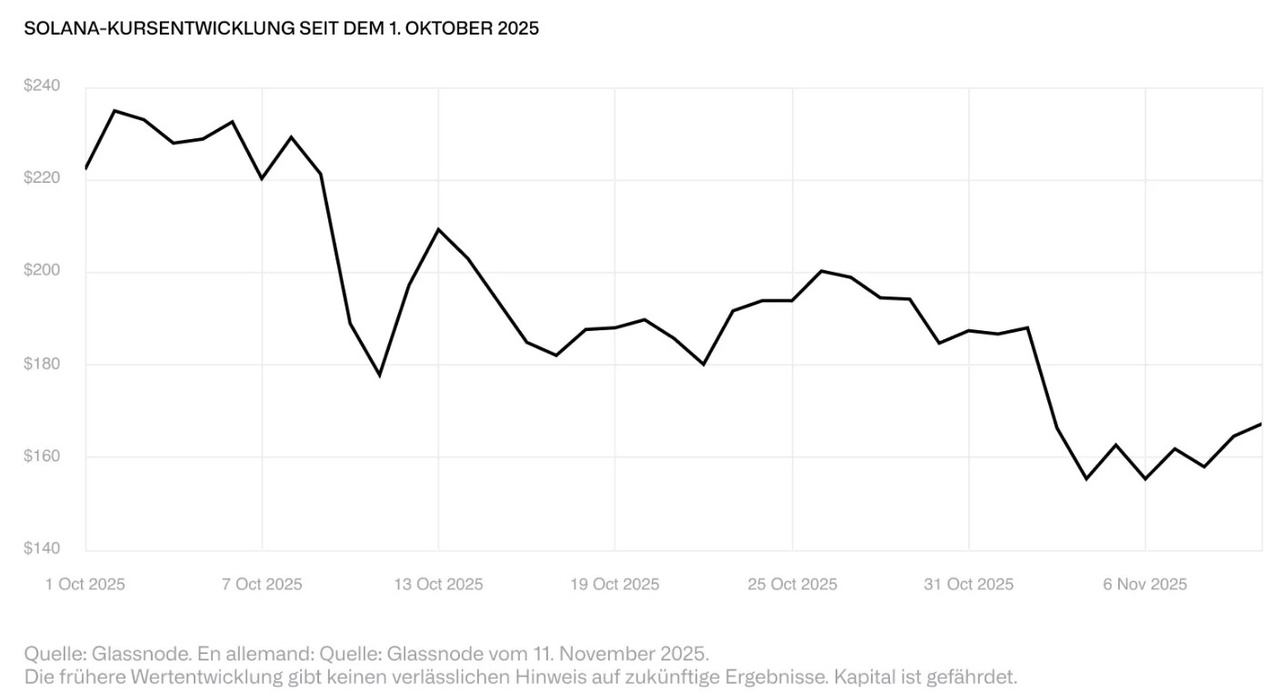

Solana's recent weakness reflects market positioning rather than fundamental problems. In the weeks leading up to the expected ETF admissions on October 10, numerous speculative long positions built up, supported by inflows of over a billion US dollars into European Solana ETPs in just three weeks. This bullish sentiment made SOL vulnerable when the government shutdown in the United States and the wave of deleveraging on October 10 triggered a rapid shakeout of leveraged positions in derivatives and structured products.

The adjustment was exacerbated by the fact that ultimately only the Solana ETFs from Bitwise and Grayscale came to market within a narrow procedural window - not the broad product range that many had been banking on. The result was a classic "sell-the-news" effect, as expectations were for a deeper and more coordinated wave of demand, which failed to materialize.

From a structural perspective, little has changed. On-chain activity remains robust and ETF channels are now open, although initial inflows have lagged the narrative. At around USD 165, down from around USD 225 on October 10, the market has completed a significant position adjustment - creating scope to look at the asset more constructively again. $SLNC (-2,27%)