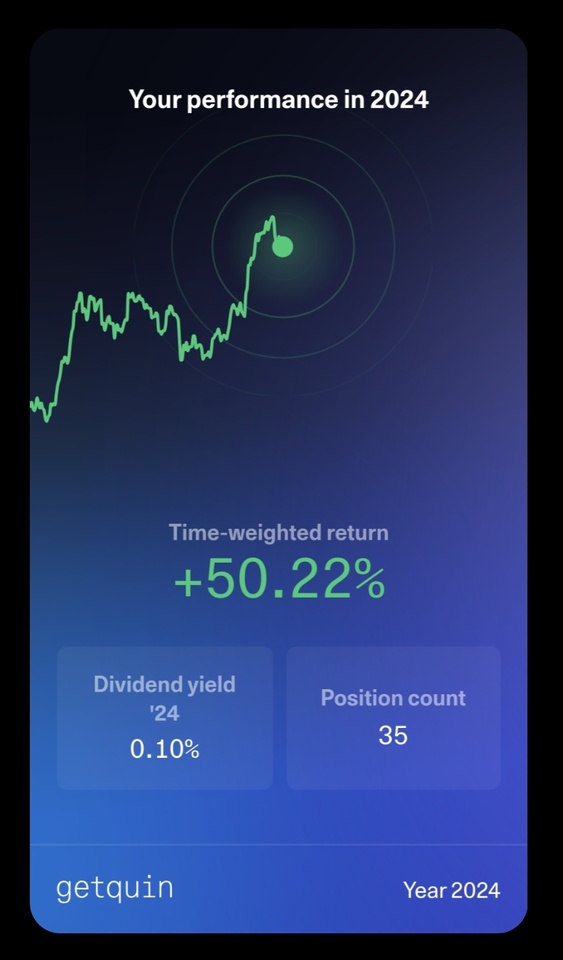

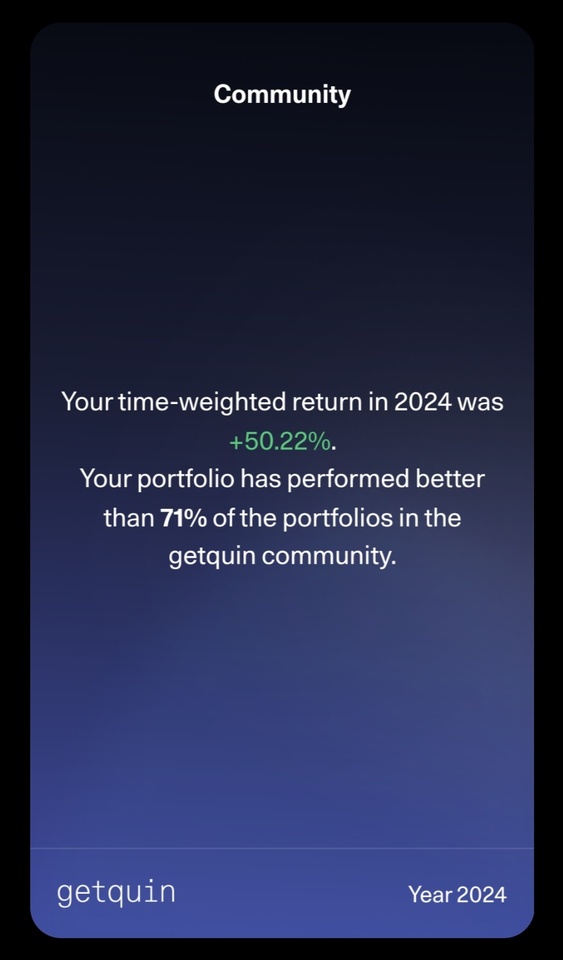

What kind of year was it? H O L Y S H I T !

It didn't go quite as well as 2023, but it doesn't have to be +60% every year.

(https://getqu.in/BY7tzt/ Review 2023)

The excess return comes from $BTC (-0,63%) and the alt-coins I sold at the beginning of the year.

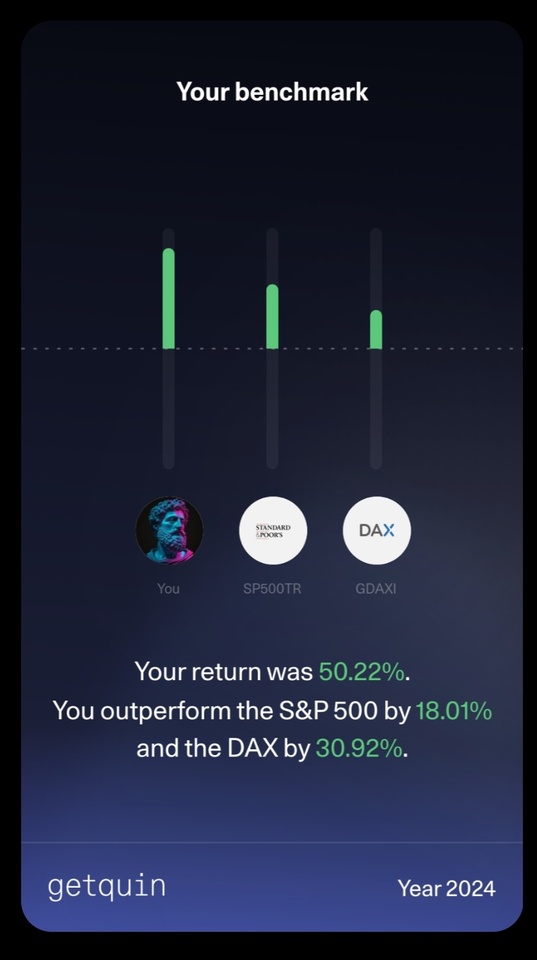

Congratulations to everyone who was invested in Pakistan and Argentina, these two actually managed to beat the S&P500. (little tip, have a look $DX2Z (+0,37%) have a look)

In developed markets, all factors have underperformed their peers, with the exception of momentum.

In the emerging markets, both Value $5MVL (+0,11%) , Quality $PEH (-0,35%) and small caps $SPYX (-0,2%) performed better than their peer group.

I have sold off some crypto this year and built up positions in several government bonds / government bond ETFs and $EWG2 (+0,41%) This now comprises almost 20% of the portfolio.

I will go into more detail at a later date as to why I built up this position.

But I can tell you this much: It has something to do with these two beauties:

Because I haven't shared my portfolio yet, but have been asked to do so several times, I'm using the end of the year to do so, here you go: 😘

And always remember, it doesn't matter what performance you had in 2024, what counts are lifetime returns. It doesn't do you any good to make 50%+ for 4 years in a row if you then lose 90% again.

Risk often only becomes visible when it materializes.

In the end I have to thank a very special person without whom this return would not have been possible, thank you Saylor Moon and please keep buying.