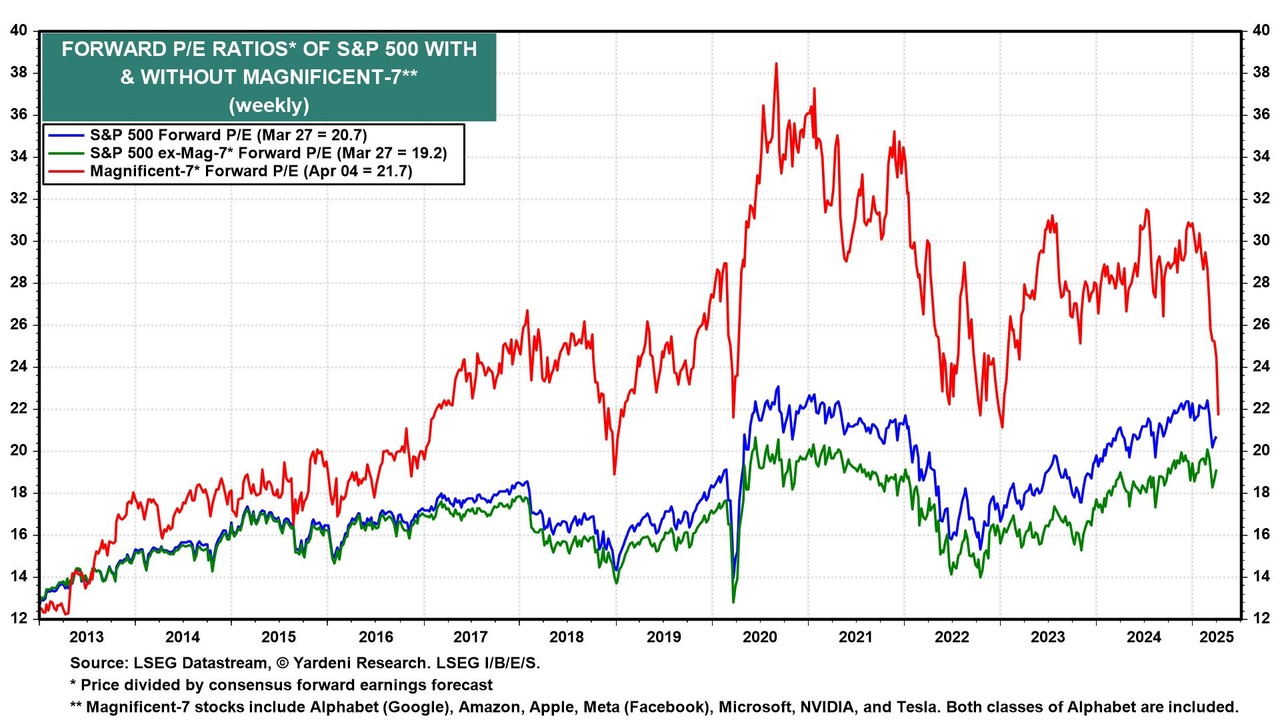

After the recent sell-off, the forward P/E of the Mag-7 stands at 21,7x and thus at the same level as in March 2020 (COVID-19) and January 2023 (tech crisis).

It will be exciting to see how the "E" in P/E will change in the coming months due to the current trade policy.

How low do they have to go for you to make them attractive?