The Market Finally Gets It? What a Re-Rating

ASML has been in both my portfolios since the very beginning, and I even published a comprehensive deep dive on the company earlier this year. For months, nothing happened – the stock was flat through the first half of 2024, and to many it probably looked boring.

Some even dared to question ASML’s market position amid the tariff crisis and comparatively “weak” earnings. But then things took a turn, and suddenly the market decided to pay attention. Shares are up almost 40% since the start of August. That’s not a small move for a company of this size. People love talking about Google’s resurgence, but many forget that ASML outperformed the giant in this period.

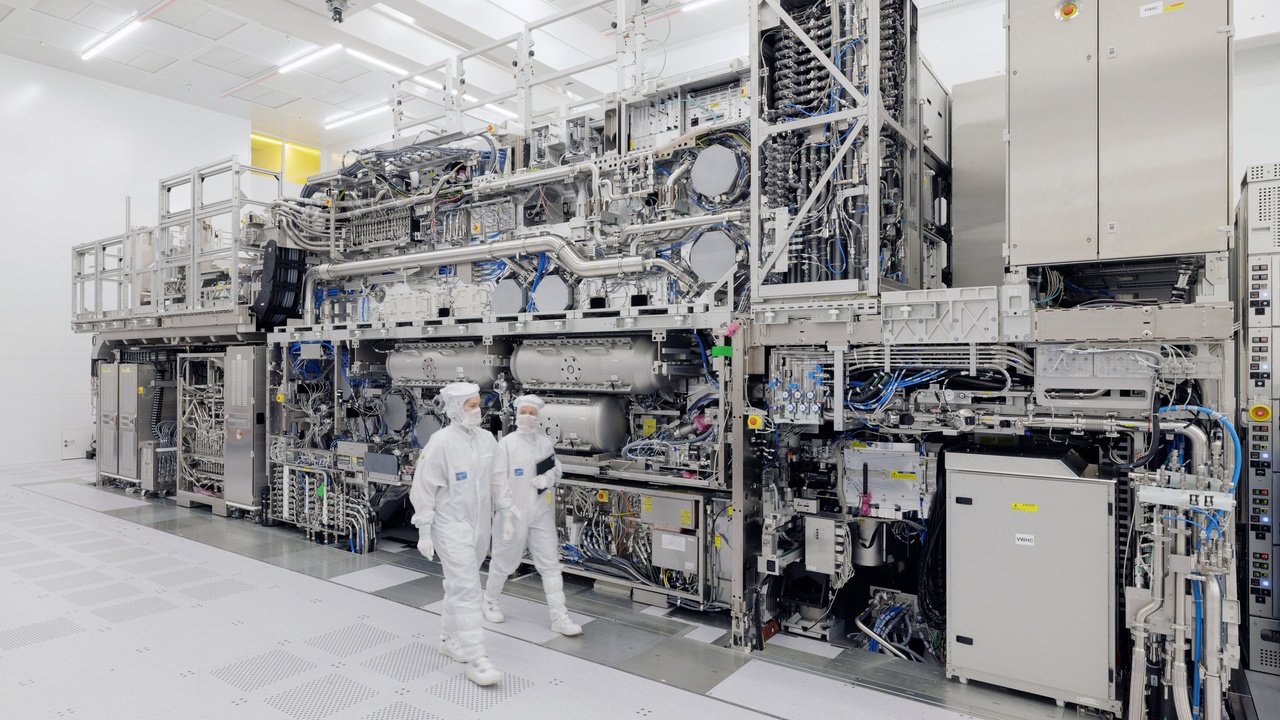

The obvious question to ask is: “what changed?” Did ASML suddenly reinvent semis? No. The story is exactly the same as before. The company holds a de facto monopoly in EUV lithography, the most important foundational technology for advanced semiconductors. If you want to build cutting-edge chips, you need ASML – no exceptions. That hasn’t changed in years, and won’t change anytime soon. As pointed out in my analysis, competitors, if any, are light-years behind. You can barely imagine a healthier position to be in. “The AI revolution hinges on Nvidia.” Yes, but don’t forget about ASML. Without them and their technology, all these advanced fantasies are nothing more than that: dreams. ASML is the backbone of this mega trend, and the market, apparently, has made this realization.

Maybe the real shift is in perception. For a long time, investors treated ASML like just another cyclical chip equipment play, ignoring the power of its monopoly. With a forward P/E around 30–35, the stock is actually still cheap historically and compared to other tech monopolies. Microsoft, Nvidia, even Salesforce – all command far higher multiples despite not holding quite the same chokehold on their industry.

So the question is whether the market has finally woken up to what ASML really is: not just another semiconductor stock, but the single most important supplier in the global chip arms race. The recent run looks like the market re-rating ASML closer to where it belongs. Something I am betting on with quite a lot of my holdings: whether it’s Salesforce, Adobe, or Fiserv, I believe markets misjudge the power of these leaders. Now one of them is finally getting close to a fair price.

For me, nothing changes. I continue to hold, as I always have. This is one of those rare “set and forget” positions, where the only real risk is if China has cooked something up in a secret lab – and even then, ASML would still dominate the Western market. You can bet that Trump wouldn’t allow Chinese chips to power “his” AI race. ASML is simply too important to ignore.

$ASML (+3,26%)

$ASML (+3,39%)

$NVDA (+0,81%)

$MSFT (+0,53%)

$CRM (-1,06%)