products (+11.4 %) and the growth of Velo Plus (Modern Oral: +384 %).

- AME: +3.5 %, driven by price mix in flammable products and Modern Oral (+16.5 %).

- APMEA: -4.8 %, impacted by regulatory and tax challenges in Australia and Bangladesh.

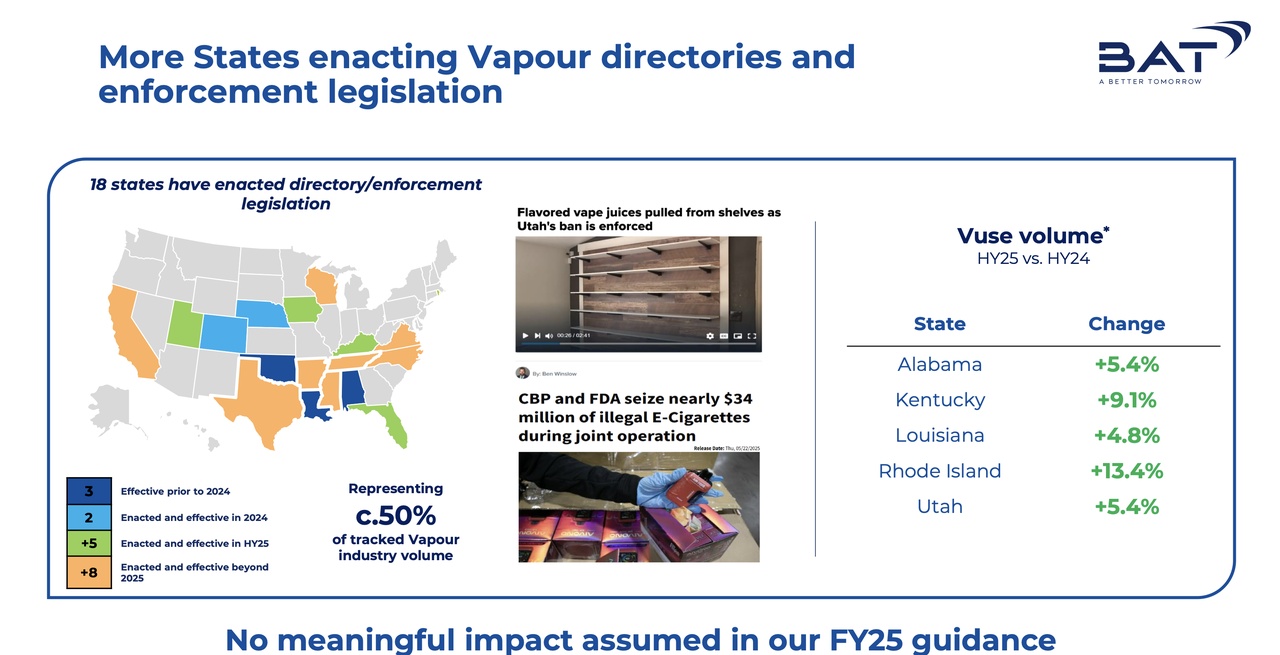

- New categories: Sales remained stable at £1.651m, but grew by 2.4% in CC, mainly due to Modern Oral (+40.6%). Vapour (-13.0%) and Heated Products (+3.1%) showed mixed results, with Vapour impacted by illegal disposables in the US and Canada.

Operating profit:

- Reported operating profit increased 19.1% to £5.069m, boosted by lower exceptional items (£325m vs £1.306m in HY24) and a provision adjustment for the Canadian litigation (£575m net credit).

- Adjusted and at constant exchange rates (for Canada), operating profit grew by 1.9%, despite an estimated 6.2% (£166m) inflationary impact on product costs.

- Adjusted operating margin remained stable at 43.2%, demonstrating the company's ability to maintain margins despite external challenges.

Earnings per share:

- Reported EPS increased by 1.6% to 203.6p, supported by higher operating profit and the provision adjustment in Canada.

- Adjusted EPS (for Canada, at CC) grew by 1.7% to 162.1p, reflecting the solid underlying performance, despite a currency impact of 4.2%.

Cash flow and debt:

- Net cash provided by operating activities fell 27.0% to £2,309m, impacted by tax payments in the US (£700m deferred from 2024 to 2025) and payments relating to the FII GLO (£368m).

- Free cash flow (before dividends) decreased by 42.1% to £1,234m due to higher capital expenditure (£119m vs £96m) and increased interest payments (£889m vs £877m).

- Adjusted net debt decreased by 9.8% to £29.749m, supported by the partial monetization of the ITC portion (£1.052m) and positive currency effects (£1.611m).

- BAT remains confident of achieving leverage ratio of 2.0-2.5x by end 2026, supported by strong cash flow generation (target: £50bn free cash flow by 2030)

Strategic performance

"Smoke-free world"

- BAT has made progress on its ambition to create what you like to call a smoke-free world. The number of consumers of smoke-free products increased by 1.4 million to 30.5 million, and the share of sales accounted for by smoke-free products grew to 18.2 % (+70 basis points).

- Velo: The brand is the fastest growing in the Modern Oral category, with sales growth of 384 % in the US and a volume share of 13.2 % (May 2025, +6.8 percentage points). Velo holds a leading position in AME with a 62.7 % volume share. A new Velo product will also be presented, with a new pouch design to increase comfort in the mouth. It should be noted again that Velo is profitable compared to ON! which is sold by Altria below the production cost of the packaging.

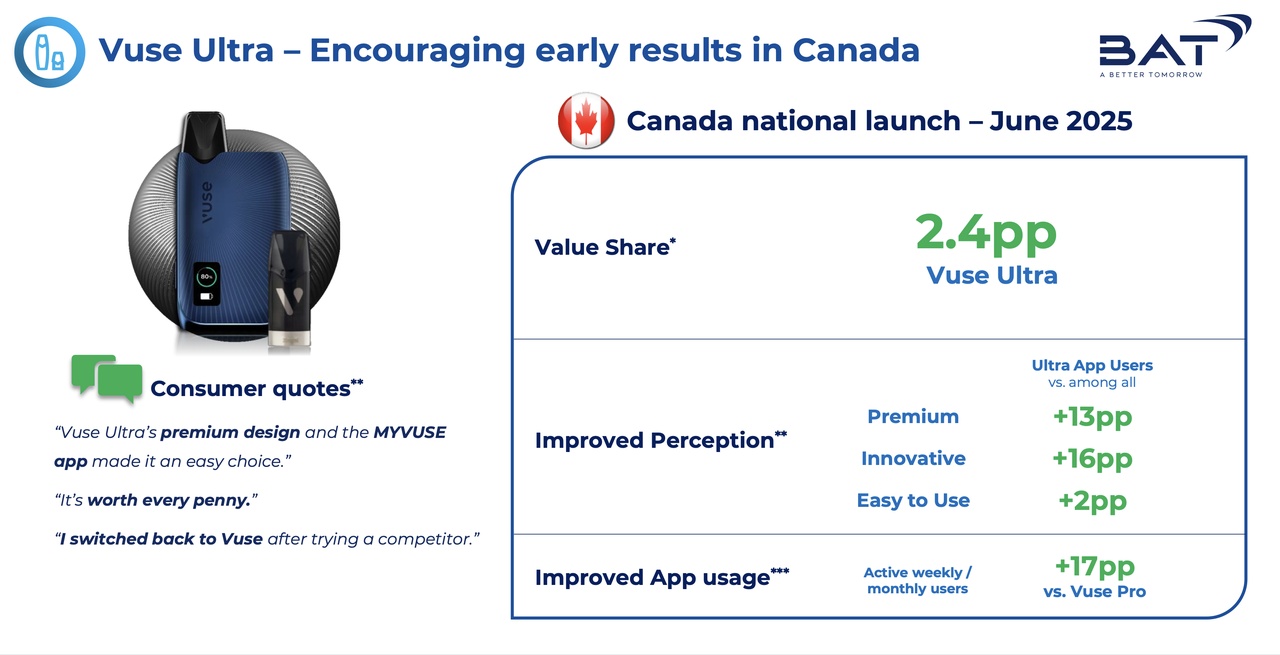

- Vuse UltraThe launch of the premium vaping product in Canada showed encouraging results, with a value increase of 2.4 percentage points and improved brand perception (+13 percentage points for innovation).

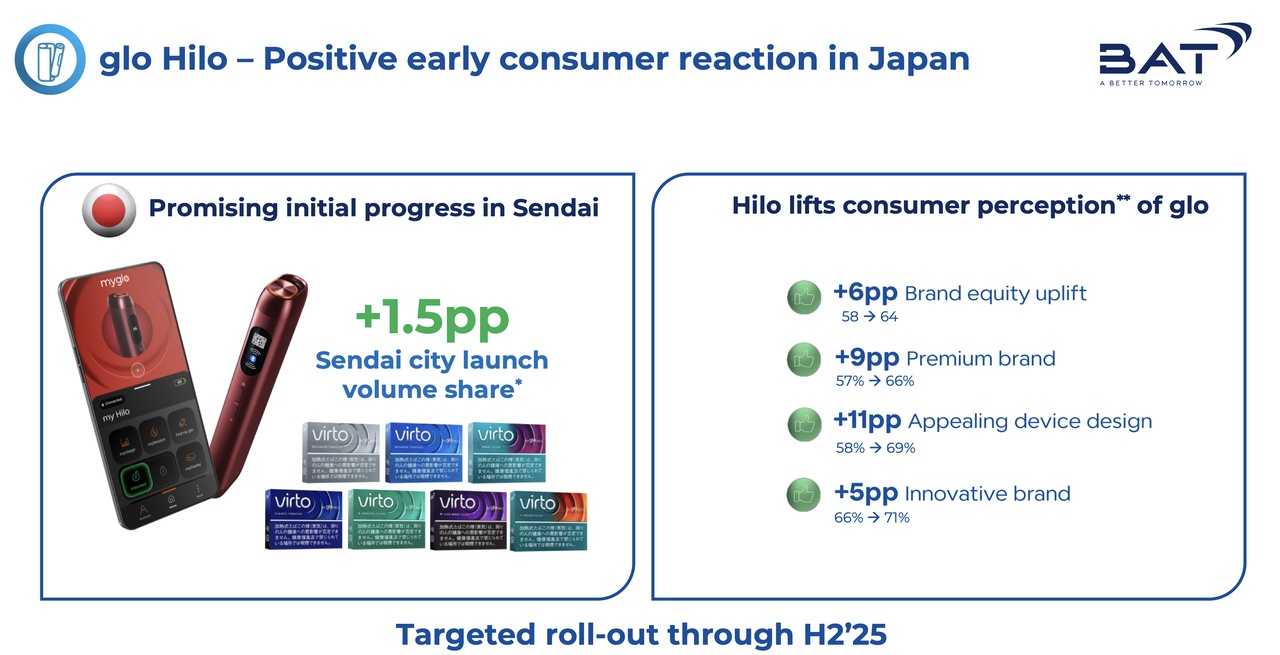

- glo Hilo: The launch in Japan (Sendai) resulted in a volume share increase of 1.5 percentage points, with a planned nationwide launch in H2 2025.

Regional performance:

- USA: Return to growth (+3.7% sales, +3.2% adjusted operating profit at CC), driven by strong price mix effects in combustible products and Velo Plus growth. The volume share of combustible products increased by 10 basis points and the value share by 20 basis points.

- AMEStrong performance with sales growth of 3.5% and adjusted operating profit growth of 10.4%, driven by Brazil, Turkey and Modern Oral. However, Modern Oral's volume share fell by 30 basis points.

- APMEA: Decline of 4.8% in sales and 12.3% in adjusted operating profit due to regulatory and tax challenges in Australia (illikite products >50% of the market) and Bangladesh (27% volume decline due to tax increases).

Digital transformation:

- BAT is driving its digital transformation through partnerships with Microsoft, SAP and AWS, resulting in a 40% reduction in IT costs.

- The establishment of a GenAI lab in Dubai underlines the commitment to innovation and data-driven decisions.

Cost savings:

- Fit2Win program targets £2bn savings by 2030, with annual savings of £500m by 2028. £870m of the £1.2bn target for 2023-2025 has already been achieved by the end of 2024.

- Savings focus on cost of goods sold (COGS) and general and administrative (SG&A) costs, with an estimated one-off project cost of £500m

Risks and challenges

BAT highlights several risks that could impact future performance:

- Illegal products: Particularly in the vapor market in the US and Canada (estimated >50% of the market), although increased enforcement actions by the FDA are beginning to show positive results.

- Regulatory and tax challenges: Particularly in Australia and Bangladesh, where tax increases and regulatory restrictions are weighing on the market.

- Currency fluctuations: An expected negative currency impact of 4% on adjusted operating profit in 2025.

- Litigation: The Canadian litigation has been largely resolved through the approved plans (CAD$32.5 billion settlement), but future litigation remains a risk.

#### **2.4 Future outlook**

BAT is confident of achieving its medium-term targets (2026: 3-5% revenue growth, 4-6% adjusted operating profit growth), supported by:

- USA: Continued growth from combustible products and Velo Plus.

- Velo: Further global growth and contribution to profitability.

- Innovations: Launch of premium products such as Vuse Ultra and glo Hilo in the largest profit pools.

- Cost savings: Continuation of the Fit2Win program and optimization of operating costs.

- Financial flexibility: Increased share buybacks (£1.1bn) and dividend growth, supported by the monetization of the ITC share.

Review

BAT 2025 interim results show solid performance despite external challenges such as currency impacts and regulatory hurdles. The return to growth in the US, the strong growth of Velo is particularly impressive and the progress in the digital transformation underlines the strategic focus on increased efficiency. However, the challenges posed by illegal products remain. BAT is well positioned to achieve its medium-term goals, provided that enforcement against illegal products and market stability in key markets continue to improve.